- Jump Trading LLC is seeking to move its class action suit to California.

- They argue that the plaintiff already has a similar case which has progressed substantially, and the cases should be consolidated to save resources.

- The ball is now in the court of the Judges as the crypto community waits to see whether defendants will be granted their plea to move the case.

Jump Trading is seeking to have the class-action lawsuit filed against it by Taewoo Kim, individually and on behalf of all others impacted by the collapse of the Terra/Luna ecosystem, moved to the Northern District Court of California from Illinois, arguing it will expedite the legal process.

A Case of Forum Shopping?

By picking Illinois, Jump’s lawyers accuse the plaintiff of forum shopping, a practice of looking for a friendly court that will likely render a favorable judgment.

The defendant argues that the decision to bring the case to Illinois was in bad taste since nearly all relevant witnesses and documents are either located outside Illinois or are easily accessible elsewhere, according to the court filing on June 13.

According to the defendants, a similar ongoing case in California has progressed substantially and should be consolidated. Jump’s lawyers stated that the suit filed in Illinois, Kim Vs. Terraform Labs is identical to a lawsuit filed in California, Patterson Vs. Terraform Labs.

The Genesis

The court documents provide a brief historical perspective on the nature and origin of this case. The complainant alleges that the California-based Algorithmic and high-frequency trading firm Jump Trading and its CEO, Kanav Kariya, were engaged in a price manipulation involving TerraUSD (UST) stablecoin a year before it collapsed, resulting in a $1.3 billion profit for the business. The firm and Kariya have also been accused of violating the Commodity Exchange Act, CFTC Regulations, and Common Law Unjust Enrichment.

To put it in another perspective, it is alleged that Jump Trading and its Chief Executive Kanav Kariya agreed with Terraform Labs founder Do Kwon to manipulate UST price and buy LUNA at a 99% discount. This was later resold at a $1.3 billion profit.

The complainant further alleges that the relationship between Jump Trading and Terraform is deep, with various agreements between the firms taking place as early as November 2019 and September 2020, allowing Jump to borrow tens of millions of LUNA tokens from Terra and offering market-making services for transactions in LUNA, UST, and aUST.

The Big Collapse!

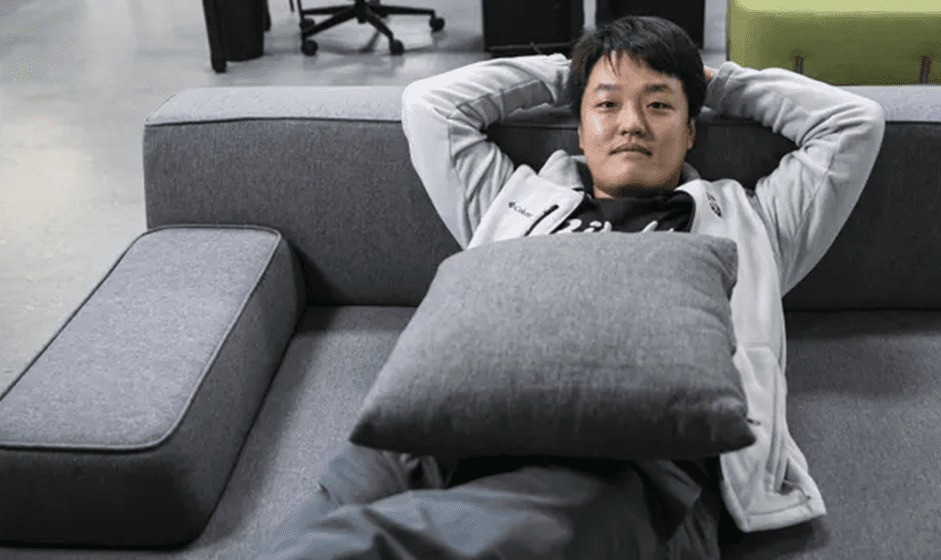

The TerraUSD/LUNA ecosystem collapsed in May 2022, wiping billions of dollars from the market and leading to the arrest of its founder, Do Kwon. The 31-year-old South Korean fugitive was accused of orchestrating one of the worst financial frauds in recent times. About $40 billion in market value was erased for the holders of TerraUSD and its floating sister currency, Luna when the stablecoin fell below its $1 peg in May last year.

The ball is now in the judge’s court; it is a wait-and-see situation, whether the defendants’ arguments will hold water. While both Petterson and Kim’s cases are similar, Kim’s case relies on federal commodities claims while Petterson’s case relies on securities claims.