- Huobi founder Li Lin is forming a $1B Ether trust with top Asian crypto pioneers.

- The group plans to acquire a Nasdaq-listed company and launch in coming weeks.

- The move reflects growing institutional demand for Ethereum investment vehicles.

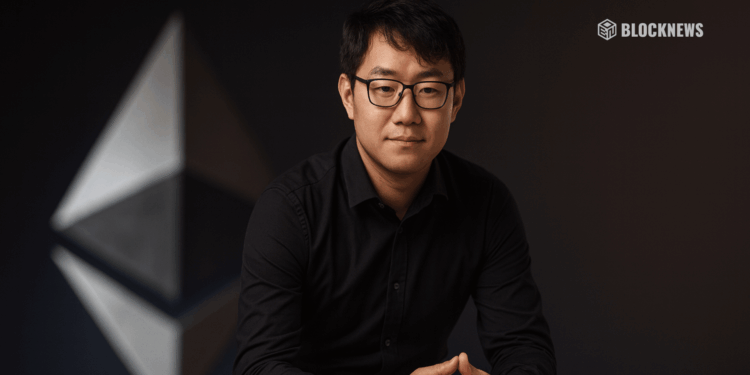

Li Lin, the founder of Huobi and chairman of Hong Kong-based Avenir Capital, is taking the lead in creating a $1 billion ether (ETH) trust, Bloomberg reports. The project brings together some of Asia’s earliest and most influential Ethereum investors in a move to establish a regulated vehicle focused on long-term ETH accumulation. The group is reportedly in talks to acquire a Nasdaq-listed company to structure the trust, with a formal launch expected in the next few weeks.

Heavyweights Behind the Venture

According to sources, Li Lin has joined forces with Shen Bo, co-founder of Fenbushi Capital, HashKey Group CEO Xiao Feng, and Meitu founder Cai Wensheng. Together, they’re forming what’s described as a digital asset trust designed to steadily build and hold ether reserves. Early commitments already total around $1 billion, with Avenir Capital contributing roughly $200 million and regional institutions such as HongShan Capital adding another $500 million. Discussions are ongoing, but the official rollout seems close.

Institutional Momentum Builds

This ambitious initiative comes as global institutional appetite for ether continues to rise. Following the success of U.S. Bitcoin ETFs, asset managers across Asia are racing to create regulated investment vehicles tied to Ethereum. CoinGecko data shows 14 publicly traded firms now hold a combined 4.4 million ETH—worth about $16.9 billion—with BitMine (BMNR.US) topping the list at over $11 billion. The growing demand for ETH exposure reflects a broader shift toward blockchain-based financial infrastructure among major investors.

Li Lin’s Next Chapter in Crypto

Li Lin, who launched Huobi back in 2013 before selling it to Justin Sun after China’s 2021 crypto trading ban, has remained deeply involved in the digital asset world. His firm, Avenir Capital, has since grown into one of Asia’s largest holders of Bitcoin ETFs, managing more than $1 billion in assets. With this new Ether-focused venture, Li appears set to strengthen his influence in institutional crypto investing and help define the next stage of Ethereum’s global adoption.