- Bitcoin bulls are eyeing targets from $130K to over $1M in 2025, depending on U.S. policy and market momentum.

- Analysts see stablecoins and institutional demand as key drivers toward a $200K year-end price.

- If the Fed pivots to money printing, Bitcoin could soar to $250K by December, says Arthur Hayes.

Bitcoin’s back in the headlines, and the price predictions are getting louder (and weirder). The usual critics like Peter Schiff and Nouriel Roubini are still doomsaying hard, but meanwhile, Bitcoin’s been tearing up the charts thanks to a fresh wave of institutional interest. It smashed through a new all-time high of $111,970 on May 22, and yeah… it’s been hanging around that level ever since—like it’s teasing us or something.

This year’s already been wild, with BTC bouncing back from a pretty grim April low of $76,300. Now, the top bulls are laying down their bets for what’s next—and let’s just say they’re not exactly holding back.

Adam Back Shoots for the Moon (Like, Literally)

Adam Back, CEO of Blockstream, made headlines last November claiming Bitcoin could break a cool $1 million this cycle—but only if the U.S. pulls the trigger on a Strategic Bitcoin Reserve. Fast-forward to March, and surprise: the White House actually backed it. Congress still needs to make it official, though. The proposed bill? It treats BTC like digital gold, stashing away confiscated coins as national reserves.

Back’s not shy about it. He says that $1M is the bare minimum if everything goes right. By May, New Hampshire had passed a Bitcoin reserve bill, and Texas is sniffing around the idea too. He even told Cointelegraph Magazine that retail hype will skyrocket again once $16B from the FTX bankruptcy floods back into the market. His ballpark guess? A “few hundred thousand” per coin, easy.

$200K Predictions: The Analysts Are Buzzing

If there’s one number popping up everywhere, it’s $200,000. Geoff Kendrick over at Standard Chartered is leading the chorus, saying BTC could hit $120K mid-year and roll up to $200K by December. What’s fueling that optimism? Stablecoins, apparently.

He pointed to the GENIUS Act, passed by the Senate, which could be a turning point for crypto legitimacy. The idea is that as stablecoins get more legit, the entire crypto ecosystem levels up. Bitwise’s André Dragosch is on the same page. So is Markus Thielen, who’s been tracking BTC’s moves in $16K increments and thinks the next ceiling’s about $122K. And then there’s Anthony Scaramucci—yep, that guy—who’s chiming in with a $200K target too.

Novogratz Keeps It (Sorta) Chill

Mike Novogratz, ex-Goldman guy and Galaxy Digital’s head honcho, has been a crypto bull forever, even if his Terra bet tanked hard. He showed up on CNBC after Galaxy’s May 16 listing and dropped a tamer estimate: somewhere between $130,000 and $150,000. Not exactly moon math, but still impressive.

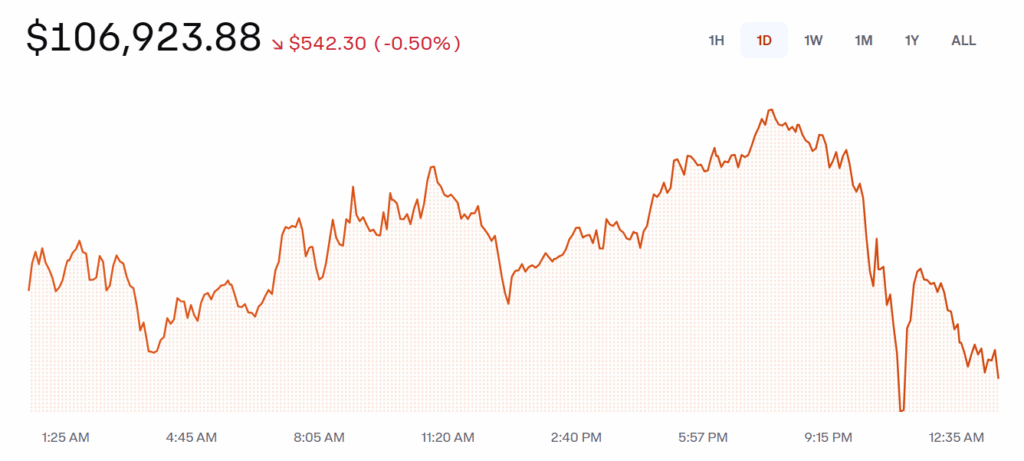

He thinks strong institutional demand, a weakening dollar, and general crypto momentum are pushing BTC higher. “We already topped around inauguration,” he said. “Now we’re eyeing that next flight range.” Basically, if BTC clears the $106K–$108K zone, it could be off to the races.

Wood and Kiyosaki Go Big… Really Big

Cathie Wood from ARK Invest has never been shy with her numbers. Her bull case? $1.5 million by 2030. That’d need a 58% annual growth rate, but hey, she’s betting on institutional money flowing in fast. ARK’s always been about high-conviction plays, and Bitcoin’s no exception.

Meanwhile, Robert Kiyosaki—the “Rich Dad Poor Dad” guy—is dreaming even bigger. He sees BTC at $1 million by 2035, but for 2025, he’s still bold: $250K. Oh, and gold? $30K. Silver? $3K. Go big or go home, right?

Arthur Hayes: All Eyes on the Fed

BitMEX co-founder Arthur Hayes has a different angle. His theory? If the Fed pivots from quantitative tightening to easing (QE), then Bitcoin’s heading to $250,000 this year. He wrote in April that the local low of $76,500 was probably it—and now we’re on the way up.

If fiat money printing ramps back up, Hayes believes BTC will respond accordingly. The DXY (U.S. dollar index) is already down over 8% in 2025, which adds weight to his call. So yeah, if the Fed flips the switch, BTC might just go nuts.