In the Crypto industry, there is a general “anti-government” and “anti-traditional banking” sentiment that you’ll find on crypto Twitter, Reddit, and the many Discord channels that exist. This is mainly due to Crypto not needing any permissions from any government to exist, nor does it need any of the middlemen in the banking world to function, which has attracted a lot of people who are pro-free markets and pro-individual liberties over government intervention. This combination of Crypto’s capabilities and the crowd that it has attracted has led Bitcoin to be targeted by many governments and international financial committees, like the IMF, with warnings/threats, crippling regulations, and/or outright bans. Yet, despite this, there are countries & local governments that have been choosing to adopt Crypto & who see it as a golden opportunity for their communities.

The most famous of these countries is of course El Salvador which announced at the Bitcoin 2021 conference that they would be recognizing Bitcoin as legal tender. Making it possible to conduct commerce in Satoshis as well as open up “banking services” to the roughly 70% of Salvadorans who do not have access to bank accounts. The Central African Republic also declared Bitcoin legal tender in April of 2022, but why would these countries make this choice when it might bring negative consequences to their economies from the IMF, the EU, or the US who expressed their disapproval at each country’s decision?

The answer to that is multi-part but can essentially be boiled down to them thinking that there is far more to gain for their economies and their people by adopting crypto than there is to lose by drawing the ire of the IMF and other international powers.

The first of those benefits, or gains from adopting BTC, is being able to have economic & monetary independence from foreign countries. The main form of currency used in El Salvador is the US Dollar, which is controlled entirely by the US Federal Bank. In the CAR it is the African Franc that has been dominant, which is largely controlled by France as it is pegged to the French Franc and the French Treasury controls 50% of all foreign exchange reserves for the 14 African countries using the currency. So, by making BTC legal tender, both countries have taken steps to protect themselves from foreign central banks & governments potentially meddling with their economies & holding influence over them. It’s a move to secure national security and independence. You can see which countries rely on, or supplement their currency with, another country’s fiat in this chart:

Salvadorans should also be able to benefit greatly from the adoption of Bitcoin as they sent about $5.9 billion in remittances back into the country, which amounted to over 20% of the country’s GDP. By using Bitcoin instead of traditional solutions today, Bukele aims to reduce remittance fees for Salvadorans by around $400 million. That’s money that Bukele can use to invest directly back into the Salvadoran economy. In the CAR, 99% of the population is unbanked along with only 11.4% having access to the internet, which are both hurdles that Bitcoin can overcome to provide financial services to these people. Bitcoin’s adoption by these nation-states should be a huge financial benefit to not only their economies but to the quality of life of their citizens.

They also want to attract as many foreign tech investors & general investments in their countries as possible to grow their economies & spur job creation. This was mentioned by both President Bukele and the CAR government. Now, these countries have incredibly small economies, with El Salvador being ranked 97th in the world and the CAR ranked 166th, so any amount of additional capital that they could attract would have a massive impact on their citizens. Especially when you look at the small island nation of Malta, through has very lax crypto regulations & incredibly friendly crypto business laws, had a reported $71B worth of crypto pass through the country between 2017 and 2021. Admittedly, most of that money was simply passing through the blockchain & didn’t stay within the country, but there were still plenty of large crypto businesses, like Binance, that set up operations there and helped Malta expand into the 25th largest economy in the world. This is very impressive given they’re the 174th ranked country by population. Although I do need to mention that Malta has had quite a bit of success in generating economic wealth in the areas of tourism, manufacturing, and traditional financial services over the decades which make up the bulk of their economy. El Salvador & the CAR would love to emulate at least some of that success though by similarly attracting crypto & tech entrepreneurs, as the tech industry has become an ever more important GDP producer over the past few decades. This is can be seen below and the GDP numbers are even higher today than what’s even displayed here.

Speaking of attracting crypto entrepreneurs, I’d be remised if I didn’t also mention the local governments that have also been competing for crypto businesses to make their cities and states home. Mayor Suarez of Miami, Mayor Adams of NYC, Mayor Parker of Fort Worth, TX, Mayor Conger of Jackson, TN, and Senator Lummis of Wyoming among many other politicians in the US have been pushing for positive crypto adoption in their districts. This is all in the pursuit of new job creation & new sources of tax revenue with crypto being seen as a new industry for them to court.

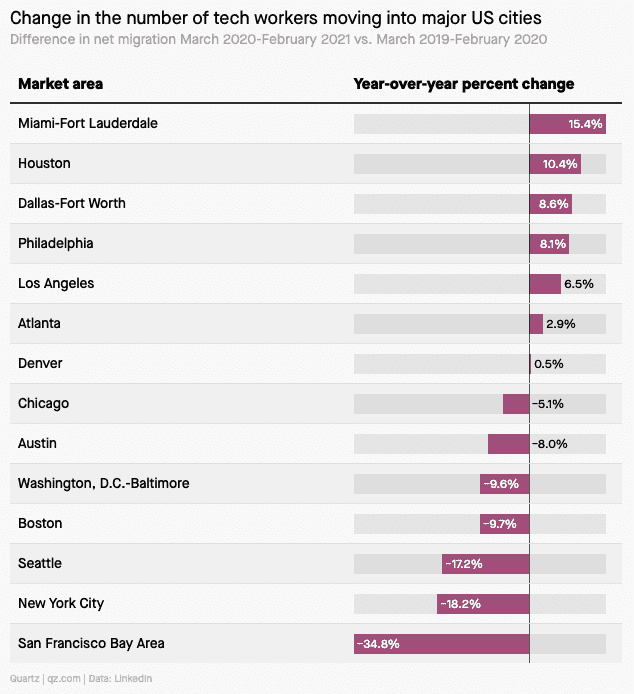

The kind of moves that these officials have been making have included receiving their salaries in Bitcoin, allowing citizens to pay taxes & utilities in crypto, attracting mining operations which have been especially successful in the state of Texas which equates to ¼ of all mining in the US, and the city of Miami has even created their crypto called MiamiCoin which they’ve been using to raise money for the city ($21M as of Jan 2022) & provide new benefits for its citizens. The branding of being a tech-friendly official, city, and/or state seems to be working for attracting Tech jobs in general, which you can see in the below chart where tech job growth is matching pretty well against more crypto-friendly cities:

With all markets, especially the crypto markets, having severely sold off at the time of writing (6/16/2022), we’ll need to see if these Tech job growth trends continue, or if the bear market might stifle or permanently suppress the growth & therefore the success of these crypto-friendly mayors & senators.

So, we have two small countries that have adopted BTC as legal tender and quite a few local governments embracing crypto for the benefits it would bring to their people and their economies, but what about the other governments & nation-states across the world? Are any other countries expressing interest in crypto, especially ones with very large economies?

Well, it might not exactly be “crypto”, but it does seem like there is a ton of interest in Central Bank Digital Currencies, or CBDCs, which are digital versions of fiat currencies like the digital US Dollar or the digital Chinese Yuan as examples. These would provide central banks the ability to burn their currency as means of inflation control, provide banking services to portions of their population who don’t have access to traditional banks….and also provide complete transparency and oversight on how their money/CBDCs are being used, which many believe would lead to heightened levels of oppression & invasions of privacy by governments. If you want to read more about the pros and cons of CBDCs, check out this Crunchbase article, “CBDCs: The Good, The Bad, And The Ugly“.

Despite the potential downsides, many believe that CBDCs being launched in major economies would result in a huge increase in crypto user adoption as the masses would begin familiarizing themselves with how crypto works, and then wade further into the decentralized side of the space. So far, only the Bahamas, the eastern Caribbean, and Nigeria have launched CBDCs, but Sweden, China, Jamaica, and Ukraine also have pilots currently in progress. Most excitingly, or potentially terrifying depending on your opinion of CBDCs, the US, EU, and India all have CBDCs that are currently in development as well. Meaning that the world’s largest economies & central banks are all exploring crypto adoption, even if it might be at the CBDC level as opposed to BTC.

Regarding Bitcoin adoption specifically, though, we did have a meeting of representatives from 44 different nations & central banks in El Salvador to discuss how Bitcoin was being adopted in the country along with how it is helping to spread financial inclusion. The countries that attended include Paraguay, Angola, Ghana, Namibia, Uganda, Guinea, Madagascar, Haiti, Burundi, Eswatini (Swaziland), Jordan, Gambia, Honduras, Maldives, Rwanda, Nepal, Kenya, Pakistan, Costa Rica, Ecuador, Egypt, Nigeria, Senegal, Dominica, Mauritania, Congo, Armenia, and Bangladesh. None of them are economic heavyweights by any stretch of the imagination, but they mostly all suffer from the same challenges as El Salvador where the main currency used in their nations is controlled by foreign banks, and/or they are suffering from high rates of inflation. Any adoption of Bitcoin, no matter how small the economy, is a huge boon to the industry and a vote of confidence. This list of 44 countries may show us which nation-states are most likely to declare Bitcoin as legal tender next.

Lastly, a government doesn’t need to make grandiose positive statements about Bitcoin, declare BTC as legal tender, or even pursue the creation of a CBDC to be seen as crypto-friendly. They could just pass very friendly tax laws for crypto traders like Belarus, the Cayman Islands, El Salvador, Germany, Malta, Singapore, and Switzerland have all done. You do not need to pay capital gains tax from the sale of cryptocurrencies in these countries. That’s one hell of an incentive for rich crypto traders to move, become citizens, and bring their net worth into those local economies if you ask me.

In summary, crypto adoption by governments looks very different depending on the nation that you’re looking at, but the one evident thing is that cryptocurrency is at the forefront of a lot of politicians’ & bankers’ minds. More adoption, regulation, and innovation are bound to happen over the coming decades across almost every country, and the use of crypto will most likely keep spreading as a result.