- Whale activity is shrinking, with PEPE’s profitable supply hitting a two-month low of 37.6%.

- Derivatives market data shows capital outflows, negative funding rates, and a rising short bias.

- Technicals remain bearish, with risks of a drop toward $0.00000900 unless bulls reclaim resistance.

Pepe (PEPE) managed a slight 1% recovery Tuesday after tumbling nearly 10% the day before, slipping below the key $0.00001000 level. Despite the bounce, on-chain and derivatives data continue flashing weakness, leaving room for more downside.

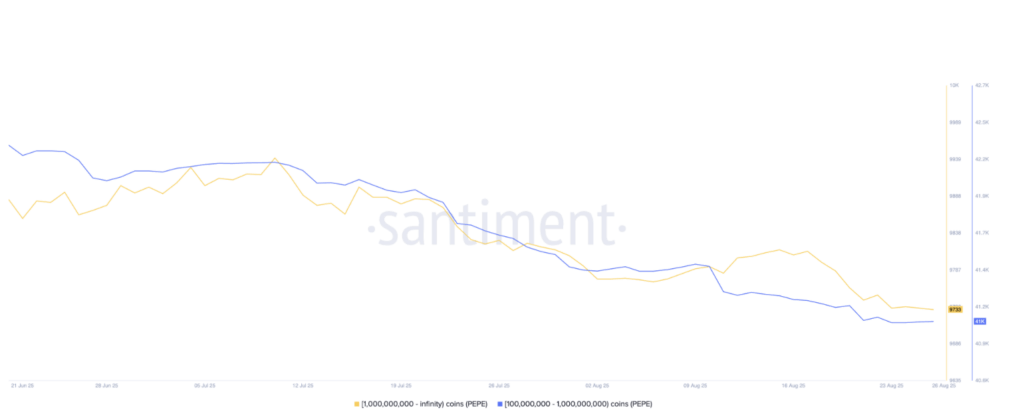

Whale Exit Adds Pressure

Santiment data shows large wallet holders are steadily exiting. Investors with 100M–1B PEPE dropped to 41,058, down from 41,506 earlier this month, while wallets holding over 1B coins slipped to 9,725 from a 9,815 peak. As these whales step away, the total supply in profit has fallen to just 37.6%, its lowest in two months—signaling more overhead pressure.

Derivatives Market Turns Risk-Off

CoinGlass data paints a similar picture. Open interest in PEPE fell 8% in 24 hours to $556.9M, with negative funding rates (-0.0168%) showing traders paying to stay short. The long/short ratio has slid to 0.89, meaning shorts dominate. Together, this highlights waning confidence and a stronger bearish tilt.

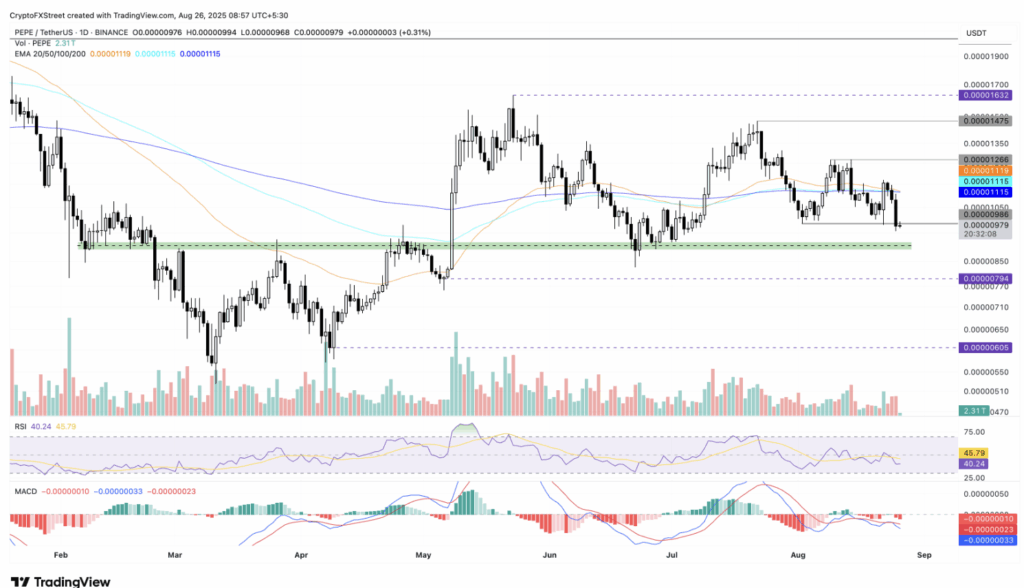

Technicals Point to Deeper Decline

After briefly retesting $0.00000986 as resistance, PEPE risks dropping further to the $0.00000900 demand zone. A looming death cross, with the 50 and 100-day EMAs closing in on the 200-day EMA, adds to bearish fears. MACD stays negative, RSI hovers at 40 near oversold, and momentum clearly favors sellers.

For any real revival, PEPE needs a strong daily close above resistance, potentially targeting the 200-day EMA at $0.00001115. Until then, the downside case dominates.