- Grayscale is launching the first US spot Chainlink ETF this week by converting its existing LINK Trust.

- Bloomberg analysts expect over 100 new crypto ETFs to debut in the next six months as approvals accelerate.

- The Chainlink ETF will track LINK’s spot price and staking rewards, highlighting growing institutional interest in Chainlink.

Grayscale is expected to roll out the United States’ first spot Chainlink ETF on Tuesday, marking a pretty significant moment for both LINK holders and the broader crypto ETF landscape. The launch, first highlighted by ETF Institute co-founder Nate Geraci, will come through the conversion of Grayscale’s long-standing Chainlink Trust into a fully tradable ETF. With strong anticipation around the product and competitors already lining up, LINK appears to be stepping into its own phase of institutional exposure.

LINK’s First Spot ETF Arrives Through Trust Conversion

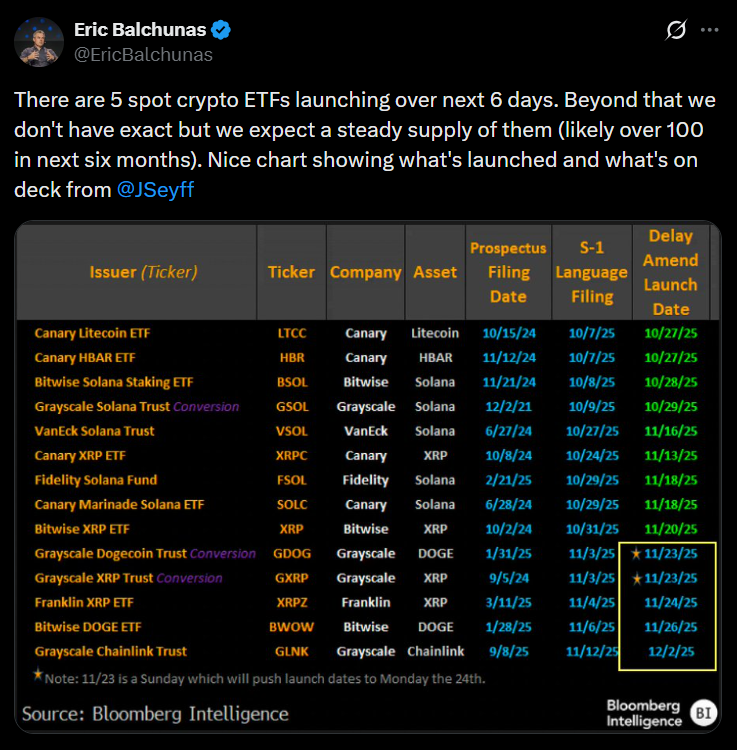

Geraci shared on X that the new ETF is “set to launch this week,” adding that Grayscale is preparing to convert its private Chainlink Trust into a spot ETF. This aligns closely with Bloomberg Intelligence projections, which pegged Dec. 2 as the estimated launch date. Bloomberg ETF analyst Eric Balchunas also noted that the debut is part of a much larger wave of new offerings, suggesting that the market could see more than 100 new crypto ETFs roll out over the next six months if current approval momentum continues.

Rising Competition and Expanding Demand

Grayscale isn’t alone in the race. Bitwise also has a LINK ETF planned, currently waiting in the wings as regulatory approvals accelerate across the board. According to Balchunas, five new spot crypto ETFs are launching within a six-day stretch, signaling just how quickly the sector is evolving under the SEC’s new leadership. With Solana, XRP, and even Dogecoin ETFs already approved this year, Chainlink’s arrival on the ETF stage feels like a natural next step for institutional crypto expansion.

How the Chainlink ETF Will Work

The new product will track the spot price of LINK while also capturing returns generated from staking the token — a model that’s become more common as investors seek yield-bearing ETF options. Grayscale first created the Chainlink Trust back in late 2020, and the conversion into an ETF marks a full-circle moment as traditional markets and blockchain infrastructure continue to overlap. In a recent report, the firm even described Chainlink as “critical connective tissue” bridging crypto with traditional finance — a strong endorsement for LINK’s long-term utility.