The former CFTC head emphasizes the necessity for a CBDC that preserves privacy and democratic ideals and uses existing crypto technology to do so. CBDCs should be “freedom currencies,” not “surveillance coins,” he argues.

- A former chair of the CFTC is a supporter of CBDCs that maintain democratic principles including freedom of speech and the right to privacy.

- A CBDC should not run the risk of being exploited for surveillance, as was the case with the Chinese e-yuan.

- CBDC tracks transaction-level data down to the individual user and can be programmed to choke out politically unpopular activity.

Questionable Remarks on CBDC

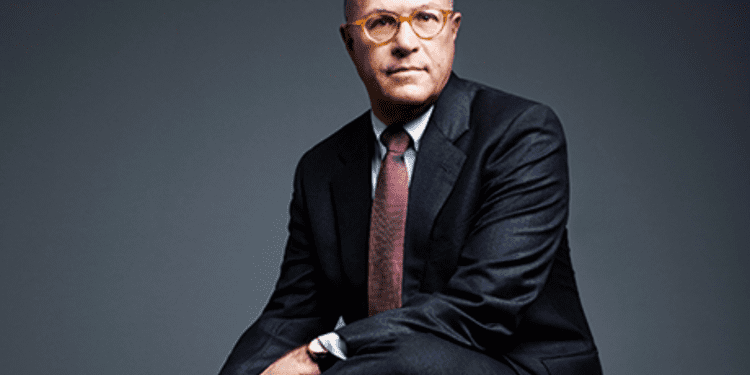

Christopher Giancarlo, the former head of the Commodities Futures Trading Commission (CFTC), has urged the U.S. to take the initiative in developing central bank digital currencies (CBDCs) that uphold democratic principles, including freedom of speech and the right to privacy. Giancarlo stressed the need to steer CBDCs away from being “spy coins” and toward being “freedom coins” in an opinion piece that appeared in The Hill. Giancarlo, a co-founder of the Digital Dollars Project, a study looking at the effects of a US CBDC, observed that the present Know Your Customer (KYC), and Anti-Money Laundering (AML) regulations are out-of-date and constitutionally dubious.

Privacy as a Priority in CBDC Development

Giancarlo, who goes by the nickname “Crypto Dad” due to his support of cryptocurrencies, suggested utilizing existing bitcoin protocols to provide a high level of privacy in CBDCs. He argued for adopting cryptographic techniques such as zero-knowledge proofs, homomorphic encryption, and multiparty computation to protect personal information while enabling “intelligent enforcement” of crime prevention measures in a report on privacy issues in CBDC development with a fellow at the American Enterprise Institute Jim Harper.

Criticism of Current Financial Surveillance Policies

The writers criticized recent documents from the Biden administration, particularly the White House Office of Science and Technology Policy’s Technical Study for a U.S. Central Bank Digital Currency System. According to Giancarlo and Harper, the paper shows a “refusal to move beyond the constitutionally questionable financial surveillance regime of today.” They questioned the new AML and KYC regulations, saying they allow for disproportionate surveillance without a warrant.

CBDCs as a Tool for Political Conformity

The authors cited China’s e-yuan, which makes all transactions public to the People’s Bank of China, in their warning about the danger of CBDCs being used as a tool for political conformity. According to them, there is a chance that a CBDC may be used to link political agreement to personal success, “relegating political dissenters to poverty,” if its privacy is not protected.

Support for Privacy Protection in CBDC Development

The issues raised by U.S. Senator Tom Emmer, a staunch opponent of a US CBDC who presented the CBDC Anti-Surveillance Act in 2022, are echoed in Giancarlo and Harper’s paper. Emmer is concerned that CBDCs are set up to stifle politically controversial behavior and track transaction-level data down to the individual user. He serves as the U.S. Congressional Blockchain Caucus’ co-chair.

Conclusion

Former CFTC Chair Christopher Giancarlo is pushing for the U.S. to take the lead in developing CBDCs toward being “freedom coins,” which would guarantee privacy and prevent them from being used as a tool for surveillance. To ensure privacy protection in CBDC development, cryptographic technology and a review of the current financial surveillance policies are crucial steps.

Policymakers should consider the potential of digital currencies to support democratic ideals, such as preserving privacy and promoting free speech, as CBDCs become an increasingly important issue for central banks worldwide.