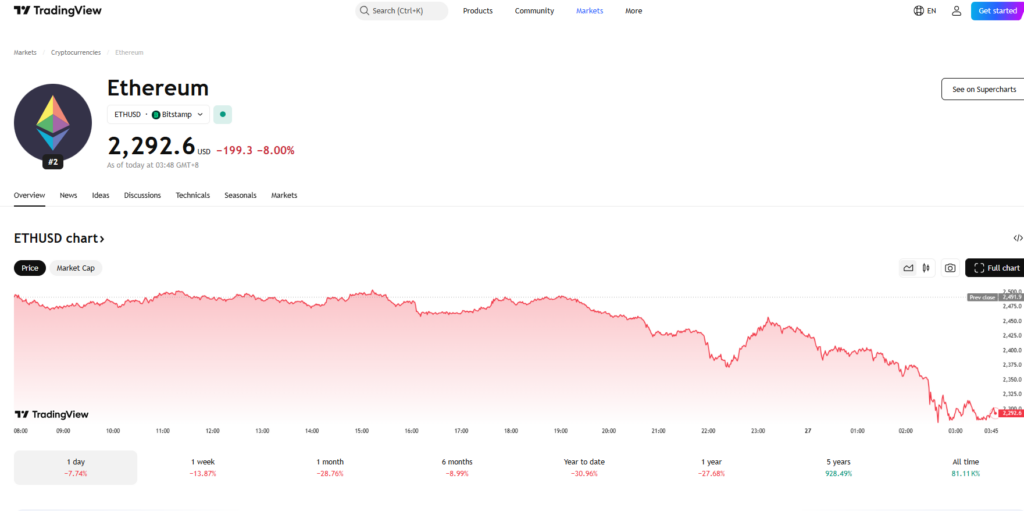

- Ethereum is struggling at $2,400, with analyst Justin Bennett warning of a potential drop to $1,000 if support breaks.

- Ethereum ETFs saw $128M in outflows this week, with BlackRock’s ETHA losing $48M in a single day.

- Some analysts remain bullish, predicting a return to $4,000 and increased institutional interest if staking is approved.

Ethereum has been under heavy selling pressure, plunging nearly 20% over the past month and now clinging to support around $2,400. Without a major catalyst, crypto analyst Justin Bennett warns that ETH could crash all the way down to $1,000 if the current level doesn’t hold.

Ethereum Stuck in Long-Term Channel—Breakdown Incoming?

Bennett’s analysis points to Ethereum trading within a long-term logarithmic channel dating back to 2017. Right now, ETH is testing the lower boundary of this structure—a level that has contained price movements since mid-2022.

- ETH briefly touched $2,855.23 in recent weeks, but failed to sustain momentum above $2,800.

- Technical indicators show weak bullish momentum, with Ethereum still stuck in a critical support zone.

- “Nearly a month later, and bulls haven’t been able to do anything,” Bennett noted, emphasizing Ethereum’s lack of strength.

If this support fails, Ethereum could spiral down to the $1,000 range—a scenario that many traders aren’t prepared for.

Ethereum ETFs Bleeding Out—Institutional Interest Fades

The selling pressure isn’t just coming from retail traders—institutions are also pulling back.

- Ethereum ETFs have seen four straight days of outflows.

- Over $128M exited ETH ETFs in just two days this week.

- BlackRock’s ETHA alone lost $48M in a single day.

With institutional confidence fading, Ethereum’s underperformance could worsen before it improves.

Analysts Still Betting on Ethereum’s Recovery

Not everyone is convinced Ethereum is doomed. Crypto analyst Wolf believes ETH is still in a “healthy, but boring” accumulation phase and predicts a return to $4,000 in Q2—which could kick off the next bull run.

Meanwhile, Ted Pillows sees Ethereum staking integration as a game-changer, noting that the SEC’s acknowledgment of Grayscale’s staking proposal could trigger a flood of institutional investment.

“Ethereum staking is coming,” Pillows said, adding that big money could flow in “like crazy” once the approval happens.

For now? Ethereum sits at a crucial moment—either it holds support and bounces, or it risks another brutal selloff.