- Silver hit a record high above $63, reaching a $3.59T market cap and surpassing Microsoft.

- A 25bps Fed rate cut sparked heavy bullish positioning in metals, accelerating silver’s breakout.

- The metal is now up 150% since early 2024 and closing in on Alphabet’s valuation.

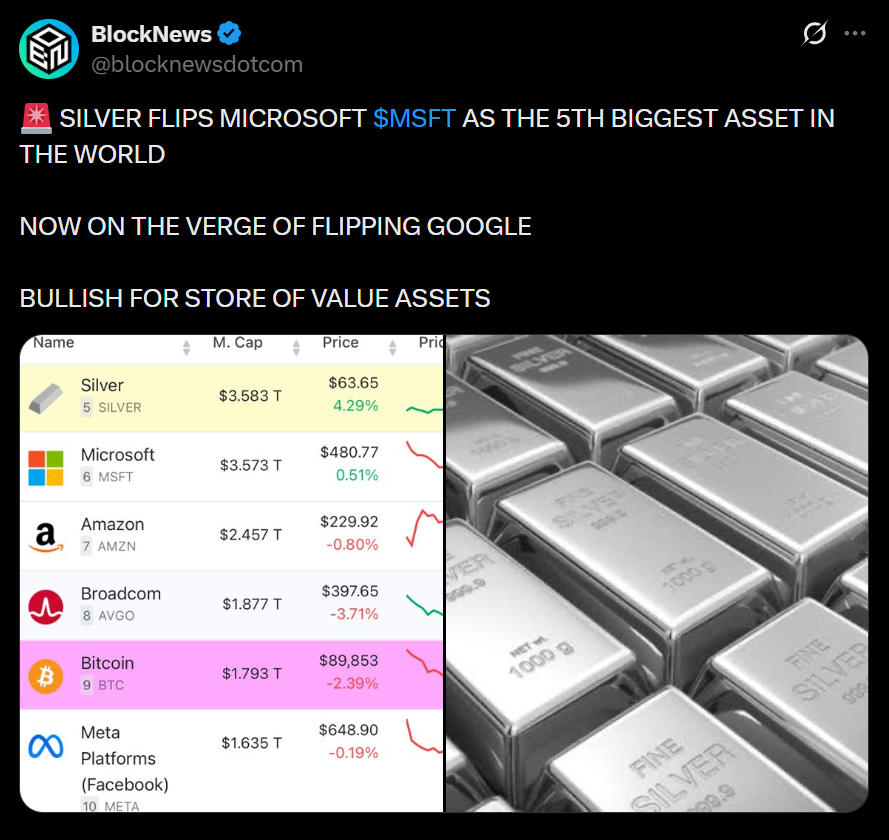

Silver pushed past $63 today, soaring to a $3.59 trillion market cap and overtaking Microsoft to become the world’s fifth-largest asset. The metal is now up more than 150% since early 2024, climbing from the $25 range as investors increasingly rotate into tangible hedges. It’s also the first time silver has returned to all-time-high territory since 2011, when it peaked near $50 before retracing sharply for more than a decade.

Fed Policy Fuels a Powerful Macro Tailwind

The latest leg of silver’s rally erupted right after the Federal Reserve delivered a 25bps rate cut, prompting markets to reset inflation expectations and push aggressively into metals. With borrowing costs falling and liquidity conditions loosening, capital continues to shift toward assets seen as defensive, scarce, and historically undervalued relative to gold. This macro setup has made silver one of the strongest-performing major assets of 2025.

Silver Overtakes Microsoft — and Eyes Alphabet Next

Silver’s market cap has now climbed above Microsoft’s $3.6 trillion valuation, pushing the metal into the global top-five asset rankings and putting Alphabet firmly in sight at $3.8 trillion. Amazon, sitting at $2.5 trillion, has also been left behind. With momentum building and industrial demand rising across energy, battery tech, and manufacturing, analysts say silver’s structural re-rating may only be getting started.

A Historic Repricing After a Decade of Suppression

After spending more than 12 years suppressed in a wide trading range, silver’s sharp breakout has reminded markets how aggressively the metal can reprice once macro sentiment turns. The renewed interest marks a clear shift toward assets benefiting from inflation hedging, industrial demand, and weakening real yields. Whether silver can sustain its new position among the world’s top assets will now depend heavily on global liquidity trends and investor appetite into 2026.