- SEC Chair Gary Gensler says crypto markets lack transparency and oversight, could benefit from more disclosures and “disinfectant”

- Gensler warns crypto exchanges to register with SEC, follow same rules as traditional finance though crypto firms argue it’s not feasible

- Gensler acknowledges CFTC’s role in crypto regulation, particularly related to ether, though disagrees with CFTC Chair on ether’s status as security or commodity

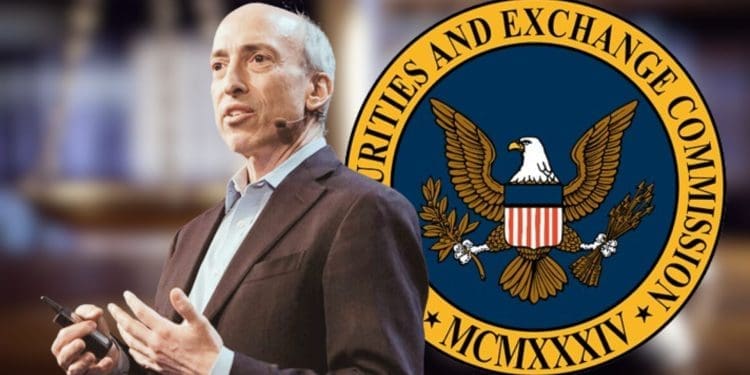

The Securities and Exchange Commission (SEC) Chair Gary Gensler made some critical remarks about the crypto industry during a recent speech, saying the market could benefit from more oversight and transparency.

Gensler Emphasizes Need for Disclosure

During his speech at the Columbia Law School conference, Gensler discussed the importance of disclosures in financial markets. He stated that disclosures lead to more efficient markets and protect investors.

Gensler remarked that some crypto participants seek to avoid registration requirements and mandatory disclosures. He said “Many would agree that the crypto markets could use a little disinfectant.”

SEC Warnings About Crypto Compliance

Gensler has consistently warned that crypto exchanges need to register with the SEC and that crypto firms must follow the same rules as traditional finance.

Over the past year, the SEC has charged companies like Coinbase and Kramer for allegedly operating illegally. Meanwhile, crypto firms argue it’s not feasible to fully comply with SEC registration.

Gensler also advocated for climate risk, executive compensation, and cyber risk disclosures. The SEC recently adopted climate disclosure rules.

Role of the CFTC in Crypto Regulation

During a Q&A session, Gensler said crypto underscores the importance of disclosures. He remarked that both the SEC and Commodity Futures Trading Commission (CFTC) have a role in crypto oversight.

Gensler and CFTC Chair Rostin Behnam communicate regularly. They’ve disagreed on whether ether is a security or commodity. Behnam argues ether is a commodity, while the SEC’s position is unclear.

Behnam said an SEC security designation for ether would conflict with CFTC rules. Gensler acknowledged the CFTC’s derivatives expertise.

Conclusion

In his speech, Gensler reiterated the SEC’s critical view of the crypto industry. He emphasized the need for more oversight and disclosures to protect investors and ensure fair markets. While supporting crypto regulation, Gensler acknowledged the CFTC’s role particularly related to ether. His remarks signal continued scrutiny of crypto from the SEC chair.