- GameStop confirmed it bought 4,710 BTC, marking its first major move into crypto.

- GME stock jumped over 30% in a month, fueled by Bitcoin investment speculation.

- GameStop joins firms like Strategy and Trump Media in adopting Bitcoin for treasury holdings.

GameStop’s leap into the crypto world is no longer just rumor—it’s real. The gaming retailer confirmed on May 28 via its X account that it now holds 4,710 Bitcoin. That’s not pocket change; it’s roughly $513 million at current market prices. They didn’t spill the exact price they paid or when they bought in, and even their SEC Form 8-K filing kept it vague. But either way, it’s their first major crypto play since they hinted at moving into Bitcoin back in March.

Back then, GameStop launched a $1.3 billion convertible notes offering to help fund this move—clearly not just dabbling. Now, it’s official: the company isn’t just about consoles and collectibles anymore; it’s stacking sats.

Stock Surge and Speculation

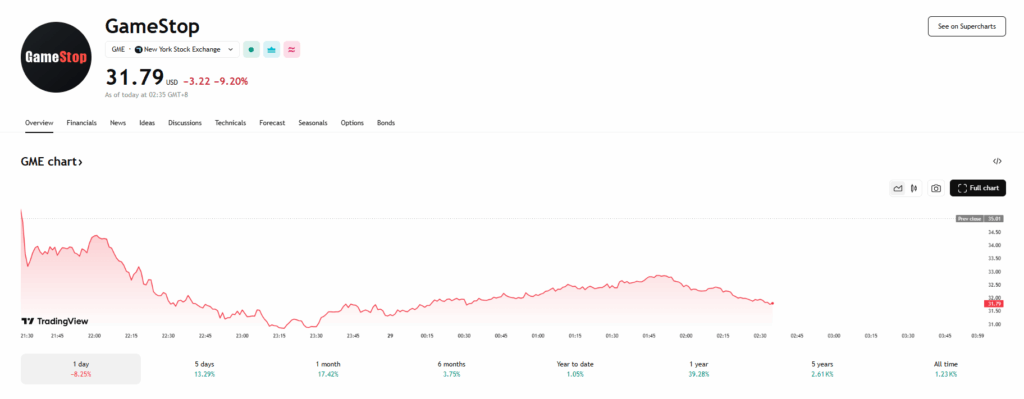

Of course, when news like this hits, Wall Street takes notice. Speculation had already been brewing in February and March, helping GameStop stock spike 18% and then another 12% respectively. On May 27, shares closed at $35 and popped to $36.30 in pre-market trading the next day. All in all, the stock is up 30% in the last month, and about 10% for the year—proof that crypto buzz still moves markets.

GameStop didn’t respond to requests for comment, but they didn’t really have to—the numbers (and the Bitcoin address, presumably) speak for themselves.

Bitcoin Adoption Trend Picks Up Steam

This move puts GameStop alongside the growing list of corporations diversifying their treasury into Bitcoin. It’s a list that includes heavyweights like Strategy (previously MicroStrategy), which scooped up over 4,000 BTC recently, Japan’s Metaplanet, and Brazil’s Meliuz. And even Trump Media—yes, that Trump—just announced a $2.5 billion raise to buy Bitcoin too, despite earlier denials.

For GameStop, a company that’s reinvented itself more times than we can count, this is a bold step into digital value storage. Whether it’s a smart hedge or just another high-risk gamble, time (and the BTC chart) will tell.