- XRP dropped 9% to around $1.50, with recovery momentum slowing as speculation rises.

- Long-term fundamentals remain strong, with XRP holders hitting a new all-time high of 507,110 and SBI reaffirming its Ripple stake.

- Perpetual shorts dominate near-term action, with $13.5M in bull liquidations and key levels at $1.67 upside and $1.11 downside.

XRP just posted one of the sharpest drops among the top five cryptocurrencies, sliding roughly 9% in the past 24 hours. At the time of writing, the token is trading near $1.50, and the mood around it feels a little uneasy. Not because XRP’s story is suddenly broken, but because the short-term market is leaning heavily toward speculation, and the momentum that could support a clean recovery is starting to slow.

It’s the kind of setup where fundamentals look steady, but price still gets pushed around by leverage. And right now, leverage is doing most of the talking.

Fundamentals Still Look Solid, Even With the Price Damage

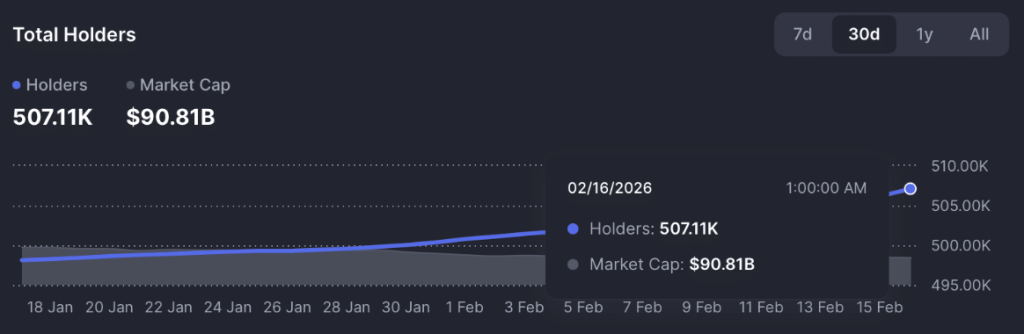

For all the weakness on the chart, XRP’s fundamentals haven’t collapsed. If anything, the on-chain holder data paints a surprisingly constructive picture. According to CoinMarketCap, the total number of XRP holders reached 507,110 on February 16, marking a new all-time high.

That’s not what you expect to see if confidence is truly evaporating.

Over the past seven months, XRP is still down about 58.9% from its all-time high of $3.66. Yet the holder base keeps growing, which suggests long-term investors are still stepping in, even while short-term traders are getting chopped up. This kind of steady accumulation during fragile market conditions tends to build a stronger base underneath price, especially once broader sentiment stabilizes.

It’s not a guarantee of an immediate rebound, but it does signal that XRP still has committed buyers. Quiet ones.

SBI’s Ripple Stake Reinforces Institutional Confidence

Institutional support hasn’t disappeared either. In a post on X, the chairman and president of SBI Holdings Inc., one of Japan’s major financial conglomerates, reaffirmed that SBI maintains a 9% stake in Ripple Labs, the company behind XRP.

He went further than that, too. He emphasized that Ripple’s total valuation, including the ecosystem Ripple has built, would be “enormous,” and pointed out that SBI owns more than 9% of that.

That kind of statement matters because it signals long-term conviction from a serious institution. This isn’t retail hopium. It’s a strategic stake being held through volatility, which reinforces the idea that XRP still has deep-pocketed believers behind the scenes.

Perpetual Traders Are the Real Reason XRP Is Bleeding

So if fundamentals look strong, why is XRP getting hit this hard?

The answer is pretty simple: derivatives.

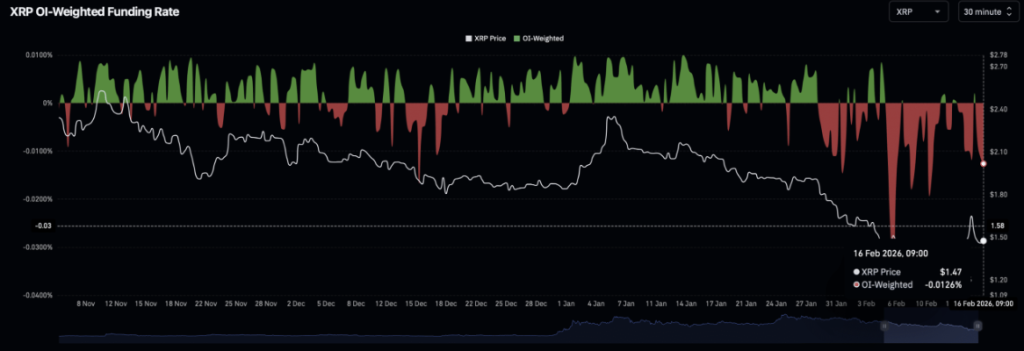

XRP’s underperformance appears to be driven mainly by perpetual market activity, where short sellers have been aggressively positioning for downside. As price dropped, that short pressure triggered roughly $13.5 million in liquidations among bullish traders, according to CoinGlass. That liquidation wave adds fuel to the downside, because forced closes turn into market sells, and the cycle feeds itself.

CoinGlass data also shows a sharp contraction in capital. XRP’s perpetual market saw about $245.7 million leave as price declined, with Open Interest now sitting near $2.6 billion. That drop suggests traders are either reducing risk or getting forced out, while short positioning continues to build.

The Open Interest-weighted funding rate fell to around 0.0101%, which indicates bearish positions are currently dominating. And when perpetual traders dominate the flow, spot price often follows, even if long-term investors are still accumulating in the background.

XRP’s Next Move Comes Down to a Few Key Levels

From a chart perspective, XRP isn’t giving a clean bullish or bearish confirmation yet. It’s in that awkward middle zone where the next move is going to define the direction.

If bearish pressure stays active, XRP could drift down to test the lower demand zone shown on the chart before attempting any move toward the descending resistance line. If buyers regain momentum, the first upside target is the recent wick low around $1.67, which formed on February 15 and now acts as a near-term recovery marker.

But if selling continues and XRP breaks below the descending channel, the downside opens toward $1.11. That would likely shift sentiment sharply and could trigger another round of leverage unwinds.

On the bigger picture, XRP remains stuck inside a descending channel. That does reflect ongoing selling pressure, but it’s worth noting that descending channels are often viewed as bullish reversal structures once price breaks above the upper resistance. Until that breakout happens, though, the market remains vulnerable to leverage-driven swings.

Right now, XRP is basically caught between two forces. Long-term accumulation is still building. But short-term derivatives traders are controlling the tape, and they’re leaning bearish.