- HYPE broke its ATH at $46.32, powered by 60% volume surge and major whale buys.

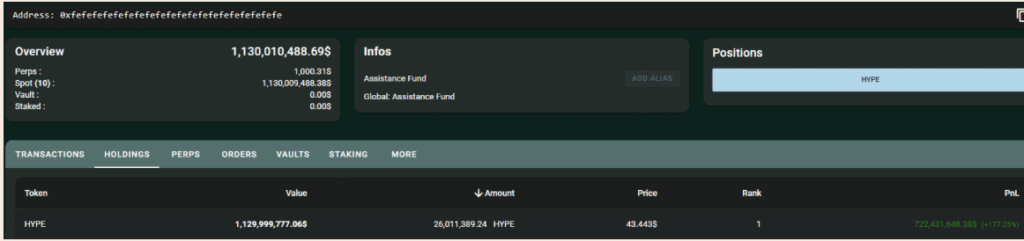

- Hyperliquid’s Assistance Fund has quietly stacked 26M HYPE and is likely not done.

- Bybit listing and Grayscale watchlist inclusion could be the fuel for the next wave.

Hyperliquid (HYPE) popped 8% in the past 24 hours, clocking a new all-time high of $46.32—not a massive leap from the previous top at $45.50, but enough to make noise. Alongside that, trading volume jumped a solid 60%, according to CoinMarketCap.

Now, even though the move seems modest, it’s what happened around the price action that’s turning heads.

Whale Moves and Assistance Fund Stack Up

Just before HYPE spiked, five wallets—yep, all likely tied to one entity—moved a chunky 22.5 million USDC onto the Hyperliquid platform. One of those wallets went straight in with a $4.33 million buy, scooping up nearly 100,000 HYPE at an average of $43.30.

Another wallet dropped buy-limit orders worth $4.5 million, while the rest look locked and loaded with $13.5 million—probably prepping for more. But that’s not all.

The Hyperliquid Assistance Fund? It’s been on a quiet shopping spree. Over the past seven months, it’s grabbed 26 million HYPE from HyperCore—buying roughly 350,000 tokens every single week. So far, it’s spent around $400 million and is now sitting on profits north of $722 million.

Yep, big numbers.

With a token unlock event looming (9.92 million HYPE unlocking in 141 days), the fund might step up its buying even more. That steady demand could keep HYPE’s momentum alive.

Will HYPE Hold Above $46?

HYPE’s chart shows a falling wedge breakout—usually a bullish sign. That breakout helped it push past the old ATH, now establishing $40 as a critical support zone.

The MACD also paints a somewhat optimistic picture. Histogram bars are growing, hinting that momentum might be building. But, and it’s a big but, if the price can’t stick above $45 for long, a drop back toward $40 could be on the table.

If that happens? Well, it might be a normal retrace… or a sign that HYPE’s rally needs to cool off for a bit. Flip side: if bulls keep things above that new ATH, we could be looking at the start of another leg higher.

Listings Could Fuel the Fire

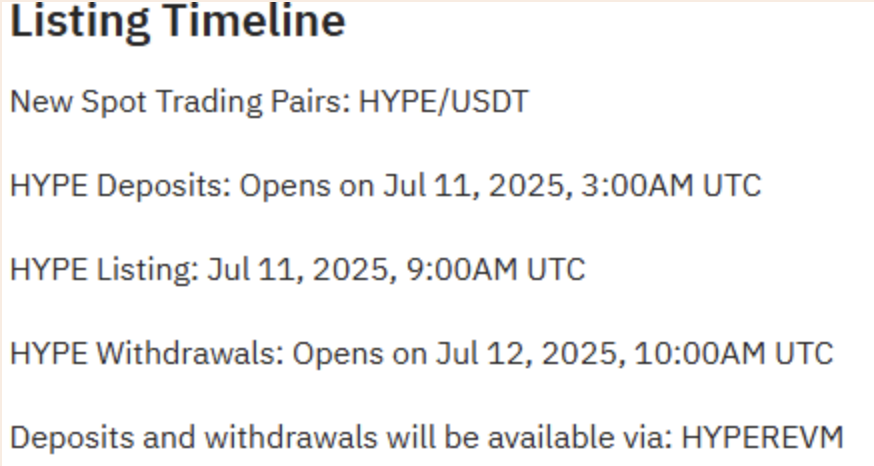

And here’s the kicker—Tier 1 exchange Bybit just added HYPE to its listings. That alone could invite a wave of new liquidity and attention, especially from more risk-averse traders who only touch top-tier platforms.

Oh, and Grayscale? Yeah, they added HYPE to their “under consideration” list for Q3 2025. It’s sitting there alongside BONK and a few others, hinting at a potential future inclusion in institutional portfolios.

That kinda exposure could be a game-changer.