- Shiba Inu surged 13% on Sunday, snapping a long period of sideways trading.

- Renewed market momentum and memecoin rotation helped drive SHIB higher.

- Forecasts point to moderate upside into early February if sentiment holds.

Shiba Inu shocked the market over the weekend after posting a sharp 13% surge on Sunday, breaking a long stretch of quiet, sideways price action. For much of the past year, SHIB has been stuck trading between $0.000010 and $0.000012, failing to attract sustained momentum. That changed quickly. After dipping to fresh lows around December 2025, SHIB rebounded again, climbing roughly 6% over the last 24 hours and trading near $0.000009339, a move many see as a signal that memecoin rotation may finally be back.

A Sudden Shift in Market Momentum

Sunday’s move came as broader crypto markets showed renewed strength. Rising geopolitical tensions appeared to push investors back toward digital assets, with Bitcoin and Ethereum breaking out of their recent ranges. As confidence returned, capital began rotating into altcoins, and memecoins like Shiba Inu and Pepe were among the first to react. After months of stagnation, SHIB’s price action suddenly felt alive again, catching both traders and long-term holders off guard.

Whale Concentration Adds Another Layer

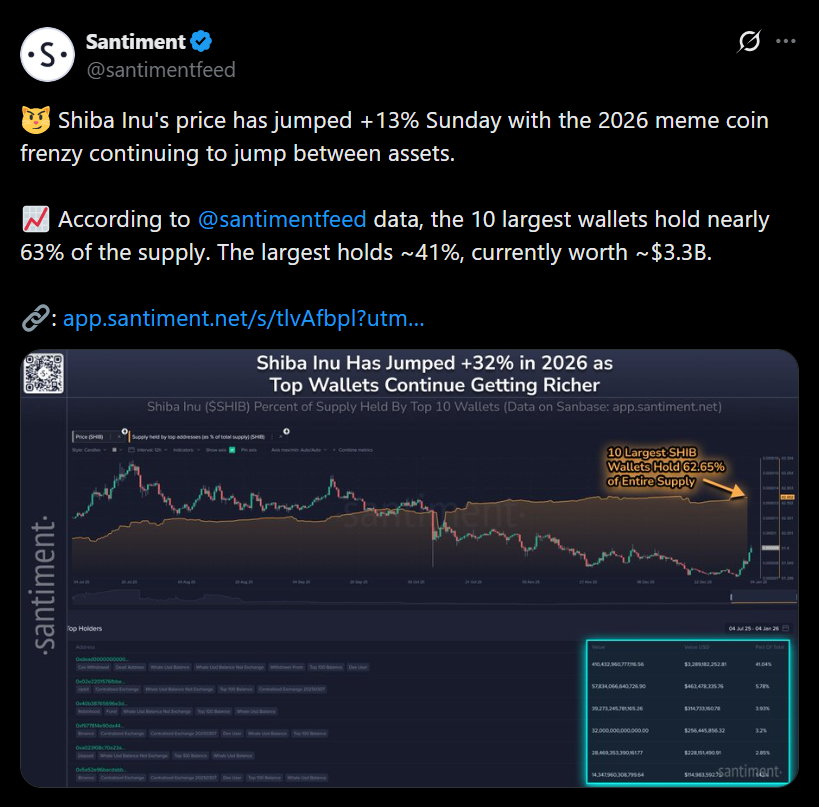

Santiment data highlighted another factor worth watching — supply concentration. According to their latest update, the ten largest SHIB wallets control nearly 63% of the total supply, with the single largest wallet holding roughly 41%, valued around $3.3 billion. That level of concentration can amplify price moves in either direction, adding fuel during rallies but also risk if large holders decide to reposition. For now, the concentration seems to be reinforcing momentum rather than suppressing it.

Can SHIB Hold Gains Into February?

Looking ahead, CoinCodex projections suggest Shiba Inu could continue climbing into early February. Their model forecasts a potential move toward $0.00001079 by February 4, implying roughly 16% upside from current levels.

Technical indicators remain neutral, while the Fear & Greed Index continues to sit deep in fear territory. SHIB has logged just over a third of green days in the past month, but volatility remains contained, leaving room for another push if sentiment keeps improving.