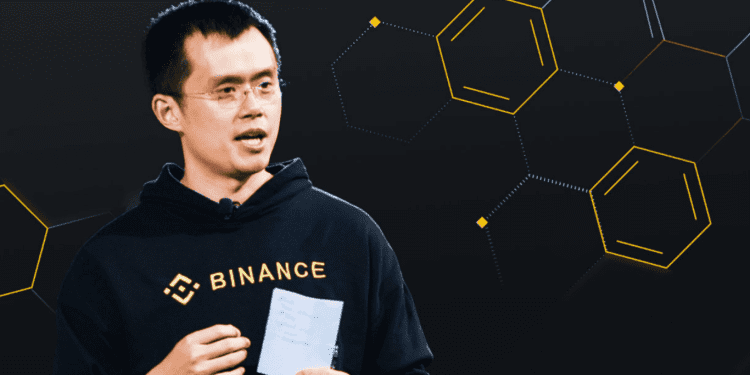

In a significant development, Binance and its founder Changpeng Zhao, are now facing charges filed by the Securities and Exchange Commission (SEC) for alleged securities law violations.

The SEC has alleged the following:

- Binance and BAM Trading operated unregistered national securities exchanges, broker-dealers, and clearing agencies.

- Binance and BAM Trading offered and sold Binance’s own crypto assets, such as the exchange token BNB, the stablecoin BUSD, certain crypto-lending products, and a staking-as-a-service program, without proper registration.

- Zhao was identified as a controlling figure responsible for overseeing the operation of unregistered national securities exchanges, broker-dealers, and clearing agencies by Binance and BAM Trading.

Contextualizing the SEC Allegations

According to the SEC, Binance and Zhao publicly stated that U.S. customers were barred from trading on Binance.com. However, it is alleged that they secretly allowed high-value U.S. customers to continue trading on the platform. Additionally, the SEC accuses Binance.US, presented as an independent platform for U.S. investors, of being controlled by Binance and Zhao behind the scenes.

The SEC further alleges that Binance and Zhao exercised control over customers’ assets, diverting them for personal use, including to an entity owned by Zhao called Sigma Chain.

Moreover, the SEC claims that BAM Trading, associated with Binance, misled investors about trading controls on the Binance.US platform, while Sigma Chain engaged in manipulative trading to inflate trading volumes artificially. Shockingly, billions of dollars of investor assets were blended and sent to another Zhao-owned entity, Merit Peak Limited, a fact that was allegedly concealed.

Furthermore, Binance and BAM Trading face charges for the unregistered offer and sale of their crypto assets, including BNB and BUSD. Zhao is implicated explicitly as a control person for these unregistered operations.

SEC Findings

The SEC’s investigation uncovered that Binance.com and Binance.US, under Zhao’s control, operated as exchanges, brokers, dealers, and clearing agencies without proper registration. As a result, these platforms generated more than $11.6 billion in revenue, primarily from transaction fees charged to U.S. customers.

BAM Trading faces charges related to the unregistered offer and sale of Binance.US’ staking-as-a-service program, and the SEC also revealed that Binance exercised control over assets staked by U.S. customers in BAM’s program.

BAM Trading and BAM Management have been accused of misleading Binance.US customers and equity investors by misrepresenting market surveillance and controls to detect manipulative trading. In addition, the involvement of Sigma Chain, an undisclosed market-making trading firm owned by Zhao, in wash trading contradicts BAM Trading’s claims about effective market surveillance and controls.

Conclusion

The SEC’s investigation involved multiple individuals and received oversight from critical SEC’s Crypto Assets and Cyber Unit members. The legal process has also commenced to ensure accountability for the alleged violations.