- On-chain analysis suggests Paradigm is the largest HYPE holder, controlling over 19.14 million tokens worth about $763 million.

- Their estimated entry price is around $16.46 per HYPE, putting Paradigm up roughly $440 million in unrealized gains at current prices.

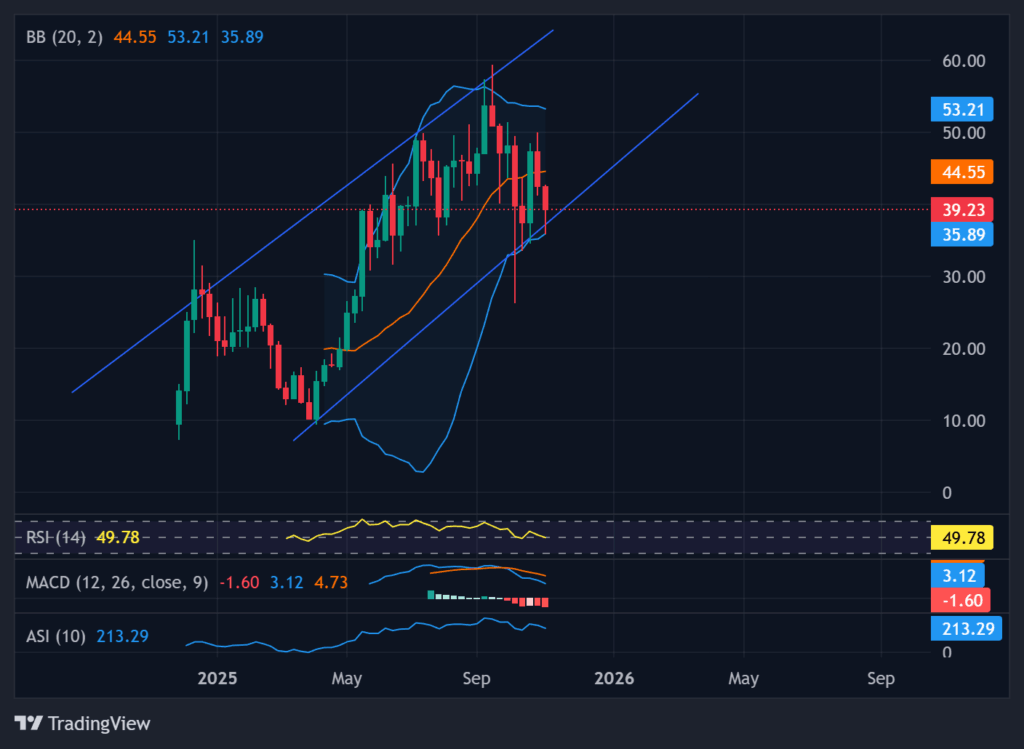

- HYPE is consolidating inside a rising channel, sitting ~33% below its all-time high, with potential to retest $53 if buying returns—or slide toward ~$35.9 if support weakens.

For months, people in crypto circles have been quietly asking the same thing: is Paradigm secretly loading up on HYPE? Well, on-chain data has basically answered that question. According to fresh analysis, Paradigm is now believed to be the largest holder of HYPE, the native token of the Hyperliquid DEX, with more than 19.14 million tokens under its control. At current prices around the low $40s, that stash comes out to roughly $763 million. That’s not just a casual position; that’s a “we really believe in this thing” kind of bet.

How Paradigm’s HYPE Position Was Pieced Together

On-chain analytics firm MLM reports that Paradigm’s stack represents about 1.91% of HYPE’s total supply and 5.73% of the circulating supply, which officially makes them the top holder. Things got really interesting on November 7, when that HYPE was reportedly consolidated into 19 new wallets — a move some analysts think is related to the upcoming SONN event that’s set to wrap up in about 11 days. The trail, though, goes back further. Since August, MLM has been tracking hints that Paradigm was scooping up HYPE, first via Wintermute shortly after the TGE, and later through FalconXGlobal on Gate.io. These transfers lined up neatly with Paradigm’s own public comments about holding HYPE since last November, which pretty much ties the bow on the theory.

Following the On-Chain Footprint and the Profit Math

The deeper you look, the clearer the pattern gets. Back in December, around 4.18 million HYPE moved from Wintermute to a fresh address, which then split the tokens into 10 sub-wallets holding between 150,000 and 840,000 HYPE each. More chunks moved again in February and April, and altogether those transfers added up to more than 15 million tokens. MLM estimates Paradigm’s cost basis at around $16.46 per HYPE, suggesting an initial outlay close to $315 million. With the token now trading near $39–$40, that position would be sitting on more than $440 million in unrealized gains — roughly a 2.5x paper profit. Paradigm hasn’t officially confirmed any of this, but the addresses and flows tell a pretty loud story on their own.

HYPE Price Action: Consolidation Now, Breakout Later?

Even with a big-name backer in the background, HYPE hasn’t been immune to market chop. The token is down about 15% over the past month and sits roughly 33% below its all-time high at $59.39. Still, it remains the 11th-largest cryptocurrency by market cap, hovering around $13.24 billion. On the weekly chart, HYPE is trending inside a rising parallel channel, with the RSI parked near 49.78 — basically neutral, not overheated and not washed out.

The MACD line is flattening too, which fits the narrative of a consolidation phase rather than a full-blown trend reversal. If buyers step back in, price could make another run toward the upper channel resistance around $53. But if momentum fades again, a drop toward the lower Bollinger Band near $35.89 is also on the table. For now, the market seems to be catching its breath while one of crypto’s biggest funds quietly sits on a mountain of HYPE.