- Solana’s monthly decentralized exchange (DEX) trading volume surpassed $70 billion for the first time, driven by top DEXs like Raydium, Orca, and Lifinity.

- Raydium contributed a record $43 billion in trading volume over the last 30 days, while Solana’s daily trading volumes exceeded $5 billion for three consecutive days.

- Solana outperformed Ethereum in 24-hour trading volume, with Raydium alone facilitating more trades than Ethereum’s top DEX, Uniswap.

Solana‘s decentralized exchange (DEX) ecosystem has hit a major milestone, with monthly trading volumes surpassing $70 billion for the first time. This growth signals the rising popularity of Solana’s fast and low-cost network.

Major Contributors to the Milestone

Top DEXs like Raydium, Orca, and Lifinity have fueled Solana’s impressive growth. Raydium led the charge, contributing a record $43 billion in volume over the last 30 days. Orca followed with $11.55 billion, while Lifinity racked up $4.48 billion in monthly volume.

Raydium also posted $2.78 billion in weekly volume, representing a 127% jump. Orca saw a 140% weekly increase to $766 million. Lifinity managed $304 million, a 214% improvement. Before this, Solana’s previous monthly high was $60 billion in March.

Three Days Above $5 Billion

Solana also recently broke the $5 billion mark in daily volume for three consecutive days, the first time achieving this.

Outshining Ethereum

In the last 24 hours, Solana has conducted 7 times more trading volume than Ethereum – $6.24 billion vs. $850 million. Raydium alone saw more than $4 billion in daily volume, dwarfing Ethereum‘s top DEX.

The Role of Meme Coins

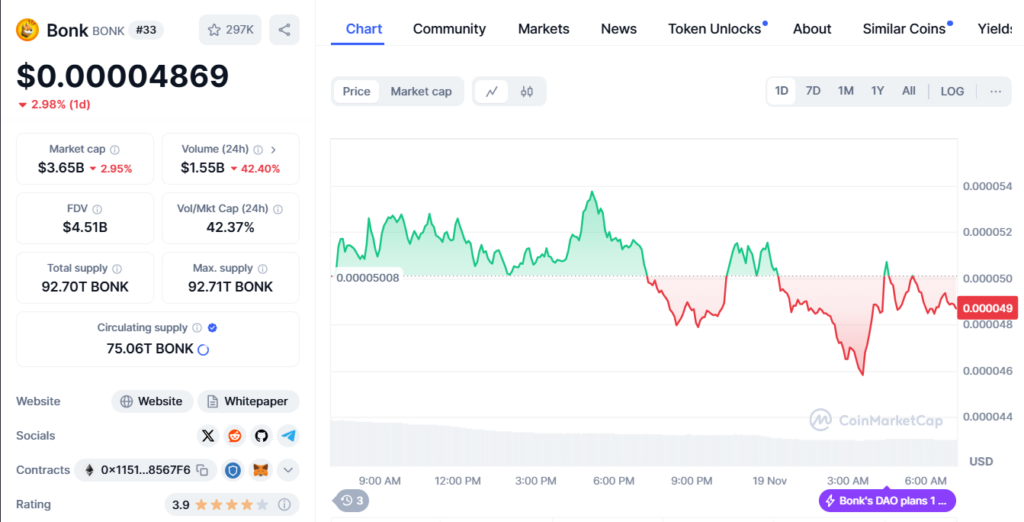

Meme coins have also boosted Solana’s popularity. Dog-themed tokens DOG and BONK are now in the top 40 biggest cryptos by market cap. Their rising adoption demonstrates Solana’s appeal for new projects.

Conclusion

With major DEXs driving record growth, Solana is staking its claim as a top destination for decentralized trading. Its high speeds and low fees make it a compelling alternative to Ethereum. The recent milestones highlight the network’s burgeoning possibilities.