- Morgan Stanley filed with the SEC to launch a staked Ethereum ETF.

- The fund would hold ETH directly and pass staking rewards through to investors.

- The move follows recent Bitcoin and Solana ETF filings, signaling a broader institutional strategy.

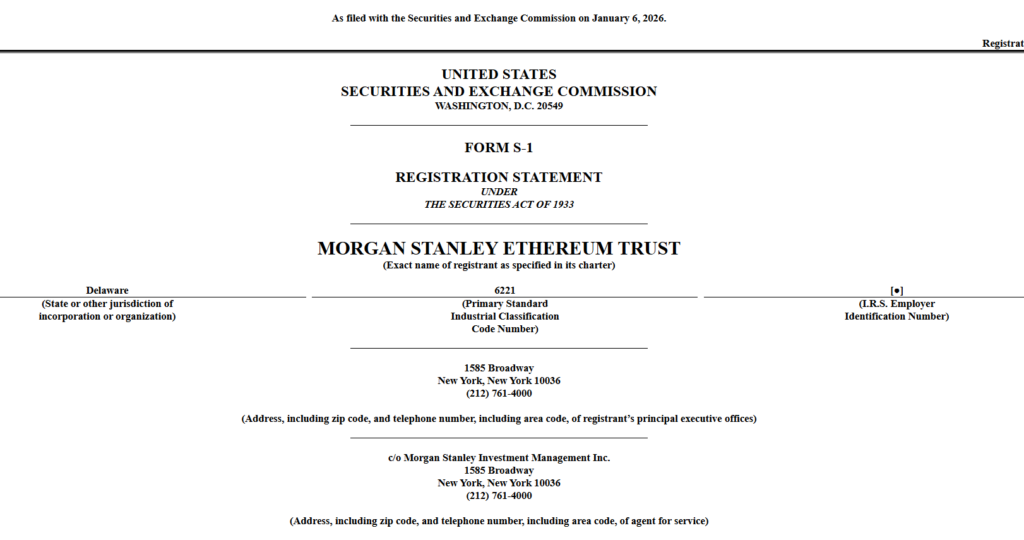

Morgan Stanley Investment Management, which oversees more than $1.8 trillion in assets, has officially filed a registration statement with the US Securities and Exchange Commission to launch an Ethereum exchange-traded fund under the name Morgan Stanley Ethereum Trust. The move adds another heavyweight to the growing list of institutions pushing deeper into crypto, and it signals rising confidence in Ethereum as a long-term, yield-generating asset rather than just a speculative trade.

A Direct ETH Product With Staking Built In

The proposed ETF is structured to give investors direct exposure to Ether without requiring them to buy, store, or manage the asset themselves. The fund would hold ETH directly and stake a portion of its holdings through third-party providers, allowing staking rewards to flow into the fund’s net asset value. While the ticker symbol and trading venue haven’t been announced yet, the inclusion of staking is notable. It reflects a shift toward treating yield as a core feature of Ethereum exposure, not an optional add-on.

Part of a Broader Crypto Push From Morgan Stanley

This filing follows closely on the heels of Morgan Stanley’sS-1 submissions for spot Bitcoin and Solana ETFs. Like the Ethereum product, the proposed Solana trust would also stake a portion of its holdings and pass staking rewards through to investors. Taken together, the filings suggest a coordinated strategy rather than isolated experimentation. Morgan Stanley appears to be building a full suite of regulated crypto exposure across major networks, with staking playing a central role where possible.

Ethereum Price Holds Firm as Access Improves

Ethereum was trading near $3,200 at press time, up roughly 8% over the past week, according to CoinMarketCap. While ETF filings don’t usually trigger immediate price explosions, they tend to improve the long-term structure by widening the pool of potential buyers. For Ethereum, increased institutional access combined with staking-enabled products strengthens the case for sustained demand rather than short-lived spikes.