- Ripple plans to buy $1B in XRP to build a new digital asset treasury.

- The company recently acquired GTreasury to expand on-chain asset management.

- The move could make Ripple the leading corporate holder of XRP and redefine institutional adoption.

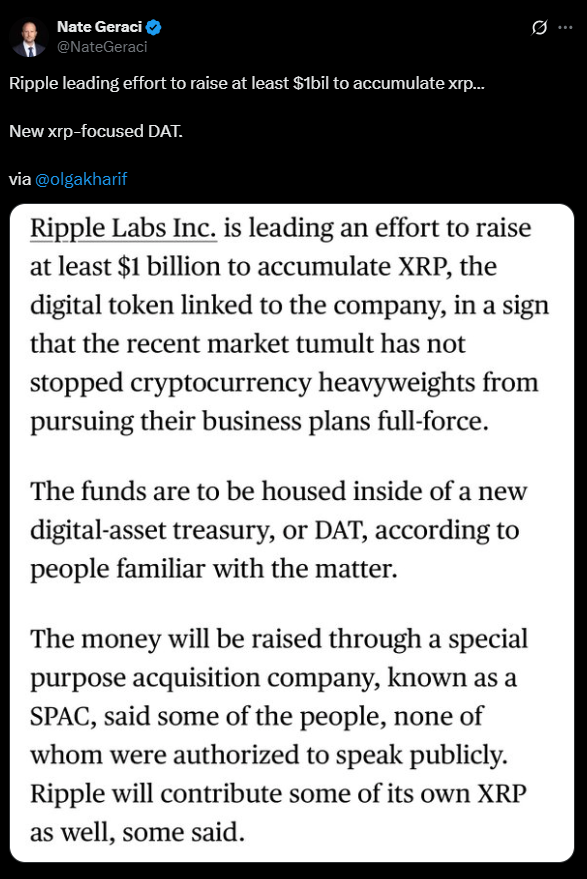

Ripple Labs is reportedly preparing to buy back $1 billion worth of XRP as part of a plan to establish a new digital asset treasury, according to a Bloomberg report citing insider sources. The deal, expected to be organized through a special purpose acquisition company (SPAC), would mark one of the largest corporate crypto purchases to date.

Ripple’s Ambitious Treasury Plan

Ripple’s new digital asset treasury (DAT) will consist of freshly purchased XRP tokens, alongside a portion of Ripple’s existing holdings. The exact structure of the deal is still being finalized, but the treasury would function as a reserve mechanism for on-chain operations and potential yield strategies tied to tokenized finance.

Ripple already owns a significant XRP stash — 4.5 billion tokens in circulation and 37 billion more in escrow. A $1 billion buyback would add roughly 427 million XRP to its balance sheet, consolidating Ripple’s position as the single largest institutional holder of the token.

Strategic Expansion Through GTreasury Acquisition

The buyback comes just a day after Ripple acquired GTreasury, a corporate treasury management firm, in a $1 billion deal. That acquisition gives Ripple the infrastructure to handle digital asset treasuries, stablecoins, and tokenized deposits — services that could be extended to institutional clients looking to generate yield from on-chain reserves.

The timing suggests Ripple is positioning itself to become a crypto-native financial infrastructure provider, merging traditional treasury management with blockchain technology.

Ripple Eyes Leadership in XRP-Based Treasuries

If finalized, this move would cement Ripple’s role as the primary liquidity and reserve hub for XRP. While corporate holdings of Bitcoin and Ethereum dominate at $152 billion and $23 billion respectively, XRP’s treasury presence has been minimal so far. Companies like Trident Digital Tech Holdings, Webus, and VivoPower have recently pledged to build XRP-based reserves worth $500M, $300M, and $100M respectively — but Ripple’s proposed $1B treasury would surpass them all.

What It Means for XRP Holders

Ripple’s massive buyback signals long-term confidence in XRP’s utility and value. While short-term price moves might stay muted amid market volatility, a corporate-led accumulation of this scale could provide structural demand support. It also reaffirms Ripple’s intent to integrate XRP deeper into real-world financial systems, from stablecoin issuance to cross-border payments.