- PEPE remains up strongly across weekly and monthly timeframes despite a daily pullback.

- Recent gains were fueled by early-year risk-on sentiment and bullish community narratives.

- Ongoing market volatility makes memecoins vulnerable to sharp swings in either direction.

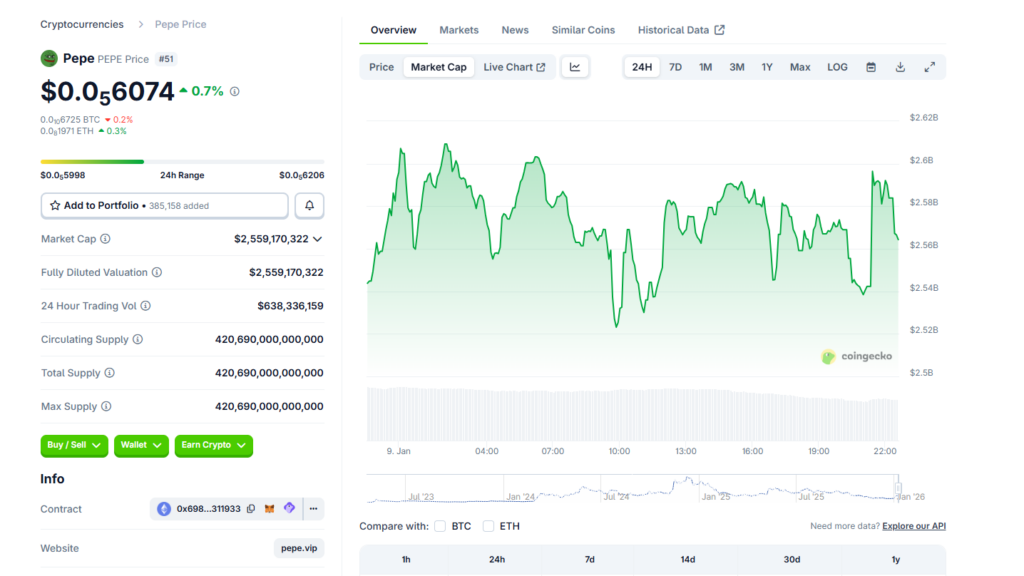

Pepe has taken a breather on the daily chart, slipping about 4.3% over the past 24 hours, but zooming out tells a very different story. According to CoinGecko data, PEPE is still up more than 57% over the last week, nearly 60% across the 14-day window, and over 40% on the monthly timeframe. In a market that has started to wobble again, that kind of relative strength stands out, even if short-term pressure is creeping back in.

Momentum Was Built Before the Broader Market Turned

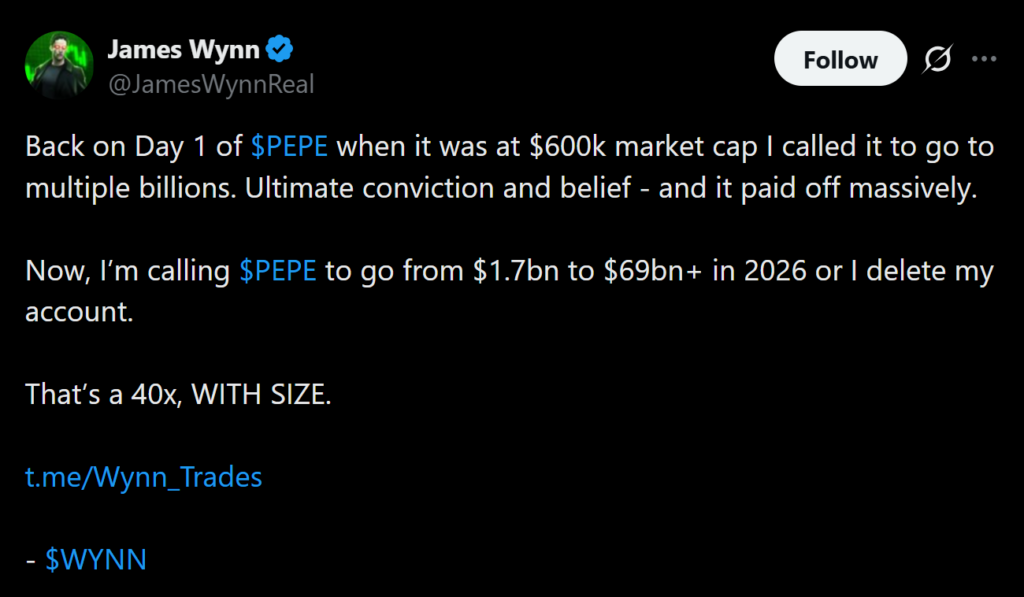

The recent PEPE surge came during a broader risk-on phase to start the year. ETF inflows picked up, Bitcoin briefly reclaimed the $94,000 level, and speculative appetite returned fast. That environment helped memecoins run hard, and PEPE was at the front of the pack. Part of the momentum was also narrative-driven. Early PEPE investor James Wynn reignited attention after forecasting a $69 billion market cap for the token in 2026, a call that resonated with a community already primed to chase upside.

Why Caution Is Creeping Back In

The tone has shifted over the past day. Bitcoin has slipped back toward $90,000, and the broader market has started to correct after failing to hold early January gains. PEPE’s 4.3% dip reflects that change in sentiment more than any project-specific issue. Memecoins tend to amplify both sides of the move, and when risk appetite fades, they are usually the first to feel it.

Volatility Remains the Real Risk

The crypto market still feels fragile. Volatility is elevated, and many investors are taking a more defensive stance. In that environment, memecoins sit at the far end of the risk curve. PEPE could continue to outperform if momentum returns, but it could just as easily see sharper pullbacks if market conditions worsen. This isn’t about fundamentals breaking down, it’s about how quickly sentiment can flip.

What Could Reignite the Rally

There is still a path for PEPE and the broader market to recover. Possible U.S. crypto legislation later this month could improve sentiment if it points toward clearer regulatory frameworks. A renewed push higher in Bitcoin would also likely pull speculative assets back into favor. Until then, PEPE’s strength should be viewed in context. It’s leading on higher timeframes, but the market underneath it remains unstable.