• Hedera surged 11% in 24 hours after confirmation of its first ETF launch.

• The Canary Hedera ETF could bring institutional inflows and liquidity to HBAR.

• Analysts expect potential gains toward $0.36 by December, though volatility and correction risks remain — here is what traders should watch next.

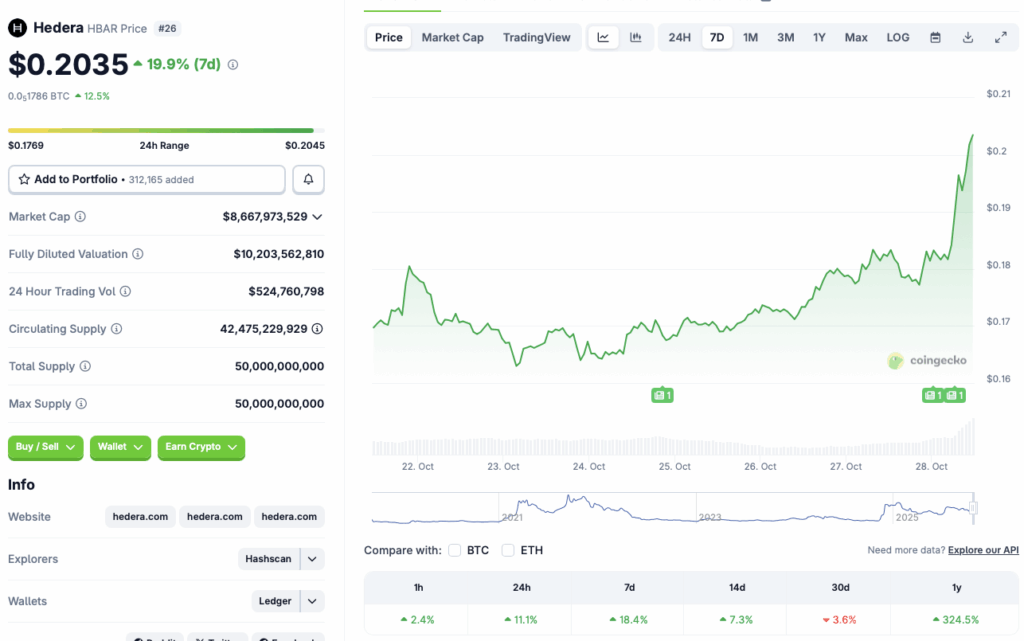

While most of the crypto market trades lower, Hedera (HBAR) is rallying sharply after confirmation that the Canary Hedera ETF will officially launch today, Oct. 28, 2025. Data from CoinGecko shows HBAR has jumped 11.1% in 24 hours, 18.4% this week, and an incredible 324% year-over-year since October 2024. The surge stands out as Bitcoin and other majors slip — with BTC falling 1.7% to $113,000 — signaling strong investor excitement over new institutional exposure through the ETF listing.

Why the ETF Launch Is a Big Deal

The rally gained traction after Bloomberg ETF analyst Eric Balchunas confirmed the ETF’s launch on X (formerly Twitter), sparking widespread interest among retail and institutional traders alike. Market participants see this as a milestone for Hedera, potentially opening the door for mainstream inflows and long-term legitimacy. The new ETF will make it easier for traditional investors to gain exposure to HBAR, a factor that often boosts liquidity and price momentum in the short term.

Analysts Split on How Long the Momentum Can Hold

Despite the excitement, analysts remain cautious about how long HBAR’s rally can last. The broader market remains in a correction phase, and high volatility continues to dominate trading conditions. According to CoinCodex, however, the outlook for HBAR remains bullish, with predictions suggesting the token could hit $0.36 by Dec. 12, representing an 80% upside from current levels. Still, macro headwinds — including global trade tensions and uncertain monetary policy — could limit sustained growth.

What to Watch Next

For now, HBAR’s momentum hinges on ETF-related inflows and whether institutional buyers show real follow-through beyond launch hype. A strong debut could stabilize prices near current highs, but profit-taking could also trigger short-term retracements. If HBAR manages to hold its breakout levels in the coming days, analysts say it could set the tone for another leg up heading into December — provided Bitcoin steadies and macro pressures ease.