- Institutional Accumulation: Despite SOL being down 5% and trading below $180, institutional investors are staking heavily, with over 65% of the supply locked and Q1 revenue hitting $1.2B.

- Bearish Technicals: The Ichimoku Cloud, BBTrend (-4.31), and a potential EMA death cross all signal short-term weakness and possible further downside.

- Key Levels: If SOL drops below $160, it could slide to $141; if it breaks above $176.77, a rally toward $184.88 might follow.

Solana (SOL) has been drifting — down about 5% over the past week and staying under $180 for six straight days. But here’s the twist: institutions are quietly piling in, staking huge chunks of SOL while retail sentiment remains lukewarm. Looks like the big players might be prepping for the next altseason.

Institutional Money Flows In, But Charts Still Look Shaky

Despite weaker volumes in the altcoin space, heavy hitters have been accumulating SOL. Staking levels? Over 65% of the total supply is now locked up. And Solana apps racked up $1.2 billion in revenue in Q1 2025 — the highest in a year.

On-chain flows look solid, and the ecosystem’s expanding — but the technical picture is… well, mixed at best.

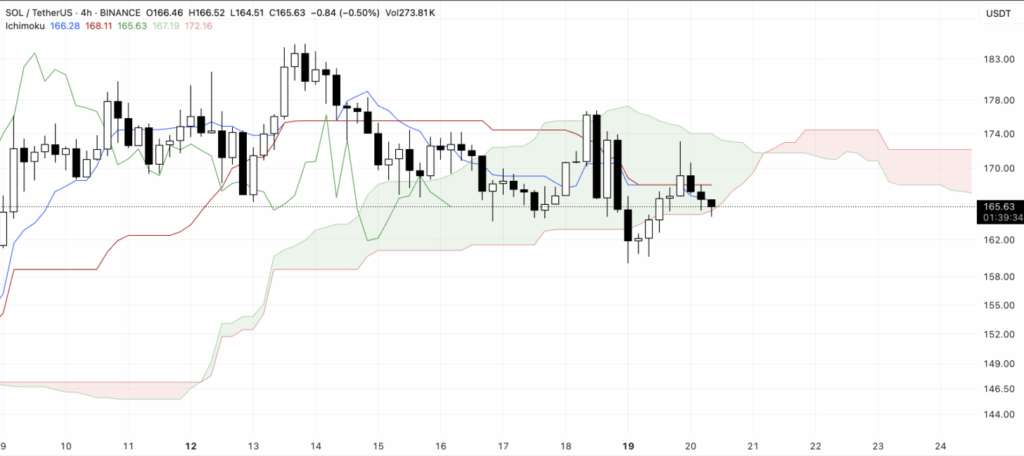

Ichimoku Cloud: Neutral to Bearish

Looking at the Ichimoku Cloud, SOL’s price is kind of just hanging out inside the cloud — signaling indecision. The blue Tenkan-sen is sitting below the red Kijun-sen, a sign of short-term weakness. The Chikou Span? It’s tangled in recent price action — not helpful.

The cloud ahead turns red and flat, pointing to resistance and more sideways or downward movement unless SOL breaks out hard.

BBTrend: Still Bearish

BBTrend is sitting at -4.31 — its third day in the red. That’s not great. It’s been hovering around -4, which signals sustained bearish pressure. The BBTrend tracks price movement relative to Bollinger Band width, and anything below 0 leans bearish.

With no upside expansion in sight, the indicator suggests consolidation or even another leg down — unless something big snaps the trend.

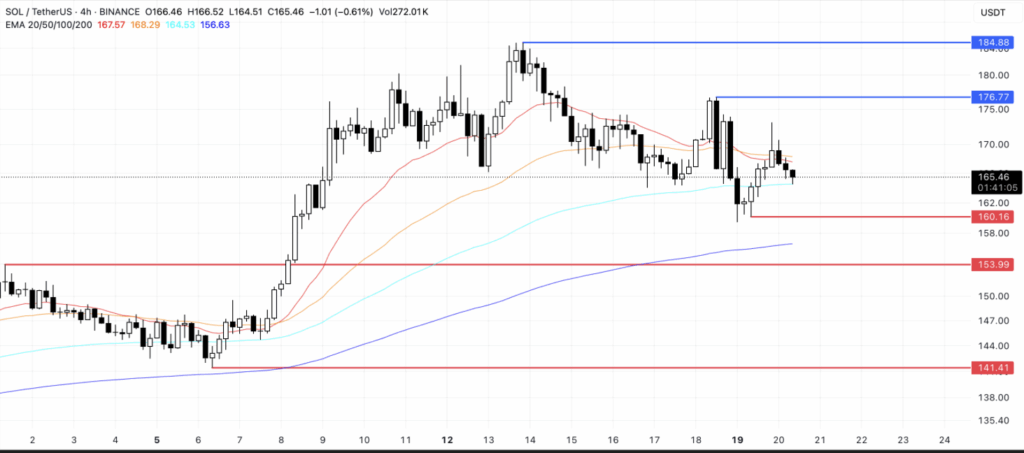

Death Cross Incoming?

EMA lines are about to cross, and not in a good way. A death cross could be forming, which happens when the short-term EMA dips below the long-term — a classic bearish warning.

If SOL breaks below $160, next stops could be $153.99 and even $141 if selling pressure ramps up. On the flip side, if bulls show up, watch for a move above $176.77. That might open the door to $184.88.

Final Thought

Long-term fundamentals? Still looking strong. But right now, price action’s telling a different story. It’s a waiting game — and a breakout either way could flip the script fast.