- Monero hit a new all-time high near $596 amid a weak broader market

- Capital rotation from other privacy coins may be fueling the rally

- Analysts see potential for further upside, with volatility likely along the way

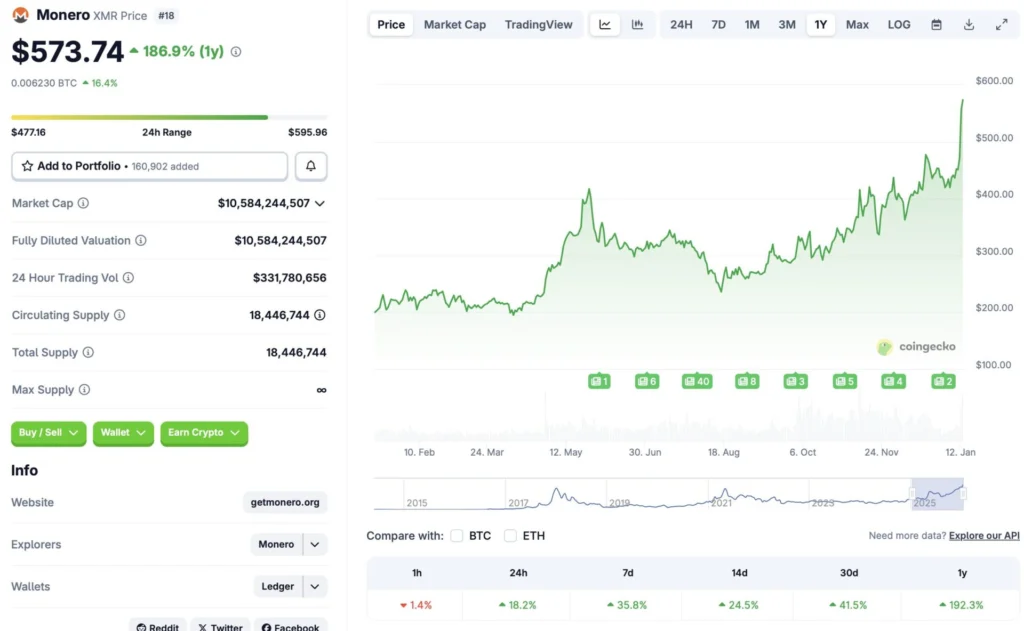

Monero has suddenly become the loudest chart in crypto. Earlier today, January 12, 2026, XMR printed a fresh all-time high at $596.61, catching much of the market off guard. According to recent data, the token is up 18.2% in the last 24 hours, 35.8% over the past week, and more than 41% over the last month, all while the broader crypto market struggles to find direction. That divergence alone is what has traders paying attention.

Why Monero Is Running While the Market Isn’t

Monero’s momentum didn’t come out of nowhere. Privacy-focused assets started quietly turning bullish toward the end of 2025, even as large-cap tokens stalled. Growing interest in financial anonymity, combined with regulatory pressure elsewhere, appears to have pushed capital toward assets that emphasize privacy by design rather than by add-on.

Another factor is rotation. After internal disputes led to a developer exodus at Zcash earlier this month, some investors appear to have reallocated capital into Monero. With ZEC facing uncertainty and Monero offering a battle-tested alternative, the shift makes sense, even if the speed of the move surprised many.

Can XMR Push Into the Top 10?

Monero’s market cap now sits around $10.6 billion, placing it roughly 18th among crypto assets. If momentum holds, a move into the top 10 is no longer a fringe idea. That said, vertical rallies invite volatility. Sharp pullbacks are normal after price discovery phases like this, especially when sentiment flips quickly.

Still, some forecasts lean higher. CoinCodex data suggests Monero could continue setting new highs through the first quarter of 2026, with projections pointing toward levels near $848 by early April. That would represent another near-50% move from current prices, assuming momentum survives broader market conditions.

What to Watch From Here

The key question is sustainability. If Monero’s rally continues while Bitcoin and Ethereum remain sluggish, it strengthens the case that this move is narrative-driven rather than purely speculative. But if market-wide volatility spikes, even strong outliers tend to feel it. For now, XMR is doing what few assets can, rallying independently, and that alone makes it worth watching closely.

Conclusion

Monero’s breakout is more than a one-day headline. It reflects shifting priorities in the crypto market, where privacy, resilience, and clear utility are being rewarded. Whether this run pauses or accelerates, XMR has already reinserted itself into serious conversations. That wasn’t the case a few months ago.