- Powell is preparing for a potential December rate cut, but divisions inside the Fed remain sharp.

- Missing October inflation and jobs data are complicating the decision ahead of the meeting.

- Markets now see a nearly 80 percent chance of a rate cut, pressuring Powell to act.

Federal Reserve Chair Jerome Powell is now quietly preparing the ground for a possible interest rate cut at the December 9–10 FOMC meeting, according to a new report from Nick Timiraos at the Wall Street Journal. The tone is shifting, but the situation is messy, with Powell reportedly torn between cutting now or waiting for more clarity early next year. Some insiders say he’s leaning toward easing as part of the broader trend that’s already produced two straight cuts, yet others inside the Fed are bracing for a fight over whether inflation has cooled enough to justify another move.

Williams Pushes for Action as Fed Voices Clash

Support for a December cut picked up after New York Fed President John Williams said he favored easing to prevent the labor market from weakening further. That comment alone pushed expectations sharply higher. But not everyone is convinced. Several Fed officials warn inflation pressures remain sticky, and they’re uneasy making a major policy call without October’s inflation and employment data, both delayed by the long government shutdown. Without those reports, Powell enters the meeting with one of the thinnest data picture he’s faced in years.

Traders Raise Bets Despite the Data Void

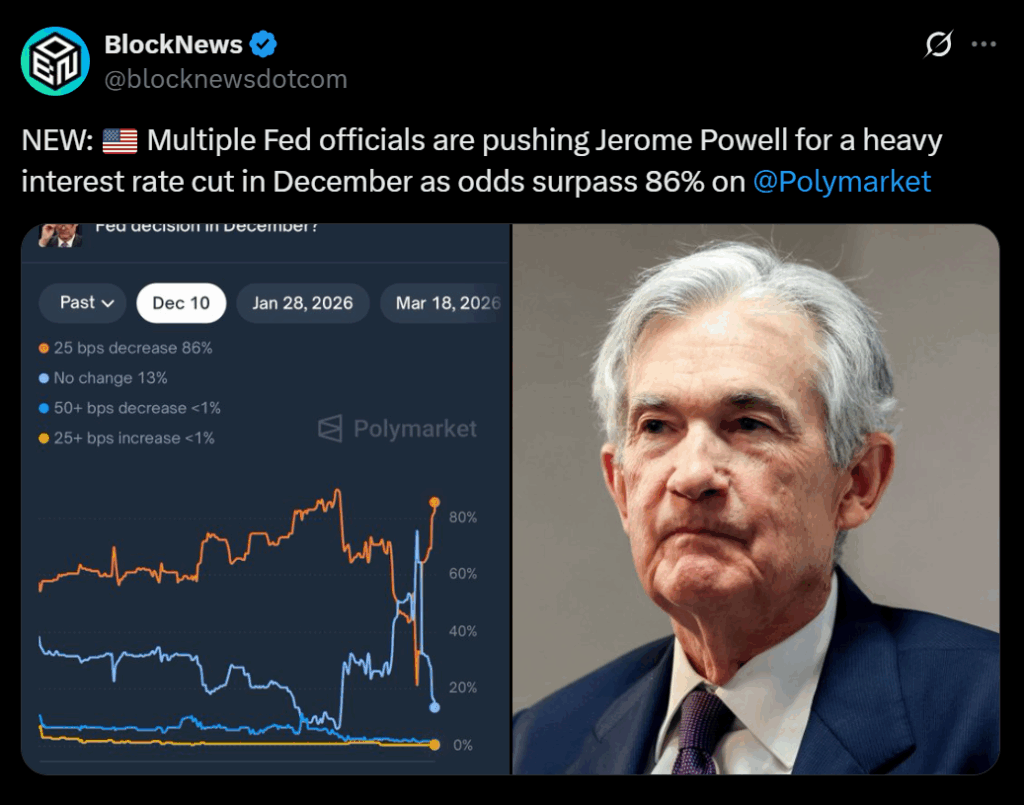

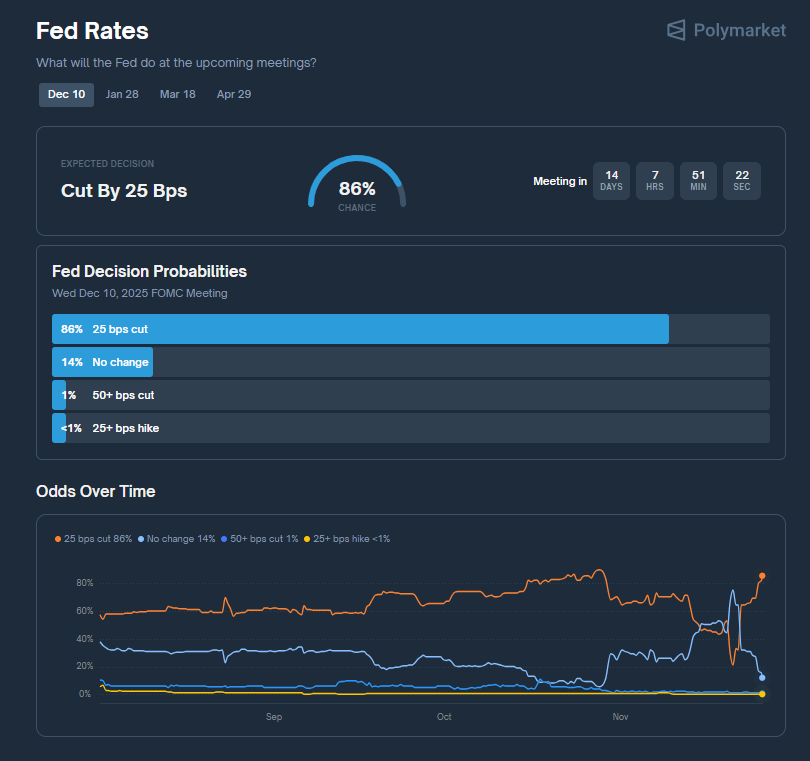

Markets, however, aren’t waiting. Polymarket now shows traders pricing a 86 percent chance of a 25-bps cut in December. Investors appear convinced Powell will act, even though the missing data normally would’ve been the last major input before the Fed’s final decision of the year. In a strange twist, less information is actually pushing rate-cut odds higher, as traders assume Powell won’t risk tightening conditions during a softening labor stretch.

Powell Must Balance Pressure, Politics, and Expectations

As the Fed heads into its final meeting of 2025, Powell faces one of his trickiest setups yet: internal division, missing metrics, and markets that are almost daring him to cut. He now has to decide whether to deliver easing sooner rather than later, or hold off and risk disappointing traders who’ve already priced in the move. Either way, the decision will set the tone for early 2026, shaping how the central bank responds if the economy slows faster than expected or if inflation surprises again on the upside.