- Silver climbed above $81, extending its 2026 rally amid rising geopolitical tension.

- The metal’s market cap is now just below Nvidia’s, nearing $4.6 trillion.

- Growing demand for hard assets suggests silver could soon overtake major equities.

Silver pushed sharply higher on Tuesday, climbing above $81 and posting a daily gain of more than 6% as geopolitical tension reignited demand for hard assets. The move extends silver’s 2026 gains to roughly 14%, fueled in part by uncertainty following the US capture of Venezuelan President Nicolás Maduro. As risk sentiment wobbles, investors are once again reaching for assets tied to physical scarcity rather than growth projections.

A Rally That Never Really Ended

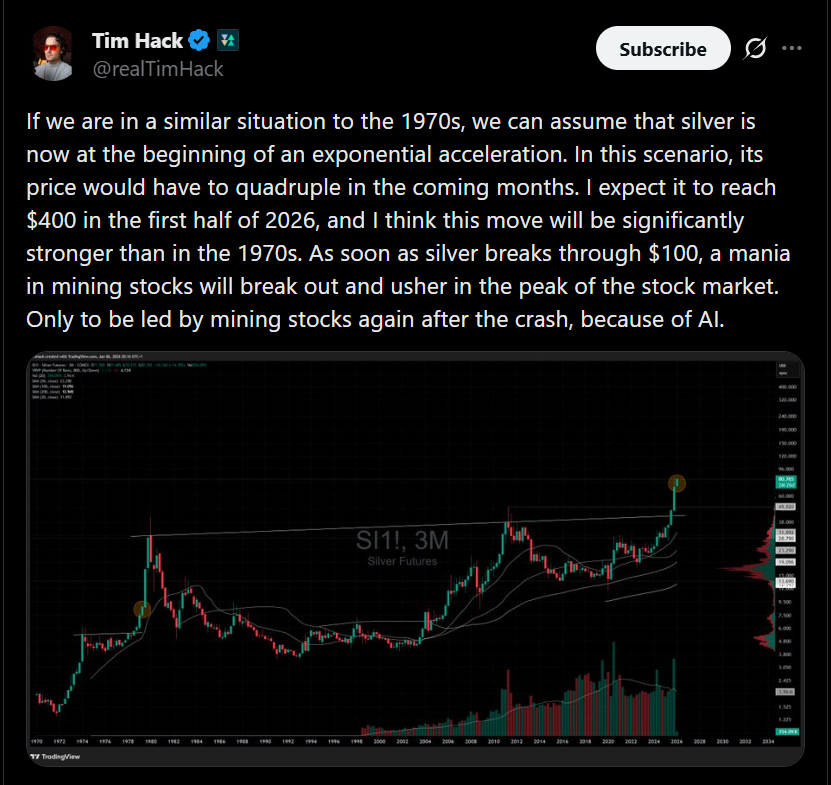

Silver’s strength didn’t appear overnight. In 2025, the metal surged an eye-catching 145%, briefly touching an all-time high near $84 before pulling back to around $71 into year-end. That consolidation now looks more like a pause than a reversal. As 2026 began, the rally resumed, supported by geopolitical risk and macro conditions that continue to favor tangible stores of value over paper assets.

Silver’s Market Cap Is Closing in on Nvidia

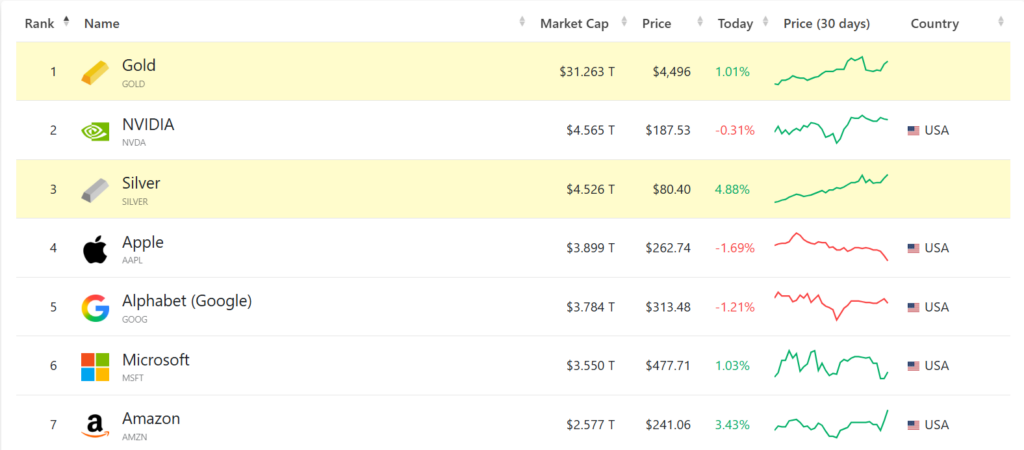

The latest price surge has pushed silver’s market capitalization to approximately $4.5 trillion, according to Companies Market Cap data. That puts it just below Nvidia, which currently sits near $4.6 trillion. The gap is narrow enough that even modest follow-through buying could see silver overtake the semiconductor giant, a comparison that highlights how dramatically capital is shifting priorities.

Hard Assets Are Back in Focus

Silver edging toward the number-two spot among global assets reflects a broader trend. Investors are increasingly turning toward hard assets as protection against geopolitical shocks and erosion of purchasing power. With gold already firmly at the top, silver is emerging as a serious alternative rather than a secondary trade. If current conditions persist, silver’s rise relative to equities may be less surprising than it initially appears.