- Popcat’s trading volume surged over 500% after Hyperliquid DEX manipulation rumors, triggering more than $63M in long liquidations.

- A massive $21M whale position was completely wiped out as futures volume spiked over 1100% and shorts took control.

- Popcat’s price crashed nearly 20%, and if bulls fail to hold the $0.1029 support, it could revisit sub-$0.10 levels.

Solana’s feisty little memecoin Popcat ended up right in the middle of a market storm after its trading volume suddenly exploded more than 500% in a single day. What should’ve looked like a breakout rush instead turned into chaos, thanks to fresh allegations of manipulation happening on Hyperliquid DEX. Solanafloor flagged the odd activity first, and that was enough to spark full-on panic across the Solana community. One moment Popcat was coasting near $0.12… and the next, the entire market was spiraling into liquidations and speculation.

Liquidations Hit Hard — $63M Gone in Hours

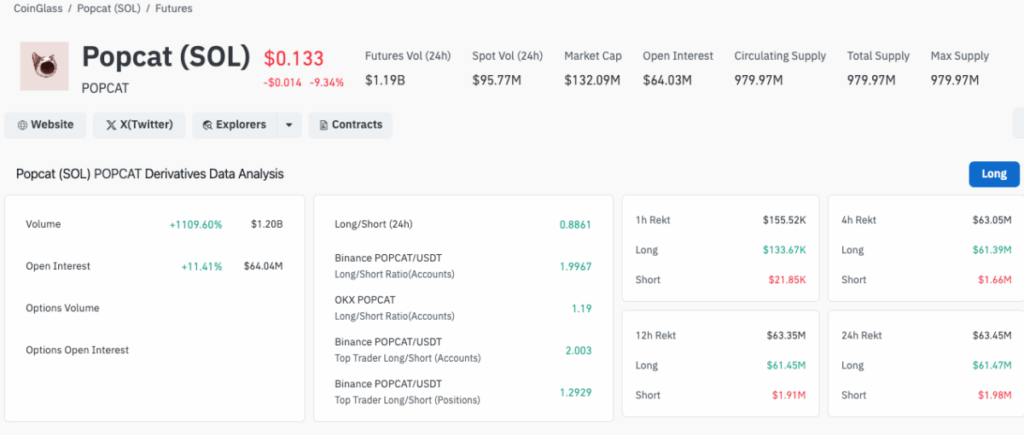

The fallout came fast. According to Coinglass, more than $63 million in long positions got wiped out in just four hours. Nearly all of it — around $62 million — came from bullish traders who were overleveraged and got caught completely off guard. Shorts barely took a hit at all, with only $1.6 million liquidated on their side, which just shows how dramatically the long crowd got squeezed.

Inside that mess was one brutal moment: a single whale holding roughly $21 million was nuked entirely. It ended up being the biggest liquidation of the day outside Bitcoin and Ethereum markets — which honestly says a lot about how violently Popcat’s futures reacted. Futures volume skyrocketed over 1109%, reaching ~$1.2 billion, while open interest pushed up more than 11% to hit $64 million. With the long-to-short ratio crashing to 0.89, shorts clearly took control and rode the volatility for fast profits.

Popcat Price Slides, Rankings Shift, and Memecoins Reshuffle

Even after the dust started settling, Popcat couldn’t stabilize. It slipped roughly 10% intraday to around $0.21 before plunging even further. The memecoin also fell out of Solana’s top-ten list as others held up better: Catinadogsworld (MEW) only dipped slightly, and the Melania token somehow pushed up 17% during the chaos. The reshuffle made one thing painfully clear — memecoins rise fast, but they can fall even faster when credibility gets shaken.

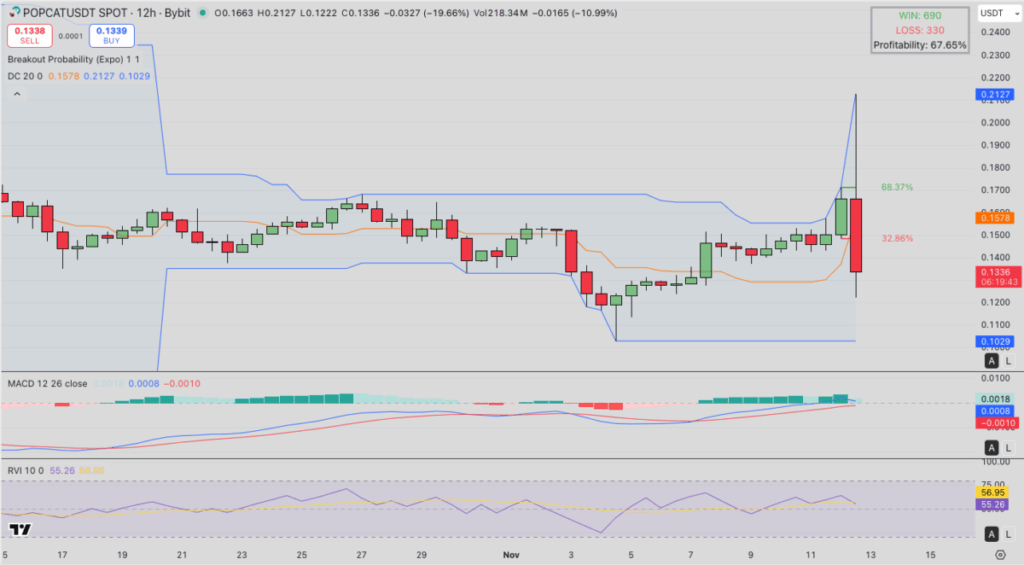

Technically, the charts look rough. Popcat was rejected at $0.2127, then dumped nearly 20% to $0.1324, leaving behind a long upper wick that screams heavy distribution. The Donchian Channel upper band acted like a ceiling, and the median line around $0.1578 flipped into resistance after the fall. Indicators aren’t helping either: the MACD histogram has been narrowing (a sign of fading bullish strength), and the RVI hanging near 56.9 suggests the market is stuck in a weird post-volatility limbo.

Can Bulls Protect the $0.13–$0.10 Floor?

If Popcat wants any shot at recovery, bulls need to defend the $0.1029 level. Losing that floor could open the door to a deeper slide toward $0.085 — a zone where the token consolidated earlier this month. On the flip side, reclaiming $0.1578 would revive some short-term bullish energy and maybe set up another attempt at $0.2127 or even $0.24, where the next liquidity pocket sits.

But if manipulation fears keep spreading, Popcat could easily dip back under $0.10 before things settle. And as we’ve seen many times in memecoin land, momentum can evaporate way faster than it forms — especially when whales start moving and retail gets spooked.