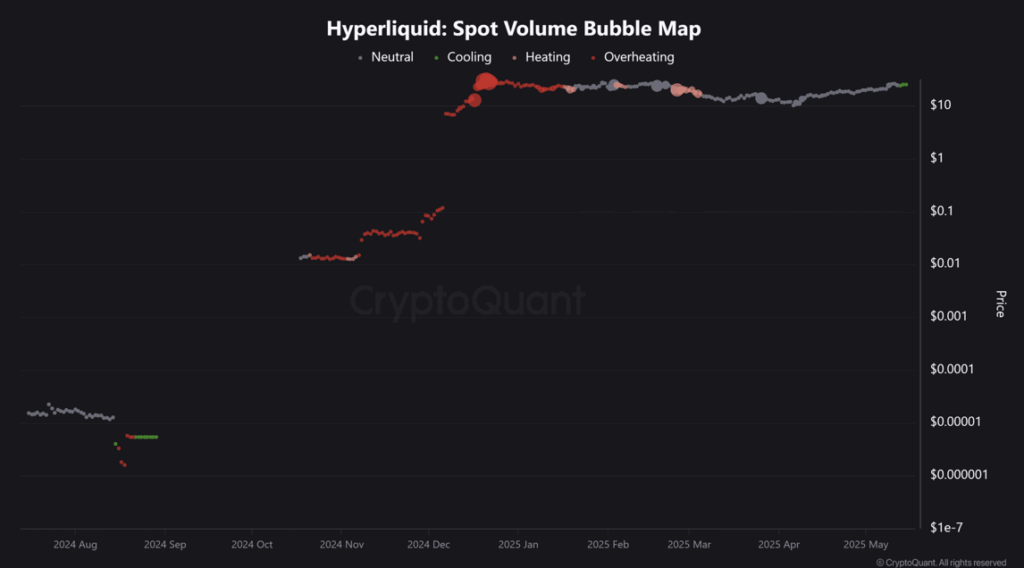

- HYPE Rallies But Spot Volume Softens: Hyperliquid (HYPE) surged 9.5% in the past 24 hours, but CryptoQuant data shows spot volumes are dipping, suggesting retail demand may be cooling despite the price spike.

- TVL Hits New Highs, Bullish Bias Holds: HYPE’s Total Value Locked (TVL) jumped over 4% to $1.073 billion, indicating strong capital inflows, while the long/short ratio remains skewed toward longs, signaling ongoing bullish sentiment.

- Bullish Channel Remains Intact: Despite spot volume softening, HYPE continues to print higher lows and highs, maintaining a bullish channel that started in April, with potential for further upside if momentum holds.

Hyperliquid (HYPE) just popped – up 9.5% in the last 24 hours. But despite the surge, CryptoQuant data shows that spot volumes are starting to cool off. It’s a weird mix – the price is pushing higher, but the buying momentum? Not so much.

Spot Volume Dips, But Bullish Signs Remain

Spot volumes usually signal immediate buying and selling pressure. When they drop after a price spike, it can mean retail demand is fizzling out. And that’s what we’re seeing with HYPE right now – volumes dipping even as the price climbs.

But here’s the catch – other metrics suggest the rally might still have some juice left.

TVL Hits Fresh Highs – Investor Confidence?

Over the last 24 hours, HYPE’s Total Value Locked (TVL) jumped over 4%, hitting $1.073 billion, according to DefiLlama. That’s a decent bump and usually signals stronger capital inflows, whether through staking, lending, or DeFi protocols.

Meanwhile, the Long/Short Ratio is still leaning heavily toward longs. Most traders are betting on more upside, and when you pair that with a rising TVL, it can be a pretty strong sign that investors aren’t done with HYPE just yet.

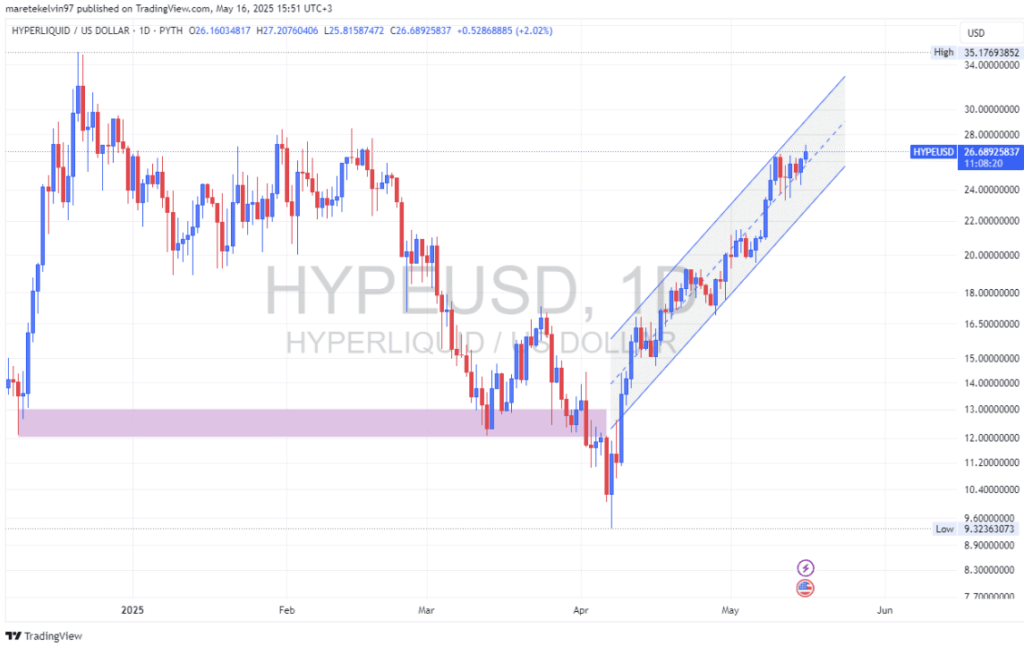

Technicals – Bullish Channel Intact

From a technical perspective, HYPE’s been riding a bullish channel since early April. It’s been printing higher lows and higher highs – classic signs of a healthy uptrend. The most recent surge fits right into that pattern, suggesting it’s part of a broader momentum play rather than just a one-off spike.

If HYPE keeps up this pace, the next resistance levels could come into play soon. But if spot volume keeps softening, expect some choppy action along the way.

Bottom Line – A Mixed Bag

On the surface, things look solid for HYPE – TVL’s climbing, the long/short ratio is long-heavy, and the bullish channel is still intact. But the decline in spot volume hints that retail demand might be losing steam. If that happens, short-term volatility could kick in. But if the broader momentum holds, HYPE could be gearing up for a bigger run to higher targets.