- Ripple plans to raise $1B to buy XRP despite having escrow reserves.

- The pre-allocation theory suggests some escrowed XRP is already committed to partners.

- Ripple’s decision may aim to protect liquidity and price stability amid growing speculation.

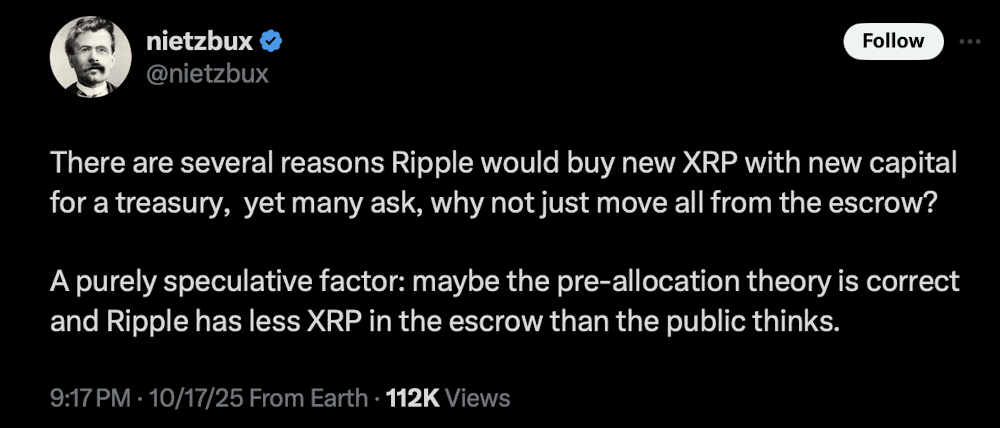

A recent post by well-known XRP community member Nietzbux (@nietzbux) has stirred conversation after questioning why Ripple would choose to buy new XRP with fresh capital instead of tapping into its massive escrow reserves. The question sounds simple—but the reasoning behind it might not be.

Ripple’s plan to raise $1 billion for XRP purchases caught many by surprise. According to Nietzbux, there could be “several reasons Ripple would buy new XRP for its treasury,” yet the community can’t help but wonder—why not just use the tokens already sitting in escrow?

The Pre-Allocation Theory

Here’s where it gets interesting. Nietzbux floated a speculative idea, one that touches on a long-standing rumor within XRP circles: “Maybe the pre-allocation theory is correct, and Ripple has less XRP in escrow than the public thinks.”

The theory suggests that some of the XRP held in escrow may already be spoken for—perhaps tied up in private deals or commitments with institutions. That would mean Ripple’s “available” balance is smaller than it appears, even though the blockchain shows billions of tokens locked up.

If true, this could partly explain why Ripple continues buying XRP from the open market rather than dipping into escrow. It might not be about optics or marketing—it could be necessity. A smaller liquid supply could also have bullish implications for XRP’s long-term price, since tighter circulation tends to increase scarcity.

Transparency, Ownership, and Interpretation

Naturally, the theory drew skepticism. Some community members pointed out that Ripple’s escrow holdings are public information, fully visible on-chain. Nietzbux agreed but made a subtle distinction: while the escrow balance itself is public, the ownership or contractual commitments tied to those tokens aren’t.

Ripple can’t just sell off escrowed XRP whenever it wants. Those tokens are released gradually and follow set conditions. But as Nietzbux highlighted, it’s possible that certain amounts are already pre-allocated—essentially promised to partners or institutions before being fully released.

Another user jumped in asking if “pre-allocation” referred to XRP being reserved for Ripple’s banking and financial partners. Nietzbux confirmed this interpretation, explaining that in such a case, the tokens may already be sold or assigned, only waiting for scheduled release from escrow.

Ripple’s Long Game

If this theory holds any weight, Ripple’s decision to purchase XRP directly from the market could be part of a broader strategy. It might help maintain liquidity, manage price volatility, and signal continued commitment to XRP’s ecosystem health.

For investors, this idea reframes Ripple’s financial behavior—it’s not just a buyback; it’s a calculated move to preserve market stability and long-term confidence.

While none of this is confirmed, the discussion reveals a fascinating layer beneath the surface. Whether pre-allocation is real or not, it highlights how Ripple’s complex treasury management continues to fuel debate about who truly controls XRP’s future—and how much of it is really in play.