- Polygon’s POL token dropped 4% to $0.27 after a node bug disrupted RPC services, forcing validators to resync and causing dApp access issues.

- Despite the outage, the core blockchain kept producing blocks, and developers say most affected nodes are now back online after restarts.

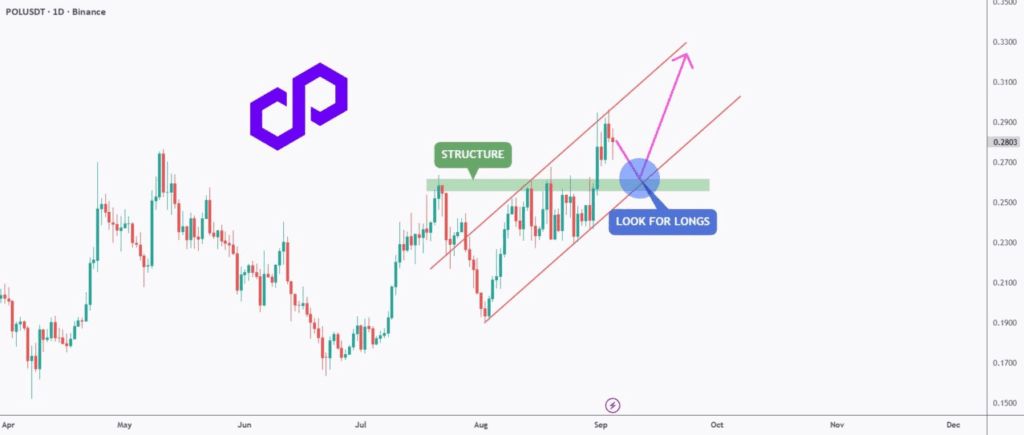

- POL still trades within an ascending channel, with analysts eyeing a potential rebound toward $0.32–$0.33 if momentum returns.

Polygon’s new POL token just hit a speed bump. After weeks of climbing, the network ran into a nasty node bug on September 10, triggering outages for RPC providers and forcing validators to rewind and resync. That hiccup dragged POL down 4% to $0.27, with trading volume slipping 17% as traders grew cautious. Still, the broader trend hasn’t flipped bearish—some analysts argue this could be nothing more than a pause before another leg up.

Node Glitch Puts Spotlight on Network Stability

The bug didn’t crash Polygon completely—the chain kept producing blocks—but dApps and users faced unreliable access as RPC services glitched out. It’s the first notable disruption since July’s Heimdall v2 upgrade. Polygon devs confirmed the issue was linked to specific node configurations, and restarting the affected systems has already fixed things for many. Still, the incident underscored how fragile user experience can feel when the backend wobbles.

The team has promised quicker fixes and better communication with node operators going forward. This comes just days after Polygon wrapped its migration from MATIC to POL, which introduced native staking on Ethereum. For many, this bug is more of a bump in the road than a derailment—but it did rattle some confidence.

Price Outlook: Correction or Just a Reset?

Even with today’s pullback, POL is still riding an ascending channel that’s been in place since July. It’s printing higher highs and higher lows, a structure traders love to see. The “structure zone” that capped earlier rallies has now flipped into support, meaning bulls still have the edge for now.

If momentum returns, projections point toward $0.32–$0.33 in the coming weeks—roughly 20% upside from current levels. In other words, this dip might not be the end of the rally, just a breather before POL tests fresh highs.