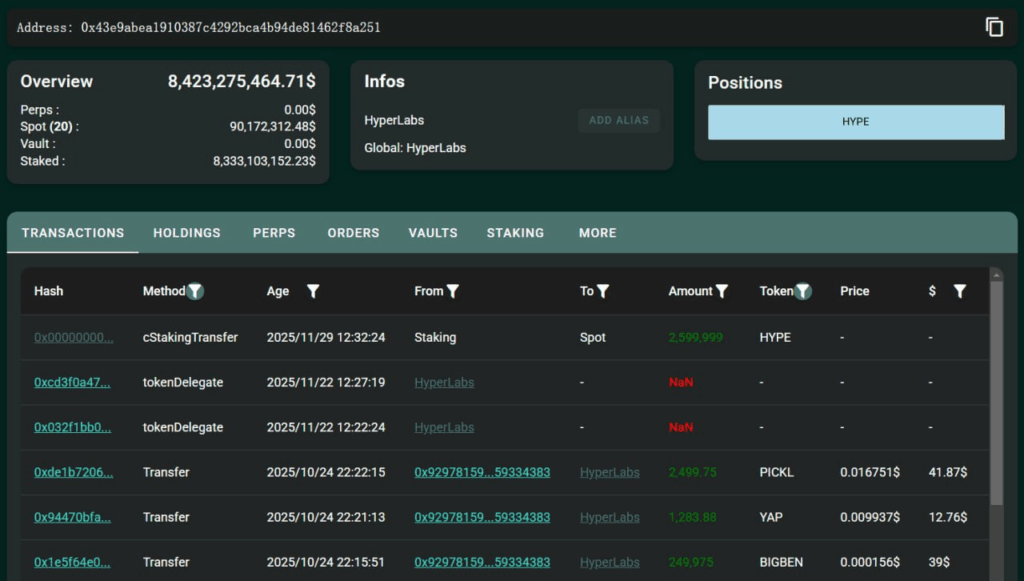

- A Hyperliquid team wallet moved $90M in HYPE from staking to spot, though it still holds over $8.3B staked, signaling no exit behavior.

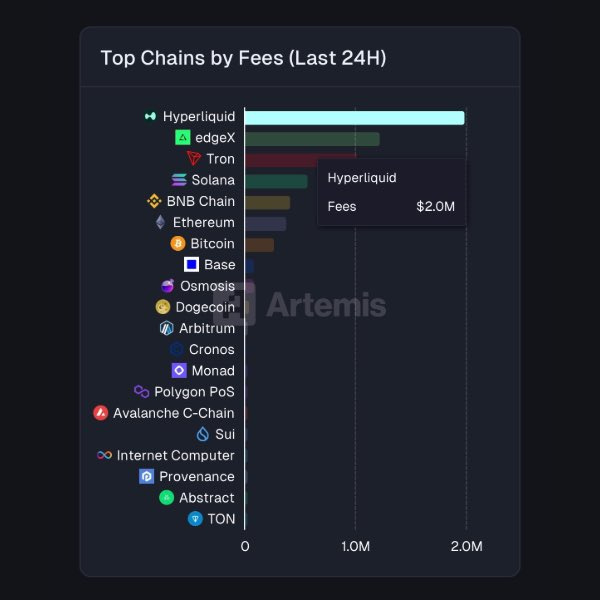

- The network pulled in $2M in fees in 24 hours, making Hyperliquid the top blockchain by daily revenue ahead of Ethereum and Solana.

- Trading activity surged with volume up 45% and open interest at $1.48B, increasing volatility as leverage climbs and the community watches treasury movements closely.

Hyperliquid grabbed the spotlight again after a team wallet shifted a huge $90 million batch of HYPE from staking into spot, stirring up chatter across the ecosystem. The timing couldn’t be more interesting—right as the network pulled in over $2 million in fees in just 24 hours, outperforming every major chain out there. With leverage climbing and traders getting louder, the move has sparked a mix of curiosity, excitement… and a bit of nervous watching from the sidelines.

Team Wallet Transfers $90M HYPE and Traders Immediately Start Reading Between the Lines

On-chain data flagged a transaction at around 12:32 UTC+8 showing a Hyperliquid team-linked address moving 2.6 million HYPE—about $90M—from staking into spot. HypurrScan caught the movement quickly, and debate spread almost instantly. Even after the transfer, the same wallet still holds over 240 million staked HYPE valued at roughly $8.3B, making it one of the biggest bags in the ecosystem.

Some traders think the move is simply a way to boost liquidity or rebalance the treasury, while others joked it was “too big not to mean something.” Still, the fact that the majority of tokens remain staked suggests the team hasn’t changed its long-term stance. But because of earlier issues—like that messy Popcat exploit that forced Hyperliquid to halt withdrawals temporarily—any team-linked movement gets amplified by community scrutiny.

Hyperliquid Overtakes All Chains With $2M in 24-Hour Fees

Fresh data from Artemis showed Hyperliquid topping the entire blockchain landscape in daily fees, pulling in $2 million within a single day. It even outpaced Ethereum, Solana, Tron, BNB Chain, and Bitcoin—chains that usually dominate these rankings without much challenge.

This surge in fee revenue underscores rising demand for the platform’s trading infrastructure. More usage, more fees, more attention. Even with HYPE sitting just under $34.50 and only showing modest weekly gains, the underlying activity points to a network that’s being used heavily despite price volatility in the wider market.

Volume, Leverage, and Speculation Keep Climbing

Coinglass data shows a pickup in trader aggression. Daily volume jumped 45% to $1.61B, while open interest crept up another 4% to hit $1.48B. These numbers hint that traders expect some kind of big move soon, even if they’re not all in agreement on which direction it’ll break.

Leverage keeps rising too, which is always a little exciting but also a little dangerous. High open interest means there’s energy in the system—but also that a cascade could get messy fast if positions unwind at once. Analysts noted the uptick comes with fresh competition in the perpetuals space after Lighter raised $68M at a $1.5B valuation. Hyperliquid seems unbothered so far, though, maintaining strong network activity through the turbulence.

Community Keeps a Close Eye on the Treasury, Just in Case

The $90M transfer from the team wallet didn’t go unnoticed, mostly because of how large it was and how sensitive people have been since earlier network hiccups. Still, there’s no sign of a sell-off or any exit behavior. Most observers point to the massive amount still staked as proof the team is still all-in on the long game.

Even with the reassurance, investors and analysts are watching things closely—between rising leverage, active treasury movements, and users still thinking back to past liquidity scares, the ecosystem is in one of those “hopeful but alert” phases. Hyperliquid’s momentum looks strong, but everyone knows volatility can flip the mood fast.