- The General Manager of the Bank for International Settlements calls for an advanced legal framework to support central bank digital currency (CBDC).

- Agustin Carsten advised countries to set up interoperable legal frameworks to meet user demands.

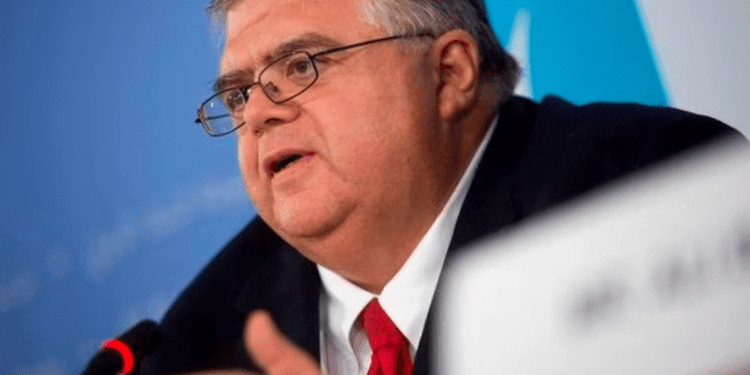

Agustin Carsten Advocates for CBDCs, Calls for Evolution of Central Banks

On Wednesday, Agustin Carsten, General Manager of the Bank for International Settlements, advised countries to set up legal frameworks to aid the adoption of central bank digital currencies (CBDCs).

At a conference in Switzerland, the finance executive spoke extensively on CBDCs and legal frameworks. In his speech, he emphasized the

importance of central bank digital currencies and their legal aspect.

In his speech, Carsten recognized the current state of traditional banking, but he emphasized the need to evolve. According to him, user demands have evolved from cash to digital. New forms of money, like stablecoins and cryptocurrencies, are solving problems associated with traditional finance. Carsten argued that digitizing central banks by adopting CBDCs is the way to meet the demands of users.

However, he examined the shortcomings of private digital money like stablecoins. According to him, they fueled a demand for change, but “They do not offer the backing and protection of the central bank; a reliable regulatory and supervisory framework; access to the central bank as lender of resort; or guaranteed finality of payments. Even stablecoins do not assure a stable value. They do not and cannot meet the standards the public expects of money.”

The financial executive examined the importance of legislation to legitimate central bank digital currencies. According to him, the legal frameworks legitimize the digital currency.

“Without the law, money cannot function,” Carsten said. “The legitimacy of a CBDC will be derived from the legal authority of the central bank to issue it. That authority needs to be firmly grounded in the law.

Central banks have legally defined mandates that set out the functions and tasks they must perform and the powers they have to accomplish them.”

After highlighting the role central banks play in being an anchor for CBDCs’ legitimacy, the General Manager of BIS examined the experimental aspect of laws and CBDCS.

According to an IMF paper in 2021, 80% of central banks operate CBDCs with a vague legal framework or are not allowed to due to existing laws.

“First and foremost, a conversation needs to take place inside countries. Different legal systems approach these questions in different ways. It is for each jurisdiction to decide whether to issue CBDC and how to balance the rights and obligations of its users at a national level. The answer to these questions will often depend on the local legal framework, as well as on culture and traditions. Many countries are happily going cashless. For others, cash is still king. The General Manager of BIS said.

Additionally, the General Manager of BIS spoke on the need for interoperability of legal frameworks with other jurisdictions. A fragmented legal framework incompatible with other jurisdictions and digital currencies defeats the purpose of evolving.