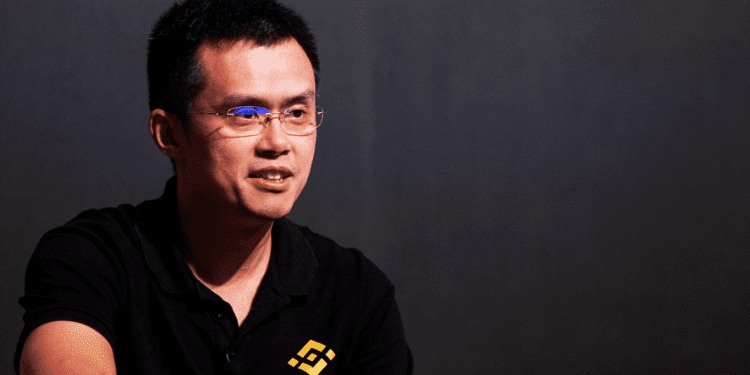

In recent developments, a class-action lawsuit has been filed against Binance, a prominent cryptocurrency exchange, and its CEO, Changpeng Zhao. The plaintiff, a resident of California, alleges that Binance and Zhao engaged in activities that contributed to the downfall of a rival exchange, FTX. The lawsuit contends that the actions of Binance and Zhao violated federal and Californian laws related to unfair competition, with an alleged aim to establish a monopoly in the crypto market by causing harm to FTX.

The crux of the lawsuit revolves around social media posts made by Zhao in early November. The plaintiff, Nir Lahav, argues that these posts, coupled with Binance’s decision to liquidate its FTX token holdings, were instrumental in the collapse of FTX. Notably, Zhao initially announced Binance’s intent to acquire FTX via a tweet, only to retract the statement a day later. The lawsuit posits that this action was not in good faith and significantly contributed to the decline of the competing exchange.

Furthermore, the lawsuit alleges that a subsequent tweet by Zhao regarding the liquidation of any remaining FTT (FTX’s token) was misleading, given that Binance had already disposed of its FTT holdings. The plaintiff asserts that this tweet was deliberately crafted to manipulate FTT’s market price. Seeking monetary damages, court costs, and the return of gains acquired through alleged unfair practices, the lawsuit sheds light on an ongoing legal battle between the SEC, Binance, FTX, and their respective CEOs.

In retrospect, while the lawsuit places significant emphasis on Changpeng Zhao’s tweets and their purported influence on FTX’s downfall, it’s crucial to consider the broader context. FTX, at the time, was grappling with many challenges beyond social media posts. Approximately four days before the Binance sell-off, CoinDesk published an article shedding light on the extensive holdings of FTX tokens by Alameda Research. This revelation likely caught the attention of Zhao and Binance, prompting thoughts of a potential acquisition. However, as events unfolded, it became evident that FTX faced more complex issues beneath the surface. In the cutthroat realm of cryptocurrency exchanges, strategic moves and decisions are driven by a mix of competitive advantage and market dynamics. The timing and nature of Zhao’s initial tweet regarding the intent to acquire FTX might have been influenced by a perception of opportunity amidst FTX’s troubles. Nevertheless, the intricate challenges and intricacies within FTX’s operations cannot be oversimplified, emphasizing the need for a comprehensive understanding of the situation beyond a series of tweets.