- Bitcoin’s Coinbase premium hit its highest level since February 20, signaling strong U.S. investor accumulation.

- BTC reclaimed its 200-day EMA, with analysts eyeing a potential retest of $90,000 if $85,000 holds as support.

- Some traders remain cautious, warning that Bitcoin could still correct to $73,000 if resistance at $90,000 persists.

Bitcoin’s (BTC) Coinbase premium index has surged to its highest level since February 20, following a strong 5% rally on March 19. This spike suggests growing accumulation, possibly led by U.S. institutions and whales.

Rising Coinbase Premium Signals Institutional Accumulation

The Coinbase premium index tracks the price difference between BTC pairs on Coinbase and Binance. A higher value indicates stronger buying pressure from U.S. investors, signaling potential accumulation. CryptoQuant analyst Woonminkyu noted that the 30-day exponential moving average (EMA) of the index has crossed above the 100-day EMA—a sign often associated with large institutional players entering the market.

“Past trends show that when this indicator rises, BTC bull markets tend to continue. High likelihood of an accumulation phase, making it a key moment to monitor BTC’s momentum,” the analyst explained.

Since Coinbase Pro was integrated into Coinbase Advanced in early 2024—a platform used by major firms like Strategy and Tesla—the Coinbase premium may increasingly reflect U.S. institutional interest in Bitcoin.

Will Bitcoin Reclaim $90K Soon?

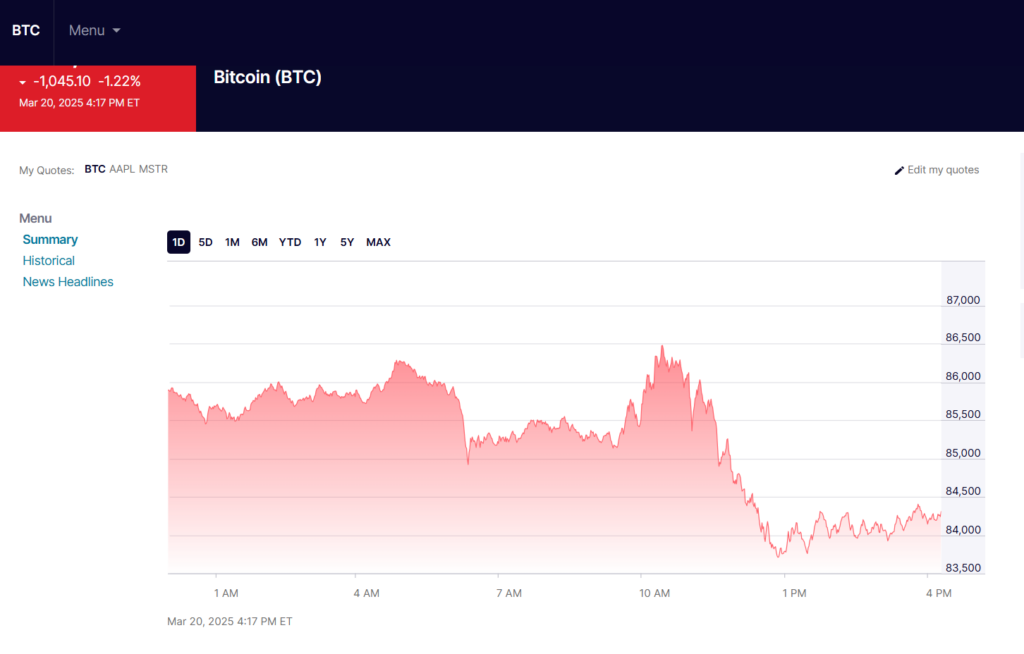

On the daily chart, Bitcoin has reclaimed its 200-day EMA (orange line), a key technical level that historically strengthens the probability of an uptrend. BTC also bounced from the lower range of the Bollinger Bands (BB), with the BB’s moving average hovering above $90,000.

A successful breakout above $85,000 resistance, now turned into support, improves the likelihood of BTC retesting $90,000 in the coming days. Michael Van de Poppe, founder of MN Consultancy, remains bullish, predicting a push toward $90K in the near future.

However, not all analysts share the same confidence. Max, the founder of BecauseBitcoin, believes BTC still has “a little more work to do.” He pointed out that EMA cloud indicators continue to suppress Bitcoin below the $88,000–$90,000 range.

Crypto trader Koroush AK also urged caution, warning that Bitcoin’s structure remains uncertain. “BTC is at a critical level below $90,000; a correction to $73,000 remains a possibility,” he suggested.

Key Levels to Watch

- Bullish case: Holding above $85,000 strengthens chances of a $90K retest.

- Bearish case: A daily close below $85,000 could invalidate the bullish structure.

With volatility rising, all eyes are on BTC’s next move—can it break past resistance, or is a deeper pullback on the horizon?