- SEC accused Brian Sewell, founder of American Bitcoin Academy, of defrauding students out of $1.2 million through a fake crypto hedge fund

- Sewell made false claims about degrees, past fund performance, and proprietary AI technology to convince students to invest in the non-existent “Rockwell Fund”

- SEC formally charged Sewell and his company with fraud; they settled without admitting wrongdoing, agreeing to pay over $1.8 million in penalties

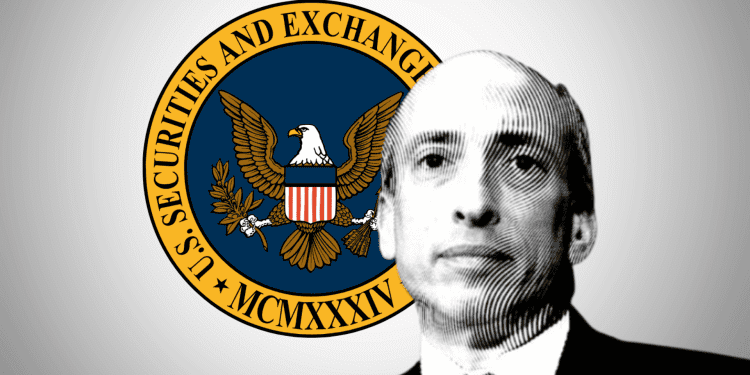

The Securities and Exchange Commission (SEC) recently filed charges against the founder of an online cryptocurrency course, alleging that he defrauded students out of $1.2 million.

Overview of the Alleged Crypto Fraud Scheme

The SEC accused Brian Sewell, founder of the American Bitcoin Academy, of making false claims to students in order to solicit investments in a crypto hedge fund that did not actually exist.

Despite not having any prior hedge fund experience, Sewell told students he would use artificial intelligence and proprietary trading strategies to generate big returns for the proposed “Rockwell Fund.”

Sewell convinced 15 students to invest a total of $1.2 million in the fake fund. Instead of investing their money, he converted it to bitcoin and later lost it when his digital wallet was compromised.

Details of the SEC Charges and Settlement

On February 2, the SEC formally charged Sewell and his company Rockwell Capital Management with fraud.

Although they did not admit or deny the allegations, Sewell and Rockwell agreed to settle the charges. Rockwell will pay $1.6 million in penalties while Sewell will personally pay over $220,000.

According to the SEC’s complaint, Sewell made many false statements to investors, including:

- Claiming he had degrees in data science from Johns Hopkins and Stanford when he did not

- Stating he had previously grown $250,000 into $9 million running a crypto hedge fund, which was fabricated

- Asserting the fund would utilize AI and machine learning technology he had developed, which did not actually exist

The SEC noted this case is part of its ongoing efforts to crack down on fraud and misleading claims in the cryptocurrency industry.