- Jack Ma’s Yunfeng Financial just bought 10,000 ETH ($44M) for its treasury.

- ETH is holding above $4K, with analysts eyeing $5,000–$6,000 targets.

- Institutional adoption and RWA tokenization could drive Ethereum’s next leg higher.

Ethereum has managed to stay above the key $4,000 mark, even as the broader crypto market looks a bit sluggish. That resilience hasn’t gone unnoticed—especially by big players with deep pockets. The latest to jump in is Yunfeng Financial Group Limited, a Hong Kong-listed firm co-founded by Alibaba’s Jack Ma.

Yunfeng Buys 10,000 ETH for Its Treasury

In a Tuesday announcement, Yunfeng Financial confirmed it scooped up 10,000 ETH, worth around $44 million, using its own cash reserves. The move is part of the company’s wider push into Web3, AI, real-world asset tokenization (RWAs), and digital currency.

“The Board believes that ETH’s inclusion as the Company’s strategic reserve assets is consistent with the Group’s layout of expansion into frontier areas,” Yunfeng explained, pointing to Ethereum’s role as infrastructure for tokenization and DeFi.

Other publicly traded firms have been following a similar playbook—think SharpLink Gaming, Tom Lee’s Bitmine Immersion Technologies, and Ether Machine—all buying ETH for their treasuries. It’s a move that echoes Michael Saylor’s famous Bitcoin strategy, but this time with Ethereum in the spotlight.

Ethereum’s Price Outlook

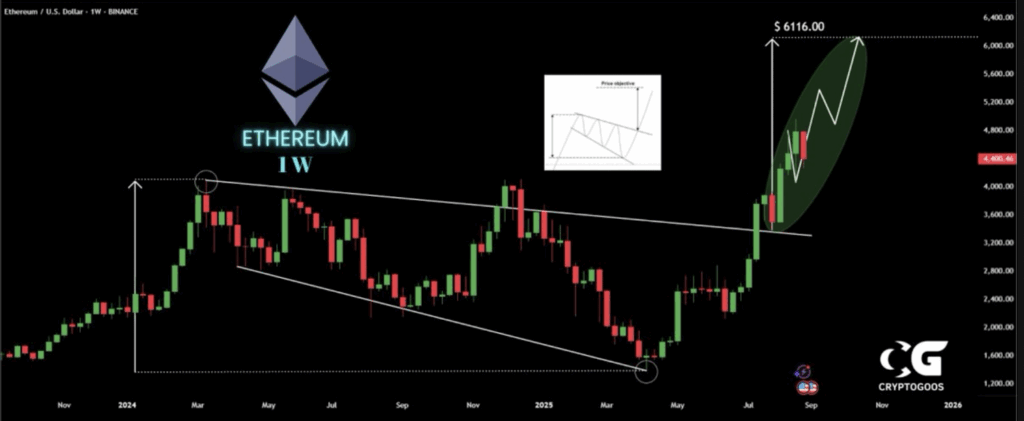

Ethereum is currently trading at about $4,279, down 2.1% in the past 24 hours. Still, analysts remain bullish. CryptoGoos, a popular chartist, says ETH’s breakout from a falling wedge pattern on the weekly chart is still in play, with a measured move pointing as high as $6,116.

“Don’t sell your $ETH too early!” he warned on X, suggesting that the next big milestone could be $5,000 if institutional inflows continue building momentum.

Why This Matters

Yunfeng’s ETH purchase will be reflected as an investment asset on its balance sheet and could diversify its holdings away from traditional fiat. The firm also hinted at exploring Ethereum’s use in insurance operations and DeFi-focused products, signaling this isn’t just a treasury play but also a tech bet.

For ETH holders, this kind of institutional adoption is the fuel that often precedes bigger price runs. Whether it happens next week or takes a few months, the $5K level is firmly on the radar.