- PEPE surged over 27% in 24 hours, leading the memecoin rebound

- Social buzz and a bold $69B market cap prediction helped fuel momentum

- Long-term sustainability depends on Bitcoin and broader market recovery

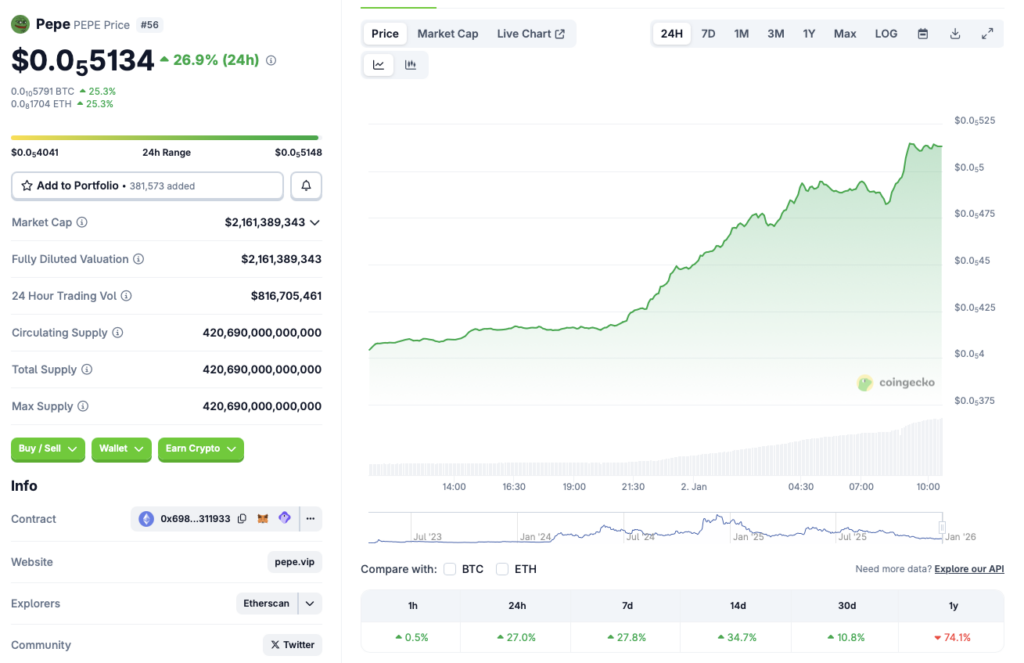

Pepe (PEPE) has surged to the top of the crypto leaderboard, emerging as the best-performing cryptocurrency on the daily charts and the second-best performer on the weekly charts among the top 100 projects. According to CoinGecko data, PEPE is up 27% in the last 24 hours, 27.8% over the past week, 34.7% in the 14-day window, and 10.8% over the previous month.

Despite the explosive short-term rally, PEPE remains deeply underwater on a longer horizon. The memecoin is still down 74.1% since January 2025, highlighting just how severe the earlier drawdown was and why today’s move is drawing so much attention.

What’s Driving PEPE’s Sudden Rally

PEPE’s breakout appears to be unfolding alongside a broader recovery across the crypto market. Most major assets are trading in the green, suggesting a renewed risk-on mood after weeks of weakness.

That improving sentiment has been especially visible in memecoins, which tend to respond quickly once speculative appetite returns. As traders rotate into higher-risk assets, PEPE has become one of the primary beneficiaries of that shift.

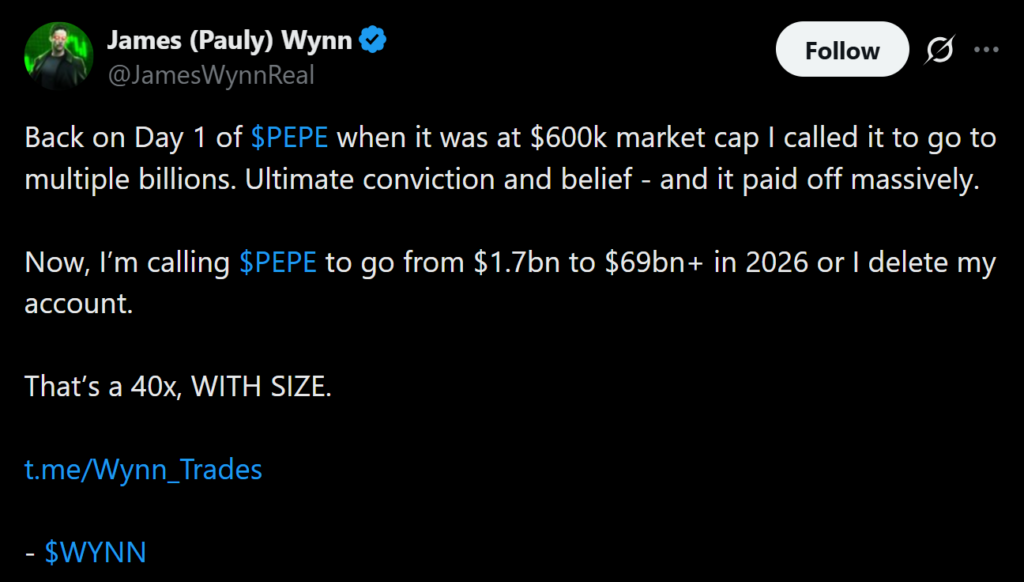

Another potential catalyst is renewed social buzz tied to James Wynn, an early PEPE investor who reportedly turned his position into more than $65 million. Wynn recently claimed that PEPE’s market capitalization could exceed $69 billion in 2026, stating he would delete his account if the target is not reached. Given his track record, many traders appear to be taking the call seriously.

Can PEPE Sustain the Momentum?

While the rally has been aggressive, sustainability remains uncertain. The crypto market as a whole is still fragile, and macroeconomic concerns continue to limit how much risk investors are willing to take.

For PEPE to approach a $69 billion market cap, broader conditions would need to align. Many analysts expect Bitcoin to attempt a new all-time high in 2026, and a strong BTC-led rally could reignite speculative flows across the market. In that scenario, high-beta memecoins like PEPE could see outsized gains.

That said, memecoin rallies are notoriously volatile. Without sustained inflows and broader market confirmation, sharp pullbacks remain a real risk. Whether this move marks the beginning of a longer trend or just another speculative spike will depend heavily on how the overall market evolves in the weeks ahead.