- Strategy moved more than $5B in BTC from Coinbase to Fidelity, sparking sell-off speculation during the market downturn.

- Arkham confirmed these are custody migrations — not sales — with Strategy still accumulating Bitcoin.

- Despite shrinking unrealized gains, Strategy says its balance sheet remains strong with significant debt coverage.

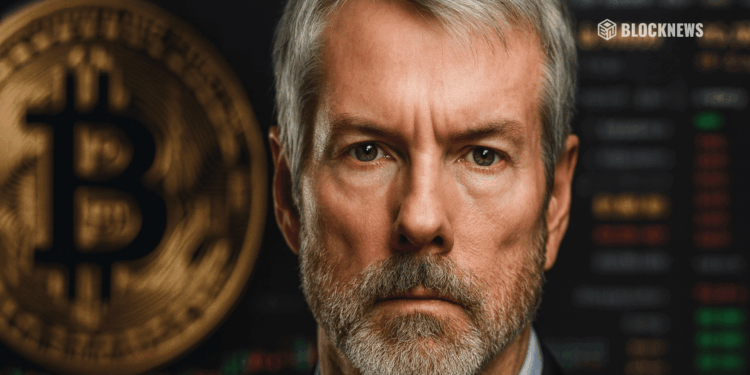

Arkham dropped a new update confirming that Michael Saylor’s Strategy has shifted 58,390 BTC — roughly $5.1 billion — from Coinbase to Fidelity over the last two months. The move is part of a larger custody transition that has now placed 165,709 BTC, worth about $14.5 billion, under Fidelity’s umbrella. Because Fidelity uses an omnibus custody structure, many of these coins now appear under Fidelity labels on Arkham rather than Strategy’s own tags. Even so, Arkham says it continues to track around 92% of Strategy’s entire Bitcoin stack, which currently sits at 641,692 BTC valued at more than $56 billion.

Concerns Rise as Transfers Coincide With Major Price Drop

The timing of these transfers created a wave of speculation throughout crypto circles. Bitcoin has been under heavy pressure, falling below $90K and shedding over 20% in the last month. As BTC slid toward $87K, Strategy’s unrealized profit shrank dramatically — down to about 16.9% compared to 68.6% just weeks ago. After the first big batch of transfers on Nov. 14, reporter Walter Bloomberg even suggested the movements might signal sales, though he admitted the picture wasn’t clear. This naturally fueled sell-off rumors during an already fragile market mood.

Arkham Confirms: These Are Custody Moves, Not Sales

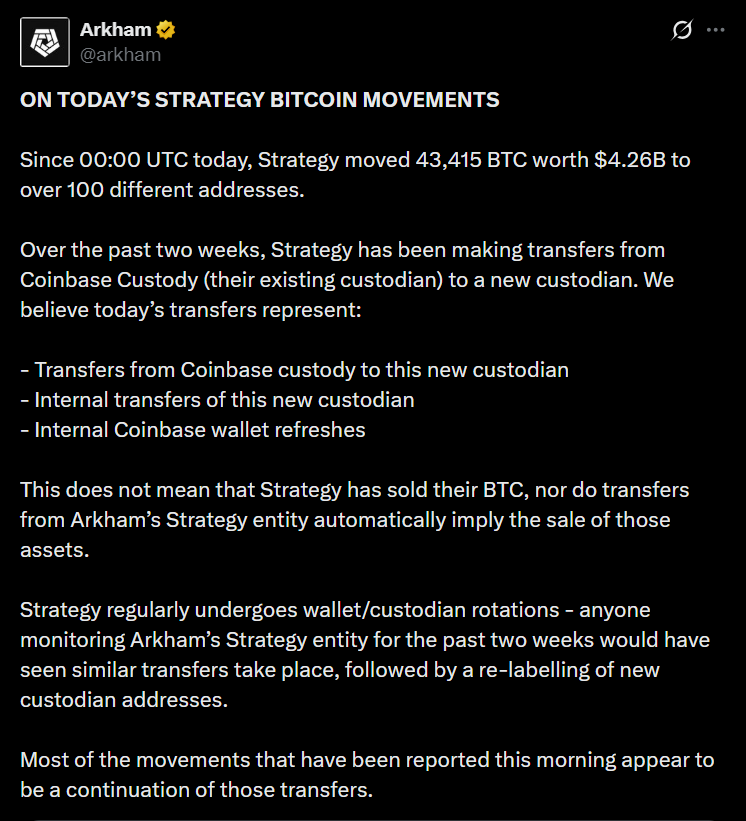

Arkham has now clarified multiple times that none of these transfers represent selling activity. According to their explanation, the coins being moved fall into one of three categories: direct transfers from Coinbase to Fidelity, internal shifts within Fidelity’s system, or Coinbase refreshing wallet structures. None of these indicate liquidation. In fact, Strategy has actually been buying into the dip — accumulating 9,839 BTC across six separate purchases since October, bringing its overall total to 649,870 BTC at the time of the update.

Strategy Reassures Investors on Leverage and Long-Term Position

Despite the shrinking unrealized profit, Strategy says its balance-sheet position remains well-protected. The firm explained that even if Bitcoin falls back to its $74,000 average purchase price, it would still hold 5.9x more assets than the value of its convertible debt. Even in an extreme pullback to $25,000, coverage stays at 2.0x, which Strategy describes as a comfortable safety margin. Saylor also directly dismissed rumors of selling, saying the company continues to hold and accumulate while restructuring its custodial setup for long-term security.