- Bitcoin traders saw $81.9M in liquidations, with longs taking 9x more damage than shorts.

- Over $209M in total crypto positions were wiped out in 24 hours, mostly from overly bullish bets.

- The wipeout happened without a major price crash, showing how leverage can unravel fast.

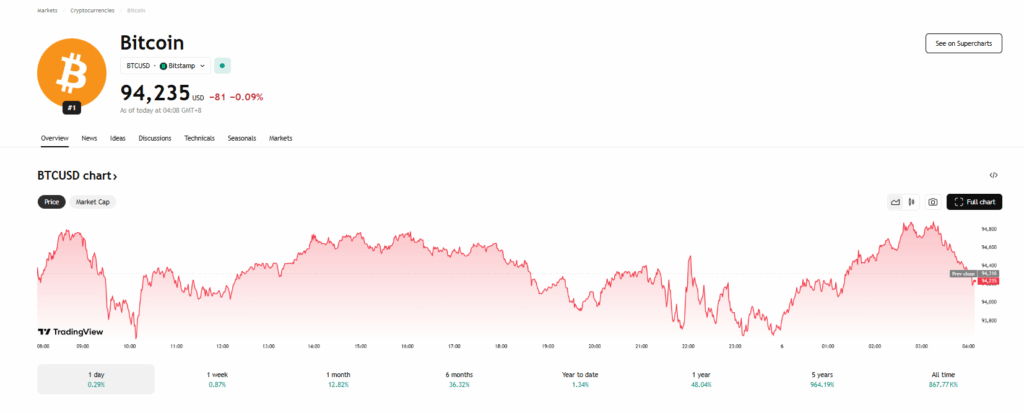

In the past 24 hours, Bitcoin traders got absolutely steamrolled—$81.94 million in liquidations. And get this: $73.55 million of that came from longs. Shorts? Just $8.39 million. That’s a 9-to-1 imbalance. Yeah… it’s one of the most lopsided wipeouts in recent memory.

Longs got crushed—everywhere

This wasn’t just a Bitcoin-only event, either. Across the crypto market, a total of $209.97 million in positions were liquidated, hitting over 74,000 traders. As with BTC, the majority of that pain hit the longs: $167.03 million versus just $42.94 million in shorts. Basically, traders were leaning too far into optimism… and it backfired—hard.

Ethereum saw $37.35 million in liquidations, while Solana and XRP got hit for $9.23M and $6.23M, respectively. Not massive numbers in isolation, but taken together, it paints a pretty clear picture: the market was tilted bullish, and it got punished.

It happened fast, and without a major crash

What’s even weirder? There wasn’t some huge crash to trigger all this. BTC dipped, yeah—but not enough to justify this level of long carnage. That’s the thing with leverage… sometimes it’s not about how far the price moves, but when and how fast.

In the last 12 hours alone, there was $80.55 million in long liquidations versus $26.84 million in shorts. That suggests a cascade effect—like a slow drop that turns into a landslide after stop-losses and margin calls start getting triggered.

The biggest individual liquidation? It came from HTX’s ETH/USDT pair, at $2.36 million, according to CoinGlass.

Was this just a reset… or something worse?

Right now, it’s hard to say if this was just the market shaking off some overleveraged positions or if it’s hinting at deeper trouble ahead. Either way, it’s another reminder: crypto doesn’t always need a crash to wreck traders—sometimes it just needs a little nudge and the rest unravels on its own.