- Brad Garlinghouse gives the Clarity Act an 80% chance of passing by late April

- He urges the industry to accept an imperfect bill over continued uncertainty

- Stablecoin yield remains the key dispute holding the framework back

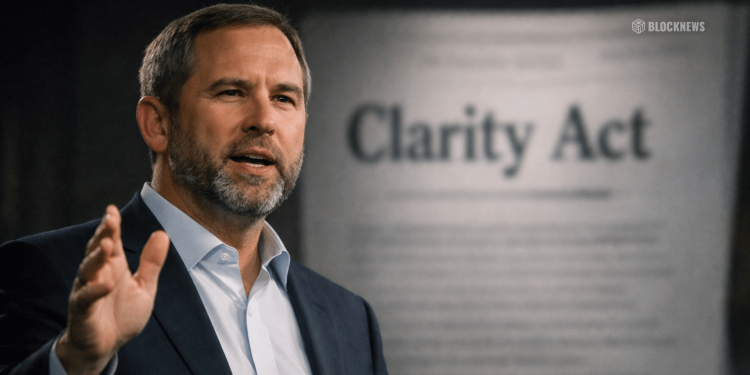

Ripple CEO Brad Garlinghouse is putting a surprisingly high number on the Clarity Act: an 80% chance of passing by the end of April. That kind of confidence is rare in US policy, especially for crypto, where “soon” usually turns into “maybe next year.” But Garlinghouse’s point wasn’t just optimism. It was urgency.

He said the Clarity Act nearly cleared the Senate Banking Committee markup process before stalling. And instead of demanding a perfect framework, he pushed the industry to accept progress. His message was blunt: clarity is better than chaos, even if the bill isn’t everything crypto wants.

Ripple Has a Personal Reason to Push This Bill

Ripple’s motivation isn’t subtle. The company spent four years in a high-profile SEC battle that ended with a federal judge ruling XRP is not a security. That was a major win for Ripple, but it didn’t solve the larger issue. The broader crypto industry still operates without a clear regulatory framework.

Garlinghouse basically tied Ripple’s long-term success to the health of the entire market. Even with XRP’s legal status more defined than most tokens, Ripple still depends on exchanges, liquidity, and US market access. If the industry stays trapped in regulatory fog, Ripple doesn’t get to thrive in isolation.

The Industry Stalemate Is Still About Stablecoin Yield

The Clarity Act stalled in January after Coinbase withdrew support, largely due to unresolved disagreements around stablecoin yield and other issues. That dispute is still the central pressure point. Banks fear losing deposits if crypto firms can offer higher returns than traditional checking accounts.

That fear isn’t irrational. Yield-bearing stablecoins could pull capital out of the banking system in a way that regulators and institutions will fight aggressively. And because stablecoins sit at the heart of crypto market plumbing, this one disagreement has been enough to slow the entire framework.

Why the Timing Matters for Crypto in 2026

High-level negotiations are reportedly continuing, and pressure is building from the administration to finalize a framework before the 2026 midterm elections. That deadline matters because once campaigns heat up, controversial bills tend to get pushed aside.

Without a market structure bill, crypto remains under fragmented rules that push companies offshore and keep exchanges, issuers, and developers operating under legal uncertainty. Garlinghouse’s argument is essentially that the industry has waited long enough. Even an imperfect framework would be better than continuing to live under enforcement-first regulation.

XRP Price Shows the Market Still Feels the Uncertainty

XRP’s price action reflects the same theme. The token has struggled to break through resistance zones, with sellers defending key moving averages and support sitting around the $1.35 to $1.40 region. The chart isn’t the main story here, but it reinforces the bigger point: crypto markets still trade under a regulatory cloud.

If the Clarity Act actually passes, it would change more than legal language. It could shift capital flows, improve US exchange confidence, and pull more crypto business back onshore. That’s why Garlinghouse’s 80% call matters, even if the bill is imperfect.