- $HBAR struggles to maintain its footing after multiple rejection points

- Key Fibonacci levels could act as a lifeline for bulls

- A break below support might trigger deeper losses, while a recovery hinges on volume

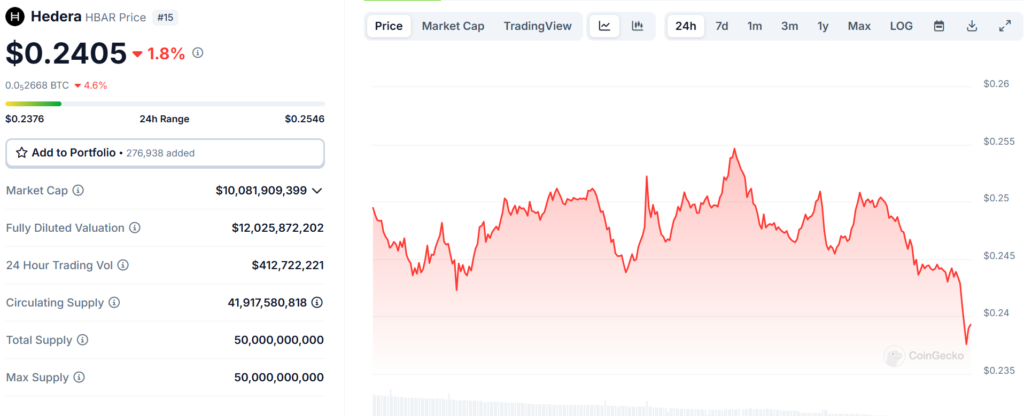

Hedera’s price action has been anything but stable, with HBAR struggling to maintain momentum as sellers dominate. The CoinGecko chart shows a consistent pattern of lower highs and lower lows, indicating a clear downtrend that has been tough for bulls to counter. Despite some temporary relief rallies, each attempt to push higher has met strong resistance, leading to sharp pullbacks.

One of the key concerns right now is the failure to hold above the $0.25 range, an area that previously acted as a short-term floor. Now that the price has dipped below this zone, the risk of further downside is growing. Bulls need to step in soon, or this could open the door for an even deeper correction toward $0.23 or lower.

Can Fibonacci Levels Offer a Lifeline?

Looking at the bigger picture, the chart HBAR is approaching a crucial support area. Historically, the 0.618 Fibonacci retracement has provided a solid base during corrections, and if Hedera manages to stabilize around this level, we might see a reversal attempt. However, if selling pressure remains strong, the next key level to watch would be the 0.786 retracement, which could act as a final defense before a more significant drop.

Another factor to consider is the overall trend structure. If $HBAR starts forming a base near these Fibonacci levels while volume picks up, it could hint at a potential bounce. But without a confirmed shift in trend momentum, any recovery attempt might just be a dead-cat bounce rather than a true reversal.

Hedera Faces Heavy Selling Pressure

For now, the most critical resistance lies between $0.25 and $0.255, a zone that previously saw multiple rejections. If bulls manage to reclaim this area and hold above it, we could see a push toward $0.27, which would help stabilize the structure. But if HBAR continues to struggle, a drop below $0.24 could accelerate the sell-off, putting $0.23 in play as the next target.

Hedera was created to provide a more energy-efficient and enterprise-friendly alternative to traditional blockchains. Unlike many decentralized networks, it operates on a Hashgraph consensus model, which is known for its high transaction throughput and low fees. While its fundamentals remain strong, technical indicators suggest that the short-term outlook is uncertain, and traders should approach with caution.

For now, $HBAR needs to show some strength before calling a bottom. A move back above resistance could flip sentiment bullish, but failure to hold key support levels could lead to more pain ahead.