- HYPE volume collapsed, sentiment dipped, and whales are selling at a loss.

- Derivatives market shows bearish bias, but no strong follow-through yet.

- Breakdown to $36.8 is possible, though a sudden squeeze to $41 isn’t off the table either.

After smashing through to $45.7 just a few weeks ago, Hyperliquid (HYPE) seems to have slammed on the brakes. It’s been stuck in a pretty lifeless range, meandering between $38 and $41—no real fire, no real collapse either. Just… stuck.

Volume’s dried up, energy’s faded, and right now? Feels like traders are either bored—or bailing.

Buyers Ghosted, and the Echo’s All That’s Left

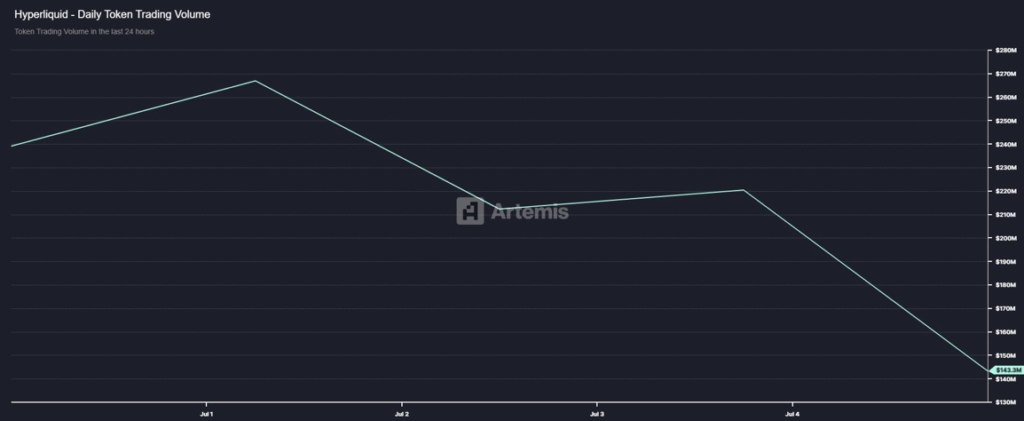

According to data from Artemis, HYPE’s daily token trading volume plummeted to just $143.3 million. That’s the lowest it’s been in three months. And it’s not just “a bit slow.” It’s like the lights went out.

Nobody’s jumping in—and the ones already holding? Yeah, some are starting to freak out.

Whale Pulls the Plug, Dumps Over 215K HYPE

Onchain Lens spotted a whale unloading 215,850 HYPE—cashing out around $8.37 million. But get this… they walked away with a $290K loss. That’s not trimming profits. That’s tapping out.

When whales sell at a loss, it usually means they’re not just nervous. They’re done. That dragged market sentiment into the red—weighted sentiment fell to -1.229, the lowest in a month. It’s not just a dip. It’s fear.

Derivatives Say Bears Are Lurking… But Quietly

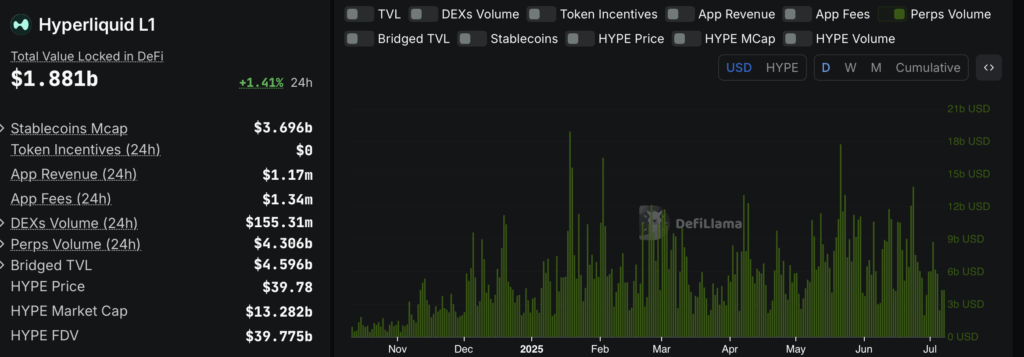

Things aren’t exactly rosy in the futures market either. HYPE’s perpetuals volume dropped hard—from $8.7 billion recently down to $2.436 billion, per DefiLlama.

Traders just aren’t biting. Even worse? The ones that are left seem to be leaning short. Funding rate flipped negative to -0.0006 on Coinalyze. That’s a red flag. Quiet bearish bets tend to build up when nobody’s paying attention.

But—and this is key—there’s no real momentum either. It’s like the whole market is tiptoeing around something. And yeah, that’s exactly the kind of setup where short squeezes sneak in and slap people.

Breakdown to $36? Or a Short Squeeze to $41?

AMBCrypto’s latest read on the indicators isn’t exactly hopeful. Stochastic RSI dropped after a bearish crossover—from 74.12 down to 62.10. Relative Vigor Index (RVGI) dipped to 0.0917, signaling more weakness ahead.

If these signs hold, there’s a decent shot HYPE slips to $36.8. But if spot buyers step in suddenly—especially with so many traders stacked short—don’t be surprised if HYPE rips higher and reclaims $41 in a flash.

Basically? The market’s in a weird spot. No one’s calling the next move with confidence. It’s a waiting game—and whichever side moves first could flip everything on its head.