- Monero surged to a new all-time high near $798 before pulling back.

- A $1,000 investment at XMR’s 2015 low would be worth about $3.6 million.

- Recent gains were fueled by renewed interest in privacy coins and sector rotation.

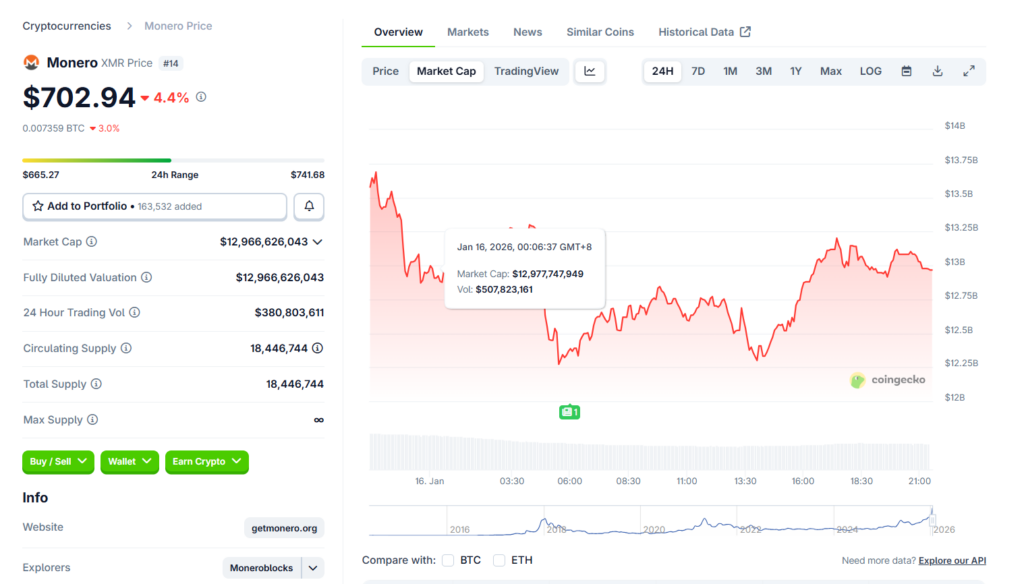

Monero has been one of the standout performers in crypto over the past year, delivering gains that few assets can match. The privacy-focused coin recently surged to a new all-time high near $797.73, capping off a powerful rally that saw XMR climb more than 220% since January 2025. While momentum has cooled slightly, with the price pulling back about 16% from its peak, the broader move has already cemented Monero’s place among the top-performing assets of the cycle.

According to CoinGecko data, XMR gained roughly 47% over the last week, 60% over two weeks, and more than 56% over the past month before the latest correction set in. Even after a 4.8% dip in the last 24 hours, the scale of the rally remains hard to ignore. For long-term holders, the numbers tell a much bigger story.

How a $1,000 Bet Became a $3.6 Million Outcome

To understand the magnitude of Monero’s rise, it helps to rewind. Back in January 2015, XMR traded as low as $0.2162. A $1,000 investment at that price would have bought roughly 4,629 XMR tokens. Fast forward to January 2025, when Monero reached its peak near $797.73, and that same stash would have been worth around $3.6 million.

That translates to a gain of more than 369,000%, a reminder of what early adoption and long-term conviction can deliver in crypto. Of course, those kinds of returns are rare and often only visible in hindsight, but Monero’s journey remains one of the more striking examples.

What Drove Monero’s Latest Surge

Monero’s recent momentum wasn’t random. Interest in privacy-focused assets picked up sharply in late 2025 as regulatory pressure and surveillance debates intensified across the industry. XMR, long regarded as the benchmark privacy coin, benefited directly from that shift.

The rally was also amplified by turmoil elsewhere in the privacy sector. Internal conflicts within the Zcash ecosystem, including the departure of its core development team, likely pushed some investors to rotate capital into Monero. As confidence in competing projects wavered, XMR absorbed much of that demand.

Signs of Cooling Are Starting to Show

Despite its impressive run, Monero is now showing early signs of exhaustion. The pullback from recent highs suggests profit-taking is underway, especially as the broader crypto market remains fragile following the late-2025 crash. Risk appetite is still uneven, and assets that rallied the hardest often correct the fastest once momentum slows.

For current investors, the question isn’t whether Monero has already delivered life-changing gains — it has. The real question is whether privacy tokens can sustain demand in a market that’s still cautious. In the near term, further consolidation or downside wouldn’t be surprising as traders reassess risk and lock in profits.