- Goldman Sachs disclosed $718 million in Bitcoin ETF holdings, including $461 million in BlackRock’s spot Bitcoin ETF.

- The bank increased its Bitcoin ETF investments by 71% since the second quarter of 2024.

- Despite its history of skepticism, Goldman Sachs now holds Ether ETFs worth $22 million.

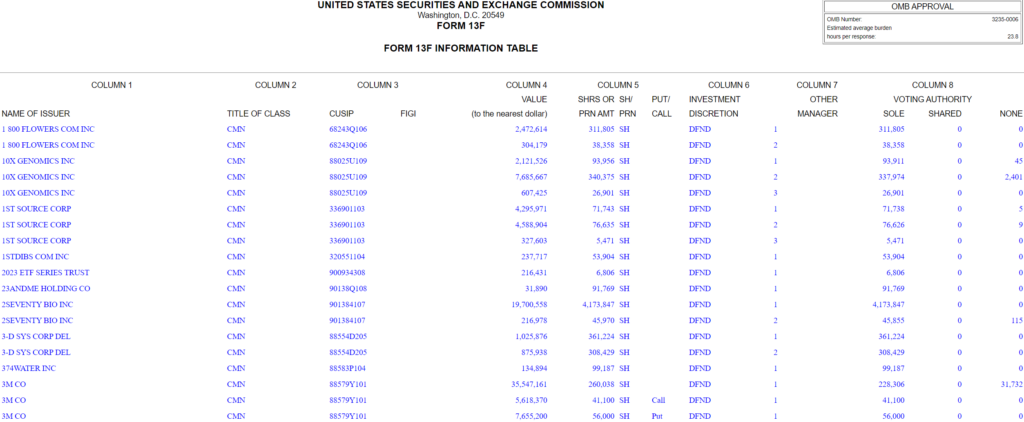

Goldman Sachs, once a vocal critic of Bitcoin, has significantly increased its exposure to the cryptocurrency through Bitcoin exchange-traded funds (ETFs). A filing submitted to the United States Securities and Exchange Commission (SEC) on November 14 revealed the bank now holds approximately $718 million across eight Bitcoin ETFs.

The report highlighted a $461 million investment in BlackRock’s iShares Bitcoin Trust ETF, marking it as Goldman’s largest single allocation in the space. The bank’s Bitcoin ETF portfolio has grown by 71% since the second quarter of 2024, when it disclosed its first Bitcoin ETF purchase.

Source: SEC

Details of Bitcoin ETF Portfolio

The latest filing showed a diversified portfolio, including $96 million in Fidelity’s Wise Origin Bitcoin Fund, $72 million in the Grayscale Bitcoin Trust ETF, and $60 million in the Invesco Galaxy Bitcoin ETF. Additional holdings were reported in smaller Bitcoin ETFs, such as the Bitwise Bitcoin ETF and the ARK 21Shares Bitcoin ETF, totaling over $30 million.

Goldman also revealed a modest $22 million investment in Ether ETFs, with most of it allocated to the Grayscale Ethereum Mini Trust ETF.

Shift From Skepticism to Investment

Goldman Sachs’ entry into Bitcoin ETFs comes after years of public skepticism. In 2020, the bank criticized Bitcoin, dismissing it as an unsuitable investment class. Even as recently as April, Private Wealth Management Chief Investment Officer Sharmin Mossavar-Rahmani maintained a critical stance, likening the crypto boom to historical financial bubbles.

The sharp contrast between its public criticisms and its current investments underscores the growing institutional acceptance of cryptocurrencies as a legitimate asset class. Goldman’s moves suggest a recognition of the increasing demand for digital asset exposure among institutional investors.