- Saylor told Zcash’s co-founder Bitcoin shouldn’t adopt Zcash-style privacy due to regulatory risks.

- He believes heavy privacy features could give governments justification to target Bitcoin.

- The debate reflects a deep industry divide between privacy ideals and mainstream acceptance.

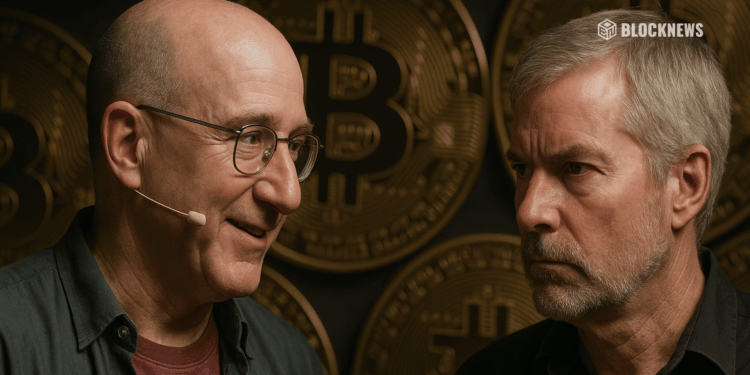

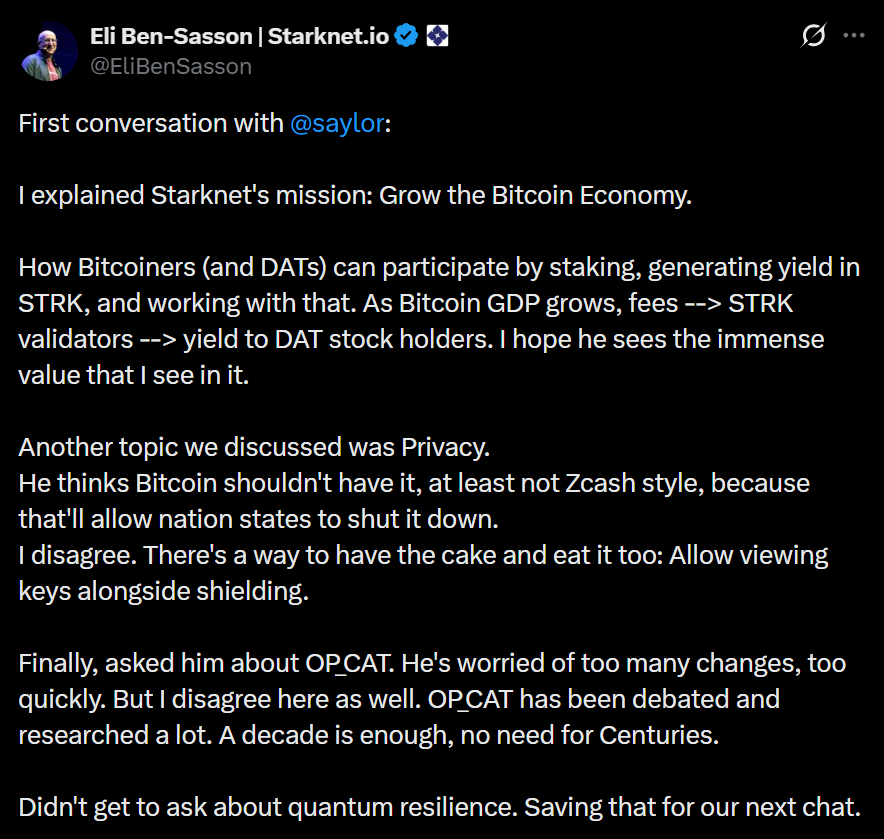

Zcash co-founder Eli Ben-Sasson recently shared details from a discussion with Michael Saylor, and the message was blunt: Saylor believes Bitcoin should not adopt Zcash-style privacy features. According to Ben-Sasson, Saylor warned that heavy privacy layers could hand governments a perfect excuse to crack down on Bitcoin, possibly even attempt to shut the network down outright. The exchange highlights just how tricky the “privacy vs. regulation” line has become for major voices in the space.

Bitcoin’s Regulatory Tightrope

Saylor’s stance comes from Strategy’s massive exposure to Bitcoin — now a cornerstone of the company’s identity. With millions of investors watching Bitcoin’s regulatory treatment, Saylor argued that adopting shielded-transaction tech similar to Zcash might push lawmakers and regulators into panic mode. His fear, as described by Ben-Sasson, is that nation states could view such a move as an escalation, not an upgrade, which might bring heavy-handed intervention.

Zcash’s Mission and the Philosophical Rift

Zcash itself was built around the idea that privacy is a human right, especially in cases where citizens may face surveillance or persecution. Shielded transactions hide sender, receiver, and amount — a feature Bitcoin lacks natively. Ben-Sasson emphasized that Zcash prioritizes protection against state abuses, while Saylor’s camp is more focused on wide-scale adoption and regulatory compatibility. Both philosophies imagine different futures for crypto, and neither is wrong; they just pull in different directions.

The Bigger Debate Isn’t Going Away

The conversation between Saylor and Ben-Sasson is a reminder that crypto’s future hinges on how much privacy mainstream society — and global governments — will tolerate. Some fear over-regulation will choke innovation, while others warn that ignoring regulators could trigger aggressive policy responses. For now, Bitcoin remains transparent by design, and Saylor seems determined to keep it that way to preserve its regulatory momentum and institutional growth.