- Metaplanet upgraded to mid-cap and added to FTSE Japan Index, securing global index inclusion.

- Stock up 187% YTD, far outpacing Japan’s blue-chip benchmarks.

- Treasury holds 18,888 BTC, with a goal to reach 210,000 BTC by 2027.

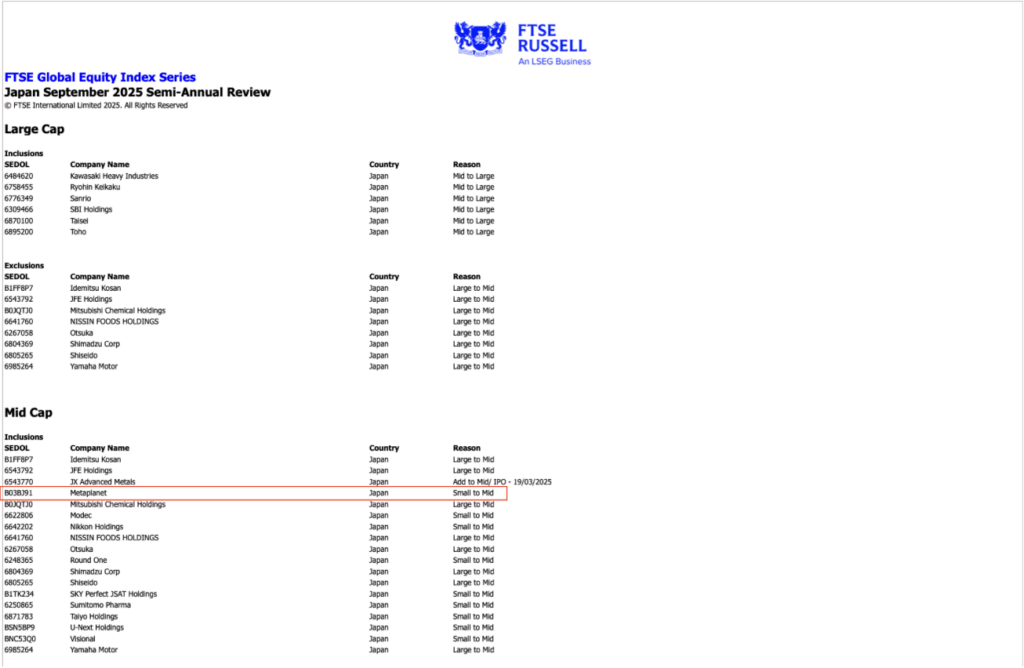

Metaplanet, the Tokyo-based Bitcoin treasury firm, just scored a major milestone. In FTSE Russell’s September 2025 semi-annual review, the company was upgraded from small-cap to mid-cap status and added to the FTSE Japan Index. That move not only places it alongside Japan’s mid- and large-cap players but also ensures automatic inclusion in the FTSE All-World Index, giving global investors exposure to the stock—and by extension, indirect exposure to Bitcoin.

Bitcoin Treasury Strategy Pays Off With Explosive Growth

The timing comes after a monster Q2. Metaplanet has been riding momentum all year, with its pivot from hotel operator to Bitcoin balance-sheet giant paying off big. The company’s stock has rallied around 187% year-to-date, easily outpacing Japan’s blue-chip TOPIX Core 30 index, which is only up 7.2% over the same stretch. The message is clear: while traditional firms like Toyota and Sony grind out single-digit returns, Metaplanet’s Bitcoin strategy is drawing in outsized attention.

Outperforming Japan’s Blue Chips

At present, the firm holds 18,888 BTC in its treasury, making it Japan’s largest Bitcoin holder and the seventh-biggest public holder worldwide. That puts it ahead of corporate heavyweights like Tesla, Coinbase, and Hut 8. With Bitcoin sitting above $112K, the stash is worth billions, and leadership isn’t slowing down. CEO Simon Gerovich recently floated plans to acquire income-generating businesses—including possibly a digital bank—using Bitcoin as both war chest and growth engine.

Building One of the World’s Largest BTC Treasuries

The company’s long-term goal is bold: accumulate 210,000 BTC by 2027, equal to 1% of Bitcoin’s entire fixed supply. If it succeeds, Metaplanet won’t just be a Japanese mid-cap stock—it could become one of the most influential corporate players in Bitcoin’s global financial integration.