- Institutional Bitcoin demand now exceeds new supply by roughly six times

- Rising global liquidity and ETF access are reinforcing long-term accumulation

- Sustained ETF inflows are acting as a stabilizing force near key price levels

Institutional capital is absorbing Bitcoin at a pace that miners simply can’t keep up with, and the imbalance is starting to look structural rather than temporary. From ETF inflows to global liquidity trends, the signals are stacking up in a way that feels familiar, but sharper this time.

Institutions Are Buying Bitcoin Faster Than It Can Be Mined

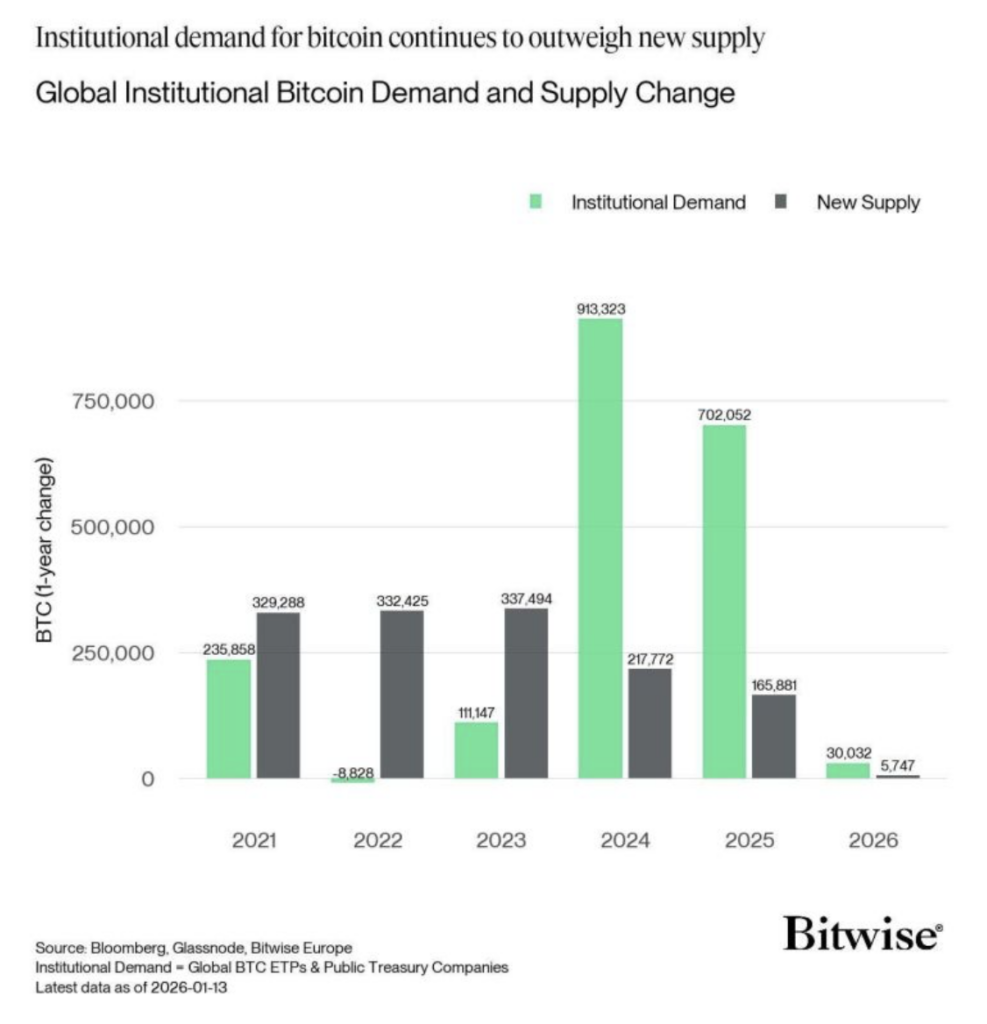

Bitcoin is being absorbed by institutions at a rate never seen before. Back in 2021, institutional demand sat around 236,000 BTC, which was still below the roughly 330,000 BTC mined that year. The market was heated, sure, but supply was not yet being overwhelmed.

Things flipped briefly in 2022 during the drawdown, then normalized again in 2023. That year saw around 111,000 BTC purchased by institutions while miners produced about 337,000 BTC. Demand was present, but it wasn’t dominant, not yet anyway.

The real shift arrived in 2024. Institutional demand surged to roughly 913,000 BTC, while new supply fell sharply to around 218,000 BTC. That gap was hard to ignore. In 2025, momentum stayed strong with about 702,000 BTC purchased against just 166,000 mined. By 2026, institutions are buying Bitcoin at roughly six times the rate of new issuance, a dynamic that feels less cyclical and more intentional.

ETF Adoption and Scarcity Are Quietly Reshaping the Market

This kind of imbalance usually doesn’t appear without deeper drivers. ETF acceptance has clearly changed the access layer for large capital, making allocation simpler and, frankly, more palatable. On top of that, post-halving supply dynamics are tightening conditions further, even if the market hasn’t fully priced that in yet.

Long-term allocation strategies are also playing a role. Institutions are no longer treating Bitcoin as a short-term trade, but more like a structural asset with defined scarcity. Historically, similar demand-supply mismatches have preceded aggressive price expansions and reinforced bullish cycles across multiple market phases. It doesn’t guarantee outcomes, but it does tilt the odds.

Global M2 Growth Is Rising, and Bitcoin Usually Follows

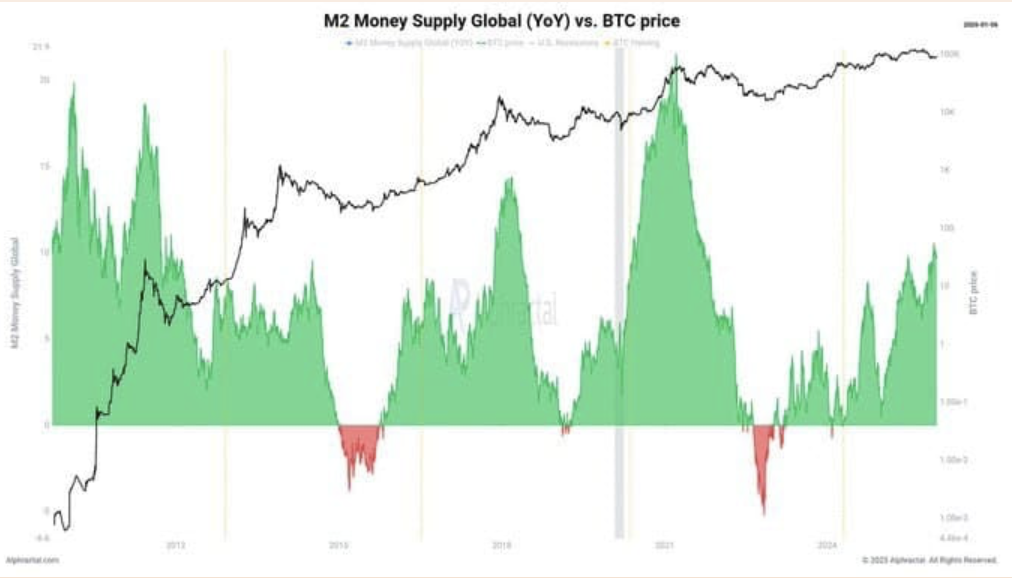

Another macro layer worth watching is global M2 money supply growth, which is now climbing at its fastest pace since post-2020. Central bank easing, expanding fiscal deficits, and renewed liquidity injections have relaxed financial conditions across markets. Risk appetite, unsurprisingly, has improved too.

Bitcoin has a habit of lagging these shifts at first. In previous cycles, including 2017, 2020, and 2021, sustained M2 expansion eventually coincided with strong Bitcoin bull runs. The relationship isn’t linear though, and liquidity growth tends to arrive in uneven waves depending on the broader cycle.

Still, excess liquidity tends to chase scarce assets. Bitcoin’s fixed supply, global accessibility, and portability make it a natural outlet once liquidity turns persistently positive. If M2 growth continues accelerating, the long-term bias likely remains in Bitcoin’s favor. That said, any slowdown or reversal in money supply growth deserves attention, since past rallies have weakened quickly once liquidity momentum rolled over.

ETF Inflows Are Anchoring Bitcoin Near Key Levels

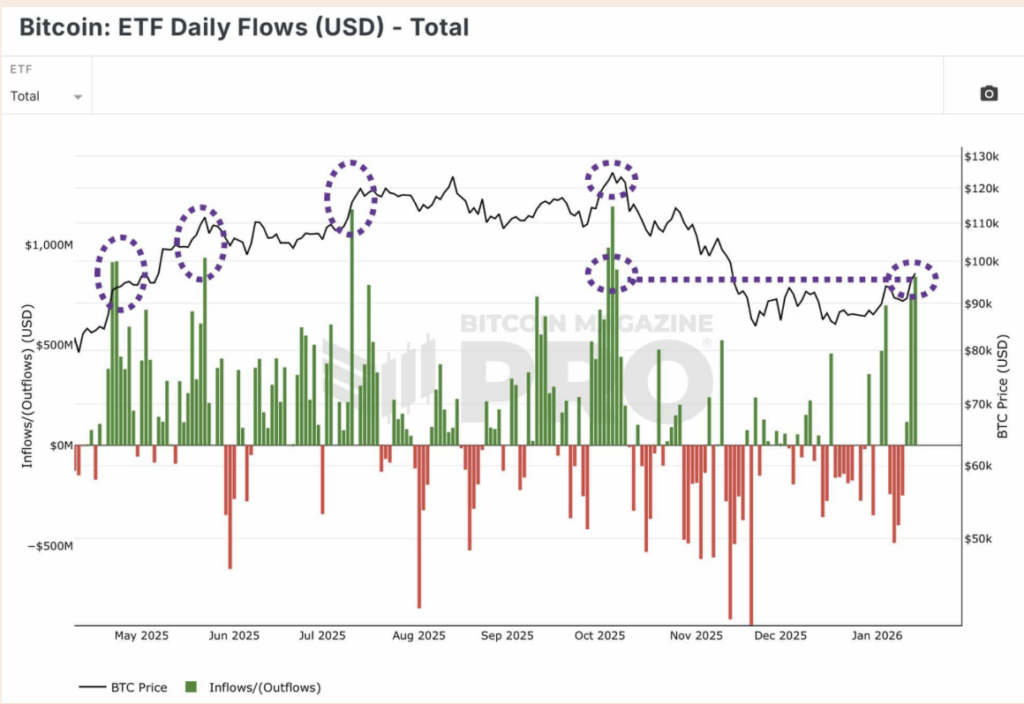

At the time of writing, Bitcoin is trading near $96,000 after rebounding from recent weakness. Short-term price swings have been driven by macro uncertainty, shifting rate expectations, and ongoing risk rotation. But beneath the noise, institutional positioning is becoming the more important signal.

Spot Bitcoin ETF inflows have shown repeated surges since May 2025, often aligning closely with local price advances. Large green inflow bars typically reflect aggressive institutional accumulation, while extended red periods tend to coincide with corrective phases.

One standout moment was January 15, when ETF inflows reached roughly $840 million in a single day. That move echoed accumulation waves seen earlier in July and October. These flows didn’t just absorb sell pressure, they actively pushed Bitcoin into higher ranges. Clustered buying also reduced downside volatility, suggesting structure rather than random noise. The message is simple, sustained inflows stabilize price action, while reversals reopen risk.