- Protocol v23 upgrade validated block 20,824,824 with zero failed transactions, boosting scalability and adding decentralized KYC plans.

- Pi trades around $0.3586, stuck in a descending channel; breakout targets $0.65–$1.67, while failure could drag it to $0.18.

- A 100x move ($36+) looks unlikely short term given Pi’s $2.9B market cap, but long-term upside hinges on mainnet adoption and new listings.

Pi Coin is grabbing attention again after the rollout of Protocol v23 on its testnet, syncing up with Stellar Core v23.0.1. For Pi Network, this is a serious technical step forward, and while it’s still early, the market seems to be waking up to it.

Why This Upgrade Actually Matters

The upgrade was validated with block 20,824,824, and here’s the kicker — zero failed transactions. Each block can now support up to 1,000 transactions, which is a big leap in stability. Developers finally have a stronger framework to test dApps before they hit mainnet.

There’s also a new decentralized KYC system in the works. Instead of clunky centralized checks, it’s designed to tie into national IDs, which could make Pi more open to external projects. In short: it’s about building legitimacy, something Pi desperately needs if it wants to compete.

Pi Price Outlook

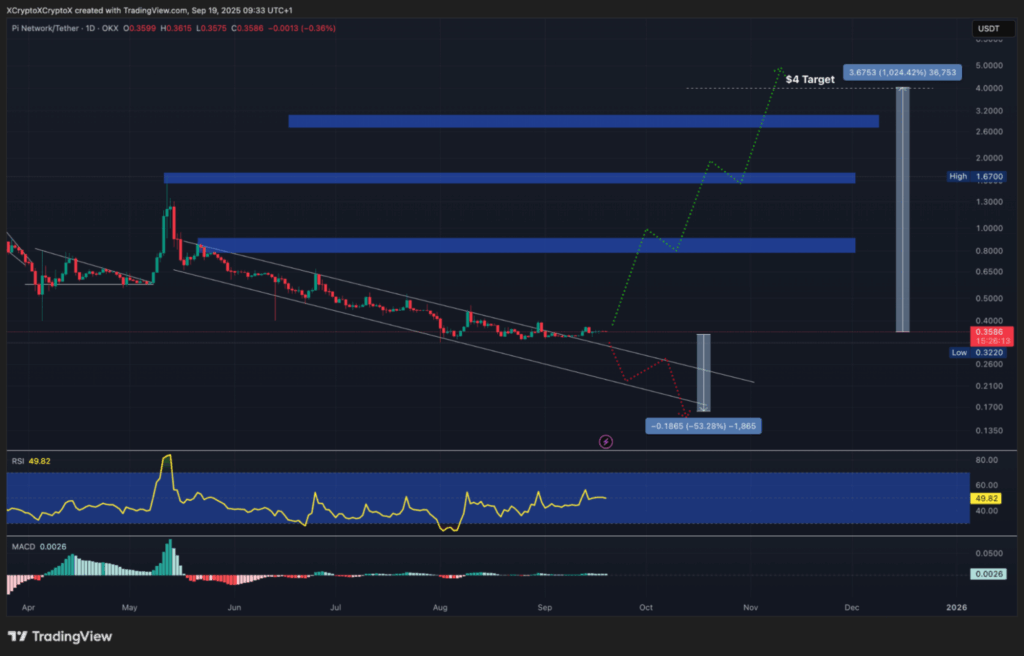

On the charts, Pi hasn’t exactly been exploding. Since May, it’s been stuck inside a descending channel. Right now, price is hovering around $0.3586, sitting near the midline. RSI is at 49.8 — neutral territory. The MACD is just barely positive, suggesting a reversal could be brewing if buyers actually show up.

A clean breakout from the channel could light a path toward $0.65, then $1.00, and even $1.67 if momentum carries. Some bullish calls go further, suggesting a move toward $4, which would be a 1000% rip from current levels. But if Pi can’t break resistance? $0.32 becomes the first stop, maybe even $0.18 — which would be ugly, a 50%+ drop.

The 100x Question

Can Pi actually hit 100x and land somewhere near $36? Honestly, not anytime soon. With a $2.9B market cap, it’s already heavy, and those kinds of gains are almost unheard of unless mainstream adoption explodes.

Still, there’s a long-term case if — and it’s a big if — Protocol v23 makes it to mainnet smoothly, decentralized KYC gets traction, and more exchanges decide to list Pi. Then maybe, just maybe, Pi could climb way beyond today’s numbers. For now though, the dream is alive, but the road is long.