- Over 210M HBAR moved in one week—whales might be accumulating while retail chills.

- HBAR fundamentals are strengthening, with real use cases like the $AUDD and live USDC support.

- A rumored green ETF listing in late 2025 could push HBAR toward $0.50–$1.50 if momentum kicks in.

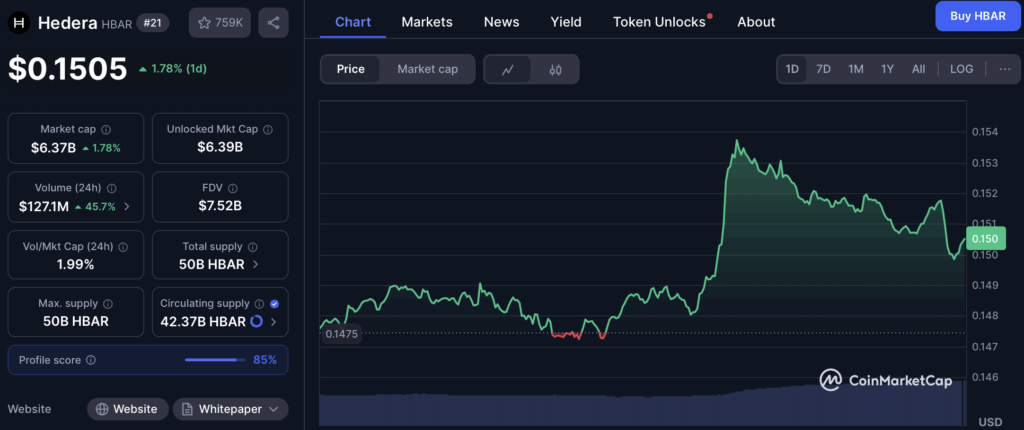

Hedera (HBAR) is starting to buzz again. Not loudly—but that’s kinda the point. Retail traders are mostly out of the picture, chilling on the sidelines, while HBAR quietly builds momentum. Price-wise, it’s still way down from those 2021 glory days, sitting at around $0.1489. But lately? There’s been a weird mix of low noise and high signal that’s got some people paying attention again.

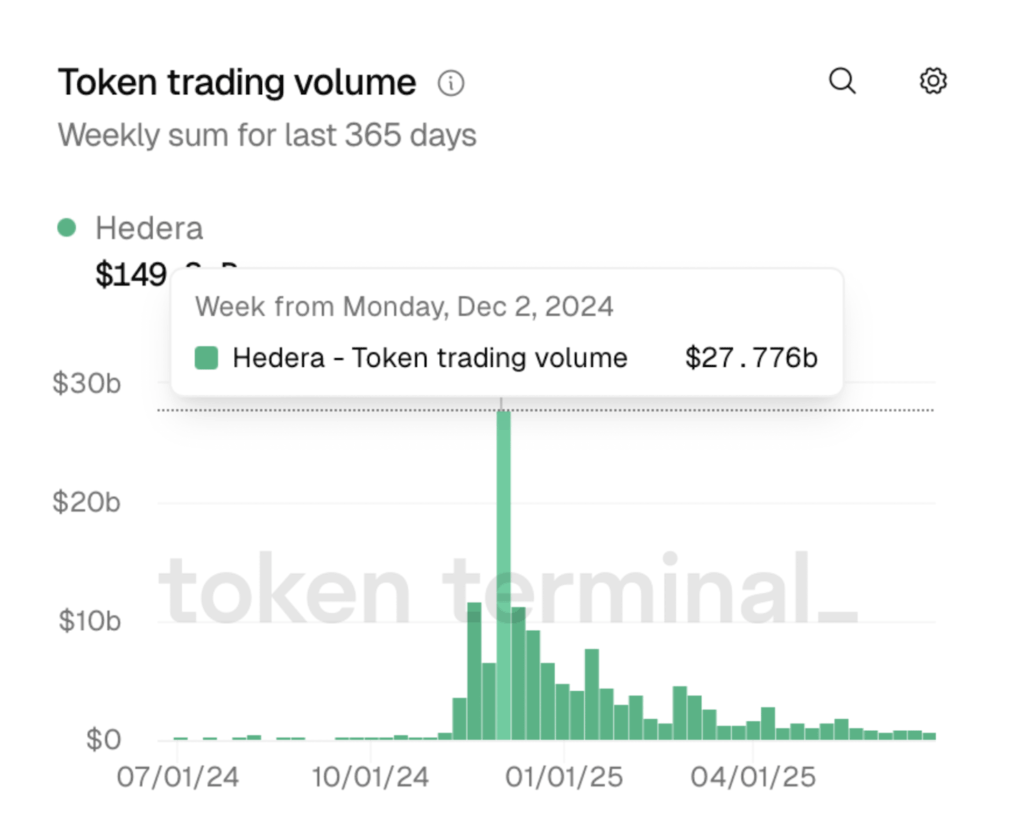

Top analyst Steph_iscrypto pointed out something kinda wild—HBAR trading volume has tanked over 90% since December 2024. Sounds bad on paper, but honestly, that kind of dip usually means the tourists have left. And when retail clears out? That’s often when the whales get to work. Funny enough, that’s exactly what seems to be happening right now.

Big Transfers, Low Chatter—What’s Going On?

On June 28, more than 210 million HBAR moved on-chain. That’s not chump change—roughly $16.8 million, just flying under the radar. And that same week? Someone yanked 50 million HBAR off Coinbase. Cold storage, maybe. Meanwhile, another 175 million tokens landed back into a known whale wallet. These aren’t retail-sized moves. It’s giving “strategic accumulation.”

While all that’s going on, the fundamentals are quietly stacking up. WSB Trader Rocko reminded folks that HBAR already pulled a 10x move earlier this year—in just five weeks. And the momentum? Still building, apparently.

Real-World Stuff Actually Happening

Then there’s the Australian Digital Dollar ($AUDD), which launched on Hedera. That’s a real-world currency using their tech. USDC support? Already live. Oh—and Hedera just co-chaired a policy roundtable in Washington D.C. with Chainlink and Oliver Wyman. They were talking digital money, regulation, the future—all that grown-up stuff crypto sometimes avoids.

And here’s where it gets even more interesting: there’s buzz that HBAR might end up in a “green blockchain ETF” designed around low-energy, Web3 infrastructure. If that ETF drops later in 2025 like people are expecting… it could be a major unlock for institutional capital. Quiet coin, loud implications.

What Happens If the ETF Actually Lands?

We threw the question at GPT, and the numbers it crunched were, well, pretty eye-catching:

- If the ETF gains even a little steam, HBAR might rip to $0.35–$0.50 short-term.

- If retail jumps back in and ETF volume sticks? Could be looking at $0.75–$1.00.

- And if it’s all systems go—big staking, CBDC partnership, bull market vibes—then $1.50+ might not be that wild after all.

None of this is a sure thing, of course. That’s crypto. But the setup? Quiet accumulation, real-world use cases, under-the-radar government partnerships… it’s all there.

So yeah, HBAR might not be front-page news today. But that could change—fast.