- The 300 million XRP transfer appears to be an internal Ripple wallet move, not an external sale

- Historical patterns suggest routine escrow and treasury management rather than market manipulation

- XRP price action depends more on broader market trends than single whale transfers

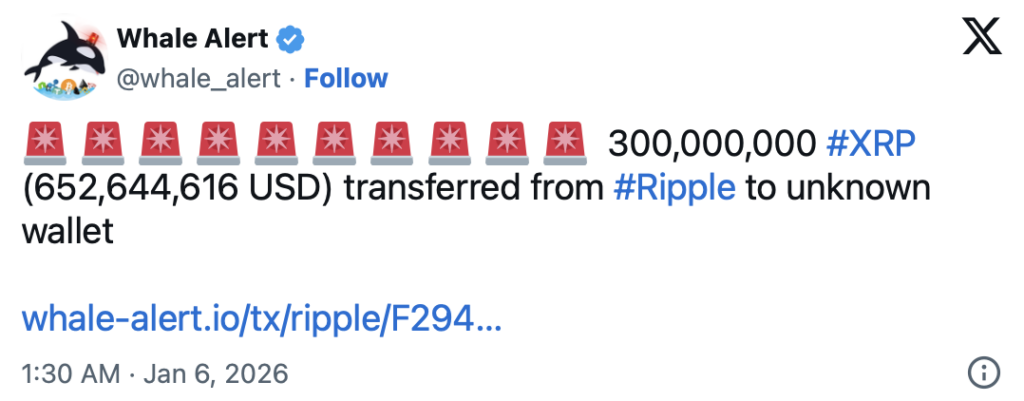

On January 5, 2026, on-chain trackers flagged a massive XRP transfer that immediately caught the market’s eye. Roughly 300 million XRP, valued at about $652 million at the time, moved from a known Ripple-linked wallet to an address labeled as “unknown.” These kinds of whale-sized transactions always spark speculation, especially when they involve Ripple itself.

Investors quickly began asking familiar questions. Is this just internal bookkeeping, or is Ripple preparing for something larger behind the scenes. In crypto, size alone is enough to fuel narratives, even before the facts are fully understood.

Breaking Down the 300 Million XRP Transaction

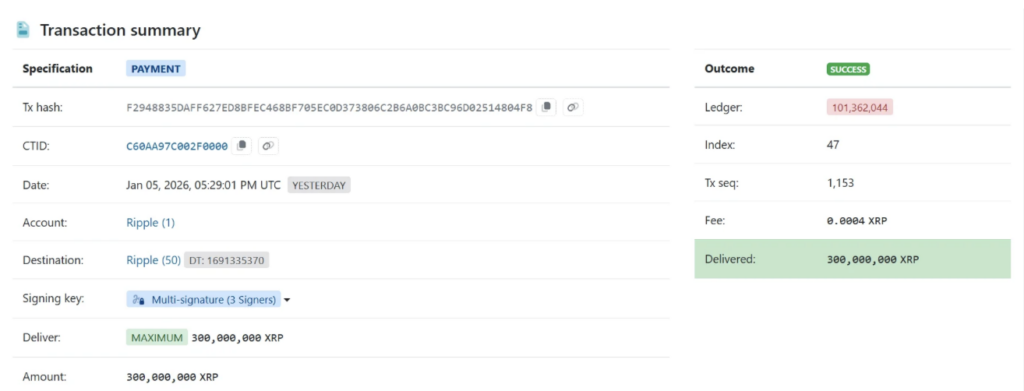

The transfer took place at 17:29 UTC on January 5, with XRP trading near $2.18. The sending wallet was clearly tagged as Ripple-associated, pointing to corporate treasury or escrow-related control rather than a private holder. The receiving address, meanwhile, lacked a public label in some tracking systems, which led to the “unknown wallet” tag.

Despite the large dollar value, the mechanics were very ordinary by XRPL standards. The transaction settled in seconds, cost a fraction of a cent in fees, and occurred during a broader crypto market upswing where XRP itself was already up around 6% on the day. Context matters here, and timing often shapes perception more than reality.

The “Unknown Wallet” Isn’t as Mysterious as It Sounds

At first glance, sending 300 million XRP to an unidentified address can feel unsettling. In practice, “unknown” usually just means unlabeled, not external. XRP Ledger explorers such as XRPScan later identified the receiving wallet as “Ripple (50),” one of many internal addresses controlled by the company.

This suggests the XRP never actually left Ripple’s ecosystem. It was simply moved from one internal wallet to another, likely for operational or accounting reasons. Similar situations have played out before, including a 200 million XRP transfer in 2025 that initially raised eyebrows before analysts confirmed it was an internal shuffle.

Can This Wallet Be Tracked Going Forward

Because the XRP Ledger is fully public, the receiving address can be monitored over time. Analysts typically watch for signs that funds are moving toward known exchange wallets, which could indicate selling or liquidity provisioning. As of the transfer, no such exchange inflows were observed.

Another signal is fragmentation. If the 300 million XRP begins breaking into smaller transfers, it could point to distribution across partners or payment corridors. If it stays dormant, that usually implies custody or treasury storage rather than active deployment.

Why Would Ripple Move 300 Million XRP

Ripple hasn’t commented directly on this transaction, so any explanation relies on historical patterns rather than confirmation. The most straightforward explanation is routine escrow and treasury management. Ripple unlocks 1 billion XRP at the start of each month, then typically re-locks 70% to 80% back into escrow.

In January 2026, that same pattern played out. Roughly 700 million XRP returned to escrow, leaving about 300 million available for operational use. Moving that amount days later fits neatly with past behavior and doesn’t signal anything unusual by Ripple’s standards.

Liquidity, Operations, or Simple Wallet Rotation

Another possibility is operational liquidity. Ripple uses XRP for cross-border payments through its payments infrastructure, and funds are sometimes allocated to support liquidity in specific corridors. If that’s the case, portions of the XRP could later move toward exchange accounts tied to those services.

There’s also a more mundane explanation. Large holders periodically rotate funds between wallets for security or administrative reasons. Spreading assets across multiple addresses reduces risk and simplifies internal management. When this happens, funds often sit idle for extended periods, which has been observed in past internal transfers.

Does a Whale Transfer Like This Move XRP’s Price

Despite the size of the transaction, transfers like this don’t automatically push XRP’s price up or down. What matters is whether the XRP enters circulating supply through exchanges. In this case, no immediate selling pressure appeared, and XRP continued rising alongside the broader market.

Historically, Ripple has moved hundreds of millions of XRP without triggering sharp price reactions. Sometimes prices rise, sometimes they dip, and often nothing happens at all. The surrounding market environment usually plays a much bigger role than the transfer itself.

What XRP Holders May Want to Watch Next

Going forward, attention will remain on the receiving wallet’s activity. Exchange inflows, fragmentation into smaller transfers, or disclosures in Ripple’s quarterly reports could all provide clues. Exchange reserve data and trading volume will also help signal whether new supply is entering the market.

As always, context is everything. In early 2026, crypto markets were broadly trending higher, which tends to absorb supply more easily. Understanding how Ripple manages escrow and treasury movements helps cut through the noise when whale alerts hit social feeds.