- Filecoin (FIL) surged over 50% in 24 hours, outperforming the top 100 crypto assets.

- Rising AI storage demand and Web3 interest are fueling renewed ecosystem activity.

- Analysts expect near-term consolidation, but macro tailwinds could extend the rally.

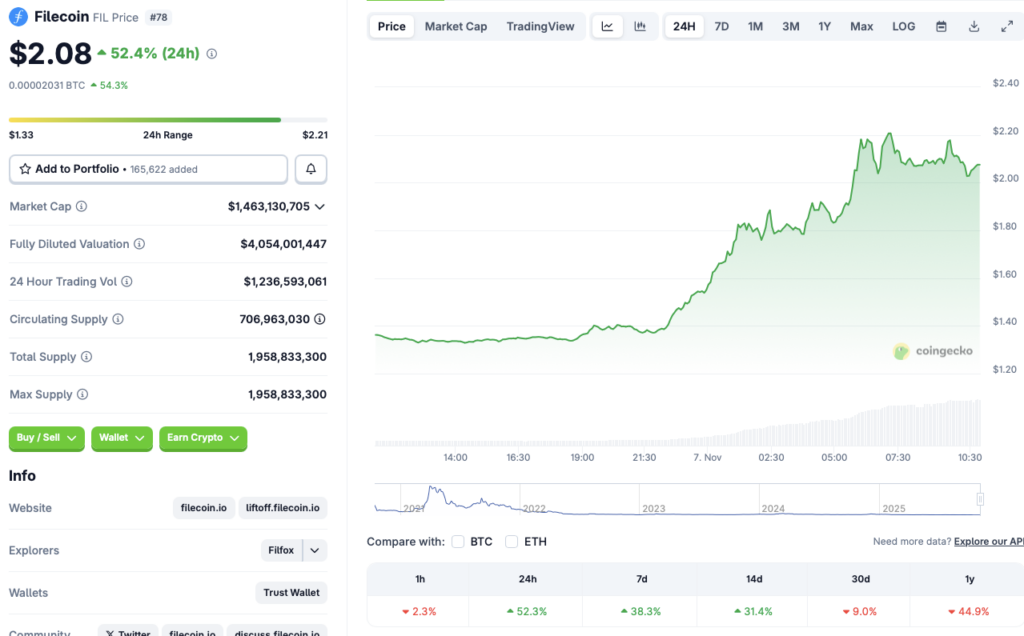

Filecoin (FIL) has become the standout performer in the crypto market, rallying an impressive 52.3% in the past 24 hours, according to CoinGecko data. The token has also jumped 38.3% over the past week and 32.4% over the last two weeks, making it the best-performing asset among the top 100 cryptocurrencies by market cap. Despite the surge, FIL still trades 9% lower than last month and remains down 44.9% since November 2024.

What’s Behind Filecoin’s Price Surge?

The rally comes during a market-wide consolidation phase, following Bitcoin’s brief drop to $99,000 earlier this week. While most large-cap assets struggled to recover, Filecoin has sharply outpaced the broader market, fueled by growing interest in decentralized storage and Web3 infrastructure.

A Filecoin ambassador pointed out that the project is benefiting from renewed excitement surrounding AI-related data storage, which has driven fresh demand for scalable, decentralized solutions. The narrative ties directly into broader trends where AI and blockchain integration are gaining traction across the tech sector.

Ecosystem Momentum and Investor Speculation

In addition to the AI and Web3 buzz, Filecoin’s rally appears to be supported by ecosystem expansion and renewed developer activity. However, analysts warn that FIL’s price could be entering overheated territory after such a steep rise.

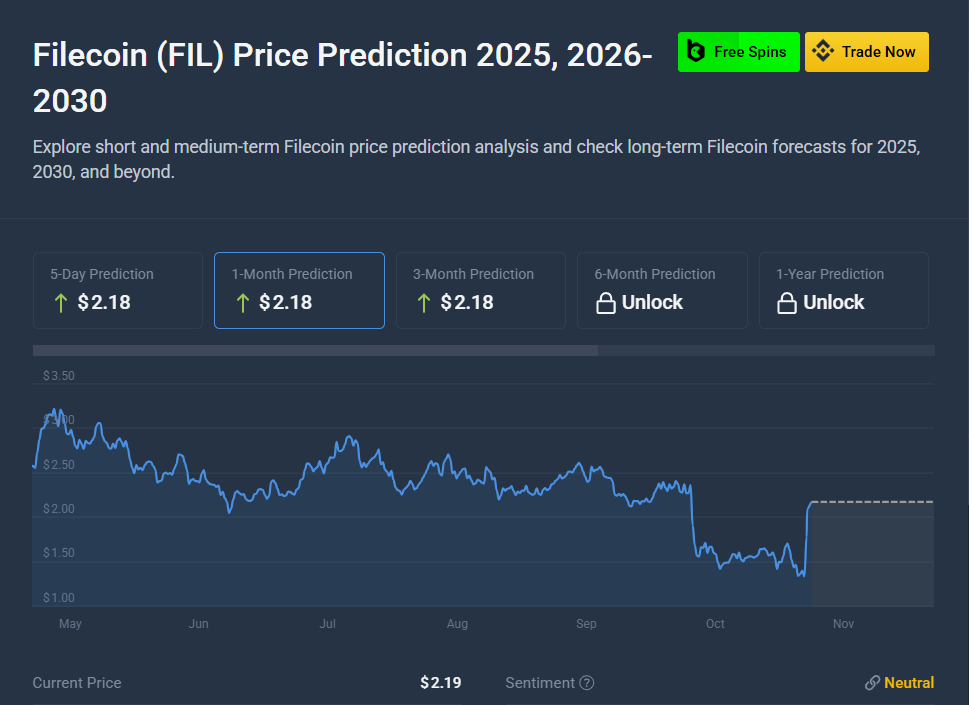

According to CoinCodex, the asset is expected to stabilize around current levels over the next month as traders lock in profits. Despite the short-term euphoria, FIL still trades nearly 99% below its all-time high of $236.84, reached in April 2021, reminding investors of the volatility typical of post-rally phases.

Macro Factors Could Shape Filecoin’s Next Move

Broader economic developments may also influence Filecoin’s near-term trajectory. The ongoing U.S. government shutdown has hurt investor sentiment, reducing liquidity across risk assets. Should the shutdown end — or if the Federal Reserve’s recent interest rate cut spurs risk appetite — crypto inflows could rebound, potentially extending FIL’s upside momentum.

While it’s too early to call this a sustained recovery, Filecoin’s latest breakout underscores growing confidence in the utility-driven side of crypto, where real-world applications like data storage and AI infrastructure are starting to dominate investor narratives.